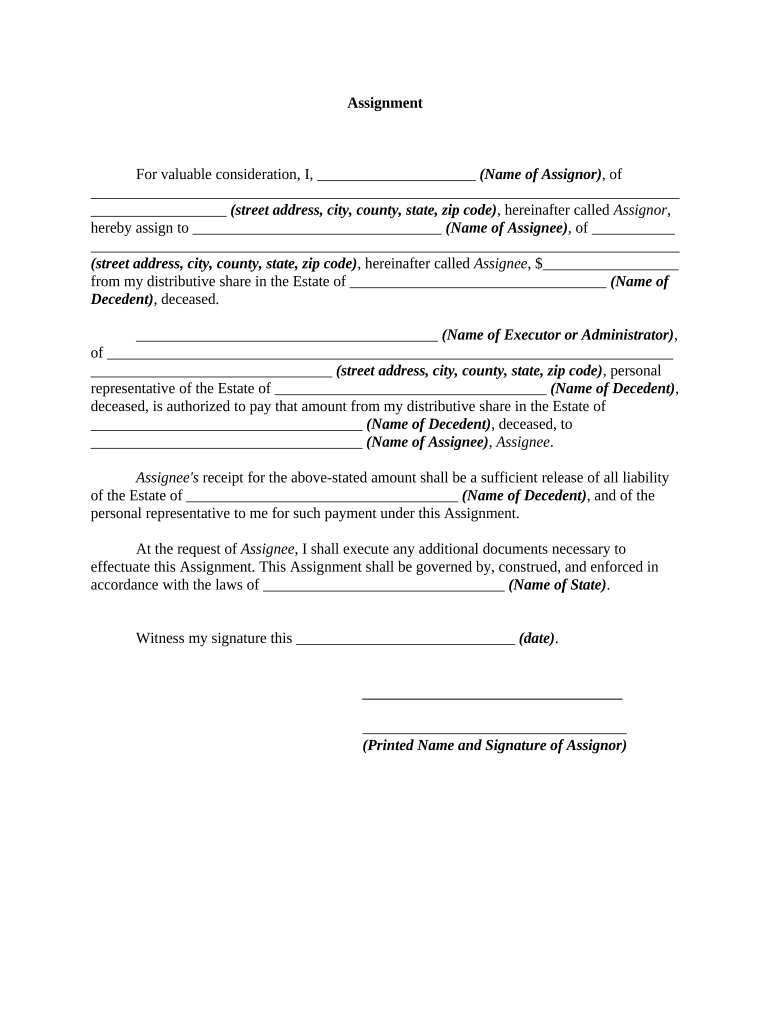

Money Estate Form

What is the Money Estate

The money estate refers to the total value of an individual's assets, including cash, investments, real estate, and personal property, at the time of their passing. Understanding the components of a money estate is essential for effective estate planning. This includes not only the assets themselves but also any debts or liabilities that may affect the overall value. Proper management and documentation of a money estate can ensure that assets are distributed according to the deceased's wishes and in compliance with state laws.

How to use the Money Estate

Using the money estate effectively involves several key steps. First, it is important to assess all assets and liabilities to determine the net worth of the estate. Next, individuals should consider creating a will or trust to outline how the estate should be distributed. Additionally, consulting with an estate planning attorney can provide guidance on minimizing taxes and ensuring compliance with legal requirements. Regularly updating the estate plan as circumstances change, such as marriage, divorce, or the birth of children, is also crucial for maintaining its effectiveness.

Steps to complete the Money Estate

Completing the money estate process involves a series of organized steps:

- Gather all financial documents, including bank statements, property deeds, and investment records.

- List all assets and liabilities to calculate the total value of the estate.

- Determine beneficiaries and how assets will be distributed.

- Consider tax implications and potential deductions.

- Create or update legal documents, such as wills or trusts.

- Consult with professionals, such as estate planners or financial advisors, for tailored advice.

Legal use of the Money Estate

The legal use of the money estate is governed by state laws that dictate how assets are managed and distributed after death. It is essential to ensure that all documents are legally binding and comply with relevant regulations. This includes adhering to requirements for wills, trusts, and powers of attorney. Additionally, understanding the probate process is crucial, as it determines how the estate is validated and administered in court. Proper legal guidance can help navigate these complexities and protect the interests of all parties involved.

Required Documents

To effectively manage a money estate, several key documents are required:

- Last Will and Testament: Outlines the distribution of assets.

- Trust Documents: Specifies terms for any trusts established.

- Financial Statements: Includes bank accounts, investment portfolios, and real estate holdings.

- Property Deeds: Proves ownership of real estate assets.

- Tax Returns: Provides insight into financial obligations and potential liabilities.

IRS Guidelines

The IRS has specific guidelines regarding the taxation of estates. Understanding these guidelines is crucial for compliance and financial planning. Estates may be subject to federal estate tax if their value exceeds a certain threshold. Additionally, beneficiaries may need to report inherited assets on their personal tax returns. It is advisable to consult with a tax professional to ensure that all IRS requirements are met and to explore any available deductions or exemptions.

Quick guide on how to complete money estate

Prepare Money Estate easily on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents rapidly without delays. Manage Money Estate on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to edit and electronically sign Money Estate effortlessly

- Find Money Estate and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Money Estate to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the money estate and how does it relate to eSigning documents?

The money estate refers to the digital management of financial assets, and eSigning documents can streamline this process. With airSlate SignNow, you can effortlessly sign and send documents related to your money estate, ensuring secure and efficient transactions. Our platform minimizes paperwork and simplifies how businesses manage their financial agreements.

-

How can airSlate SignNow help manage my money estate?

airSlate SignNow provides an intuitive platform for managing and electronically signing documents related to your money estate. You can create, send, and track important financial documents with ease, thus enhancing transparency and reducing delays. This efficient digital solution keeps your money estate organized and accessible.

-

Is airSlate SignNow cost-effective for managing large money estates?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing large money estates. Our competitive pricing plans offer unlimited document signing and a range of features tailored to your needs. By using our platform, you can reduce costs associated with traditional document handling.

-

What features does airSlate SignNow offer for money estate management?

airSlate SignNow offers a range of features ideal for money estate management, including document templates, automated workflows, and real-time status tracking. These features allow users to streamline their processes and improve accuracy when handling essential financial documents. Our solution is tailored to make managing your money estate simpler than ever.

-

Can I integrate airSlate SignNow with other tools for my money estate needs?

Absolutely! airSlate SignNow integrates seamlessly with various tools to enhance your money estate management. Whether you're using CRM systems, cloud storage services, or other financial software, our platform can easily connect, ensuring a cohesive workflow. This integration allows for a more comprehensive management experience for your money estate.

-

What are the security features of airSlate SignNow when dealing with money estate documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive money estate documents. We employ advanced encryption protocols and secure access controls to protect your information. Additionally, our compliance with industry standards ensures that your money estate documents are handled with the utmost security.

-

How quickly can I start using airSlate SignNow for my money estate?

Getting started with airSlate SignNow for your money estate is quick and easy. You can sign up for our service and begin using it within minutes, accessing all features necessary for efficient document management. This swift onboarding process helps you manage your money estate with minimal downtime.

Get more for Money Estate

- Please have your primary care physician complete this form

- 69121 13 doctors office claim formindd

- Families first coronavirus response act request form

- Medical authorization release health information

- Sue flor american heart association form

- Ancillary claims filing guidelines examples ancillary claims filing guidelinesexamples form

- 01 ims patient info form 06162017 draftdocx

- Lab submission forms utcvm university of tennessee

Find out other Money Estate

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form