Loan Requesting Form

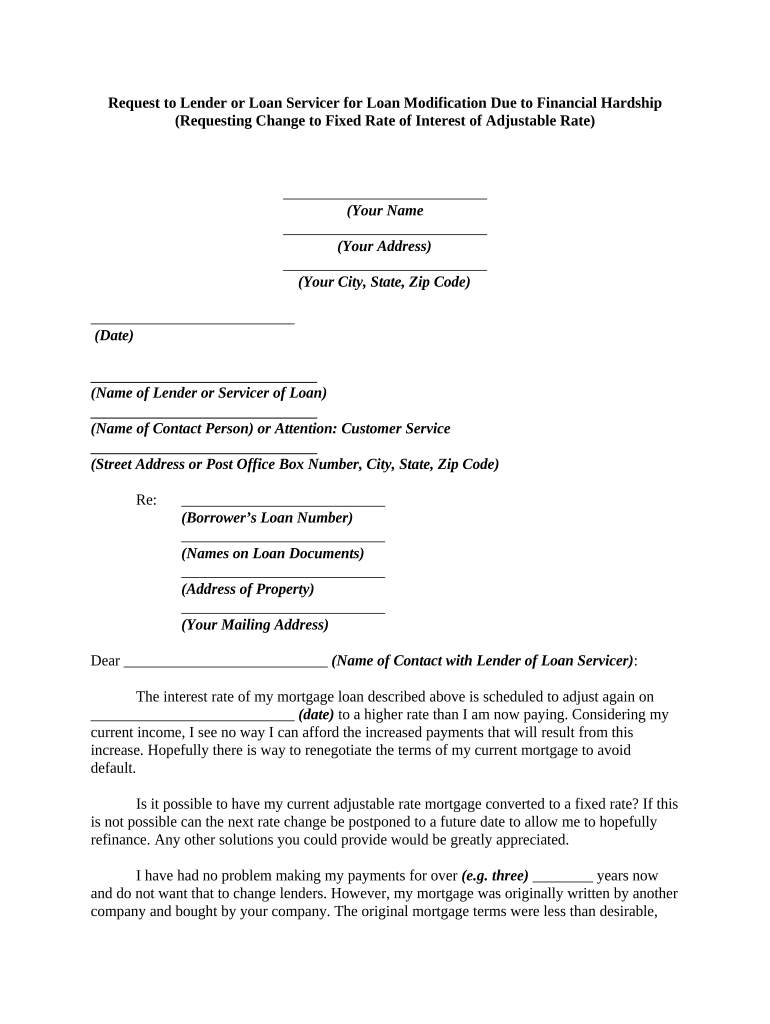

What is the loan requesting?

The loan requesting process involves submitting a formal application to a lender or servicer for financial assistance. This request typically outlines the amount of money needed, the purpose of the loan, and the borrower's financial situation. Understanding the specific requirements and terms associated with loan requesting is essential for ensuring a smooth application process. It is important to provide accurate information and documentation to support the request, as this can significantly impact the approval outcome.

Steps to complete the loan requesting

Completing a loan requesting form involves several key steps that help streamline the process. First, gather all necessary financial documents, such as income statements, tax returns, and credit reports. Next, fill out the loan requesting form accurately, ensuring that all sections are completed. After submitting the form, it is advisable to follow up with the lender or servicer to confirm receipt and inquire about the timeline for processing. Keeping communication open can help address any potential issues that may arise during the review process.

Required documents

When submitting a loan requesting form, certain documents are typically required to support the application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Credit report to assess financial history.

- Identification, such as a driver's license or Social Security number.

- Details about the loan purpose and amount requested.

- Any additional documentation requested by the lender.

Providing complete and accurate documentation can enhance the chances of approval and expedite the loan requesting process.

Legal use of the loan requesting

The legal use of a loan requesting form is governed by various regulations that ensure the legitimacy of the application. In the United States, compliance with federal and state laws is crucial. This includes adhering to the guidelines set forth by the Truth in Lending Act and the Equal Credit Opportunity Act, which protect consumers during the loan requesting process. Understanding these legal frameworks can help borrowers navigate the requirements and safeguard their rights.

Digital vs. paper version

When it comes to loan requesting, borrowers have the option to submit forms digitally or via paper. Digital submission offers several advantages, including faster processing times and reduced chances of errors. Electronic forms can be easily filled out, signed, and submitted online, often leading to quicker approvals. In contrast, paper forms may require mailing and longer wait times for processing. Regardless of the method chosen, ensuring that all information is accurate and complete is essential for a successful loan requesting experience.

Eligibility criteria

Eligibility criteria for loan requesting can vary depending on the lender and the type of loan being sought. Common factors include:

- Credit score, which reflects the borrower's creditworthiness.

- Income level, demonstrating the ability to repay the loan.

- Employment status, indicating job stability.

- Debt-to-income ratio, assessing overall financial health.

Understanding these criteria can help borrowers prepare effectively and increase their chances of securing the loan they need.

Quick guide on how to complete loan requesting

Complete Loan Requesting effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your files quickly and without delays. Manage Loan Requesting on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Loan Requesting effortlessly

- Locate Loan Requesting and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Loan Requesting to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is loan requesting and how can airSlate SignNow assist with it?

Loan requesting is the process of formally asking for a loan, typically requiring documentation and signatures. airSlate SignNow streamlines this process by allowing users to eSign and send loan documents quickly and securely, ensuring a faster turnaround time for approvals.

-

How much does airSlate SignNow cost for loan requesting services?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses involved in loan requesting. With monthly and annual subscriptions, you can choose a plan that fits your budget, providing a cost-effective solution for your document signing needs.

-

What features does airSlate SignNow offer for loan requesting?

airSlate SignNow includes features such as customizable templates, in-person signing, and workflow automation that enhance the loan requesting process. These tools help you manage documents more efficiently, ensuring that your loan requests are processed smoothly.

-

Can I integrate airSlate SignNow with other software for loan requesting?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications commonly used in the loan requesting process. Integration with platforms like CRM systems and accounting software helps streamline your workflow and keeps all relevant data synchronized.

-

How does airSlate SignNow enhance the security of loan requesting?

Security is a top priority for airSlate SignNow, especially for sensitive loan requesting documents. Our platform employs encryption, secure access controls, and audit trails to ensure that your documents remain confidential and protected throughout the signing process.

-

Is airSlate SignNow suitable for individuals as well as businesses in loan requesting?

Absolutely! While airSlate SignNow is designed to support businesses in loan requesting, it is also user-friendly for individuals. Whether you're a small business owner or an individual looking to secure a personal loan, our platform accommodates various user needs effectively.

-

What support does airSlate SignNow offer for users new to loan requesting?

airSlate SignNow provides comprehensive support for users new to loan requesting, including tutorials, FAQ sections, and customer service assistance. We ensure that users quickly understand how to navigate our tools, making your loan requesting process as smooth as possible.

Get more for Loan Requesting

- Instruction for consortium agreement form

- Digital signature form

- Consortium agreement asu students site arizona state university students asu form

- Credit card application and agreement page 1 purchasing card form

- Office of human resources box 1040 edwardsville il form

- A m commerce transcript request form

- Ferpa permission form

- Academic calendar st thomas university form

Find out other Loan Requesting

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe