Disclaimer Beneficiary Form

What is the Disclaimer Beneficiary

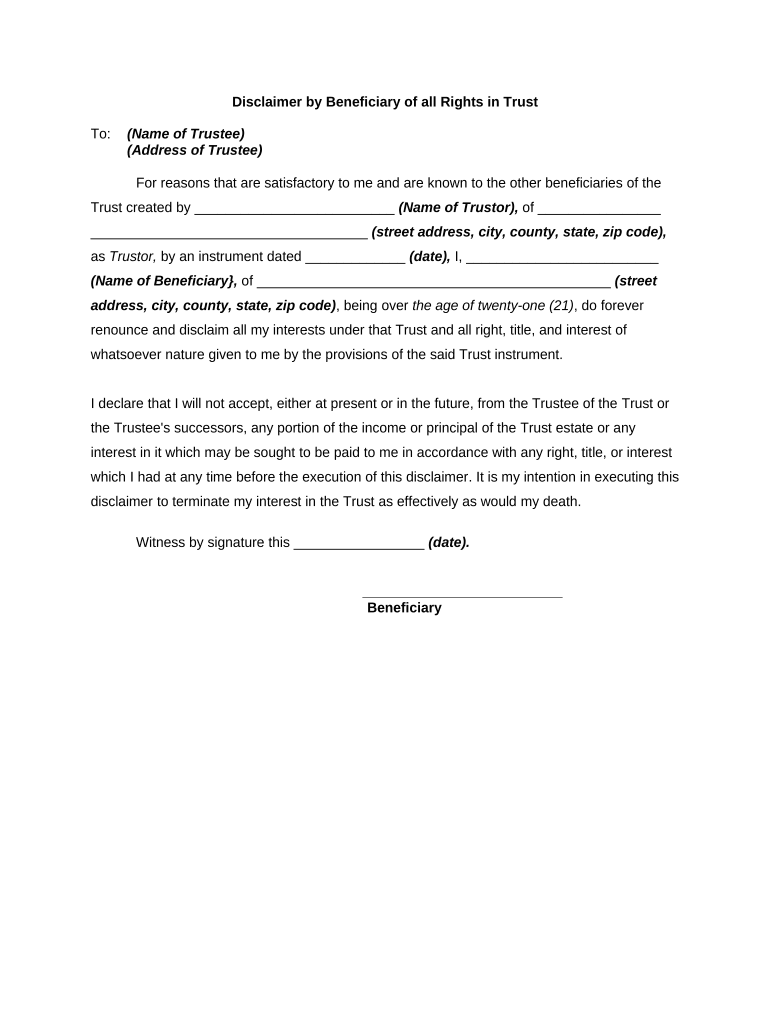

A disclaimer beneficiary is an individual or entity that has the right to refuse an inheritance or benefit from a trust or estate. This legal option allows beneficiaries to renounce their interest, which can be beneficial for various reasons, such as tax implications or personal circumstances. By executing a beneficiary disclaimer form, the disclaimant effectively relinquishes their rights to the assets or benefits in question, allowing them to pass to other designated beneficiaries without complications.

Steps to Complete the Disclaimer Beneficiary

Completing a beneficiary disclaimer form involves several important steps to ensure it is legally valid. First, the individual must review the terms of the trust or estate documents to understand their rights and obligations. Next, they should obtain the appropriate disclaimer form, which may vary by state. After filling out the form with accurate information, the disclaimant must sign it in the presence of a notary public. Finally, the completed form should be submitted to the appropriate parties, such as the trustee or executor, within the specified time frame to ensure compliance with legal requirements.

Legal Use of the Disclaimer Beneficiary

The legal use of a disclaimer beneficiary is governed by state laws, which dictate how and when a beneficiary can renounce their interest. It is crucial for the disclaimant to act within a specified period, typically nine months from the date of the decedent's death or the date the beneficiary becomes aware of their interest. Additionally, the disclaimer must be irrevocable and made in writing to be considered valid. Understanding these legal parameters helps protect the rights of the disclaimant and ensures the proper distribution of assets.

Key Elements of the Disclaimer Beneficiary

Several key elements define the disclaimer beneficiary process. These include the requirement for the disclaimer to be in writing, the necessity for it to be signed and notarized, and the stipulation that it must be filed within a certain timeframe. Furthermore, the disclaimer cannot be contingent upon any conditions, meaning it must be an outright refusal of the inheritance. Understanding these elements is essential for anyone considering this option, as they ensure the disclaimer is legally binding and effective.

State-Specific Rules for the Disclaimer Beneficiary

Each state in the U.S. has its own regulations regarding beneficiary disclaimers, which can affect how the process is handled. For example, some states may have specific forms or additional requirements that must be met for the disclaimer to be valid. It is advisable for individuals to consult state laws or seek legal advice to ensure compliance with local regulations. Familiarity with these state-specific rules can prevent potential disputes and ensure a smooth transition of assets.

Examples of Using the Disclaimer Beneficiary

There are various scenarios in which a disclaimer beneficiary might be utilized. For instance, a beneficiary may choose to disclaim their inheritance if it would result in a significant tax burden or if they believe that the assets would be better suited for another family member. Additionally, a beneficiary may wish to disclaim their interest in a trust to allow for the distribution of assets to a charitable organization or to avoid conflicts among family members. Understanding these examples can help individuals make informed decisions regarding their inheritance options.

Quick guide on how to complete disclaimer beneficiary

Effortlessly Prepare Disclaimer Beneficiary on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without any delays. Handle Disclaimer Beneficiary on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and Electronically Sign Disclaimer Beneficiary with Ease

- Obtain Disclaimer Beneficiary and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Alter and electronically sign Disclaimer Beneficiary and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary disclaimer form?

A beneficiary disclaimer form is a legal document that allows a beneficiary to refuse their inheritance or rights to an asset. By using this form, individuals can redirect their share to other beneficiaries, ensuring that the estate is managed according to their wishes.

-

How can airSlate SignNow help with beneficiary disclaimer forms?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign beneficiary disclaimer forms. Our solution ensures that all legal documents are securely signed and stored, making it simple for users to manage their documents efficiently.

-

What are the pricing options for using airSlate SignNow for beneficiary disclaimer forms?

airSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of individuals and businesses. Whether you're a solo user or part of a larger team, our cost-effective solutions provide signNow value for managing beneficiary disclaimer forms and other legal documents.

-

Is the beneficiary disclaimer form legally binding?

Yes, a properly signed beneficiary disclaimer form is legally binding. Once individuals eSign the form using airSlate SignNow, it meets all the necessary legal standards, ensuring that the disclaiming beneficiary's wishes are upheld.

-

Can I customize my beneficiary disclaimer form on airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your beneficiary disclaimer form to fit your specific needs. You can easily add fields, clauses, and instructions, ensuring that the document reflects the intent of the parties involved.

-

What integrations does airSlate SignNow offer for managing beneficiary disclaimer forms?

airSlate SignNow integrates seamlessly with various platforms, enhancing your workflow for managing beneficiary disclaimer forms. Whether you use CRM systems or cloud storage solutions, our integrations streamline document management and improve productivity.

-

How secure are my beneficiary disclaimer forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. All beneficiary disclaimer forms are protected with advanced encryption, ensuring that your sensitive information remains confidential and secure during transmission and storage.

Get more for Disclaimer Beneficiary

Find out other Disclaimer Beneficiary

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe