Balance Sheet Payable Form

What is the balance sheet payable?

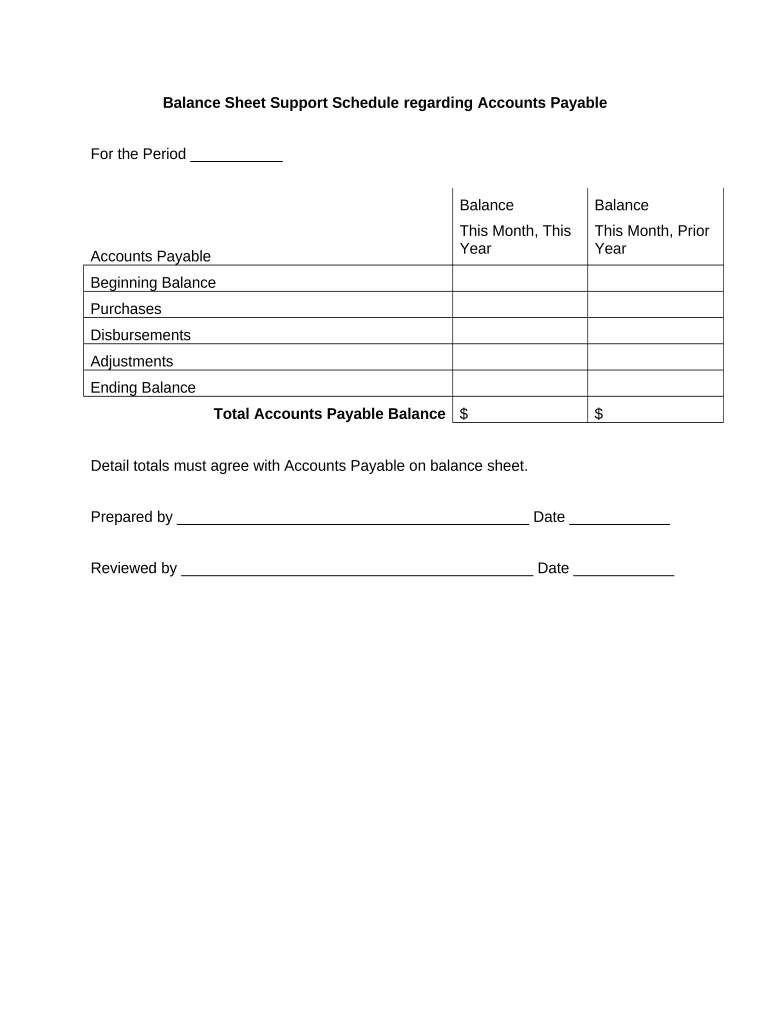

The balance sheet payable refers to a financial statement that outlines a company's liabilities, specifically those that are due within a year. These liabilities include accounts payable, short-term loans, and any other obligations that require payment in the near future. Understanding the balance sheet payable is essential for businesses to manage their cash flow effectively and ensure they meet their financial commitments on time.

Key elements of the balance sheet payable

Several critical components make up the balance sheet payable. These include:

- Accounts Payable: This represents the money a company owes to its suppliers for goods and services received but not yet paid for.

- Short-Term Debt: Any loans or financial obligations that are due within one year fall under this category.

- Accrued Liabilities: These are expenses that have been incurred but not yet paid, such as wages or taxes.

- Deferred Revenue: This refers to payments received in advance for goods or services to be delivered in the future.

How to use the balance sheet payable

Utilizing the balance sheet payable involves regularly reviewing and updating it to reflect the current financial obligations of the business. This practice helps in budgeting and forecasting cash flow needs. By keeping accurate records, businesses can prioritize payments, negotiate terms with suppliers, and ensure they have sufficient liquidity to cover their short-term liabilities.

Steps to complete the balance sheet payable

Completing the balance sheet payable requires a systematic approach:

- Gather Financial Data: Collect all relevant financial documents, including invoices, loan agreements, and contracts.

- List Liabilities: Create a comprehensive list of all short-term liabilities, categorizing them appropriately.

- Calculate Totals: Sum the total of each category to determine the overall balance sheet payable.

- Review and Adjust: Regularly review the balance for accuracy and make adjustments as necessary to reflect any changes in obligations.

Legal use of the balance sheet payable

The balance sheet payable must comply with accounting standards and regulations. In the United States, Generally Accepted Accounting Principles (GAAP) guide how these statements should be prepared. Proper documentation and transparency are crucial to ensure that the balance sheet payable accurately reflects the company's financial obligations, which can impact credit ratings and investor confidence.

Examples of using the balance sheet payable

Businesses can use the balance sheet payable in various scenarios:

- A company evaluating its liquidity may analyze its balance sheet payable to ensure it can meet upcoming obligations.

- During financial audits, the balance sheet payable serves as a critical document to verify liabilities.

- When seeking financing, lenders often review the balance sheet payable to assess the company’s short-term financial health.

Quick guide on how to complete balance sheet payable

Complete Balance Sheet Payable effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents since you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Balance Sheet Payable on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Balance Sheet Payable without any hassle

- Locate Balance Sheet Payable and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or shared link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Balance Sheet Payable and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a balance sheet payable?

A balance sheet payable refers to the liabilities a company owes to its creditors within a specific timeframe. It reflects the outstanding debts that need to be settled and is crucial for financial analysis. Understanding balance sheet payables helps businesses manage their cash flow effectively.

-

How can airSlate SignNow assist with managing balance sheet payables?

airSlate SignNow enables businesses to streamline their invoicing and document management processes, thereby enhancing their ability to track balance sheet payables. By utilizing electronic signatures and document automation, companies can ensure timely payments and reduce discrepancies. This efficiency ultimately supports better financial health.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, ensuring that you can manage your balance sheet payables affordably. The plans are designed to cater to the distinct needs of small businesses to larger enterprises. You can visit our pricing page to find a plan that aligns with your budget and requirements.

-

What features does airSlate SignNow offer for tracking balance sheet payables?

Our platform provides features such as document templates, e-signatures, and status tracking that are crucial for monitoring balance sheet payables. You can automate notifications and reminders to ensure that payments are not missed. This functionality greatly enhances accountability within your accounting processes.

-

Can airSlate SignNow integrate with accounting software for balance sheet payable management?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, allowing for efficient balance sheet payable management. This integration ensures that all your documents and payables are synchronized, reducing manual entry errors. It streamlines your financial workflows, saving you time and improving accuracy.

-

What are the benefits of using airSlate SignNow for managing balance sheet payables?

Using airSlate SignNow for managing balance sheet payables offers several benefits, including improved efficiency, reduced paperwork, and faster processing times. The ease of electronic signatures also shortens the approval cycle for payables. As a result, businesses can maintain healthier cash flow and better vendor relationships.

-

Is there a free trial available to test airSlate SignNow for balance sheet payable management?

Yes, airSlate SignNow provides a free trial that allows you to explore our features for managing balance sheet payables without any commitment. This trial period enables you to assess how our platform can improve your document workflows and enhance your payable tracking. Sign up today to experience the benefits firsthand.

Get more for Balance Sheet Payable

Find out other Balance Sheet Payable

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple