Irrevocable Letter of Credit Form

What is the Irrevocable Letter Of Credit

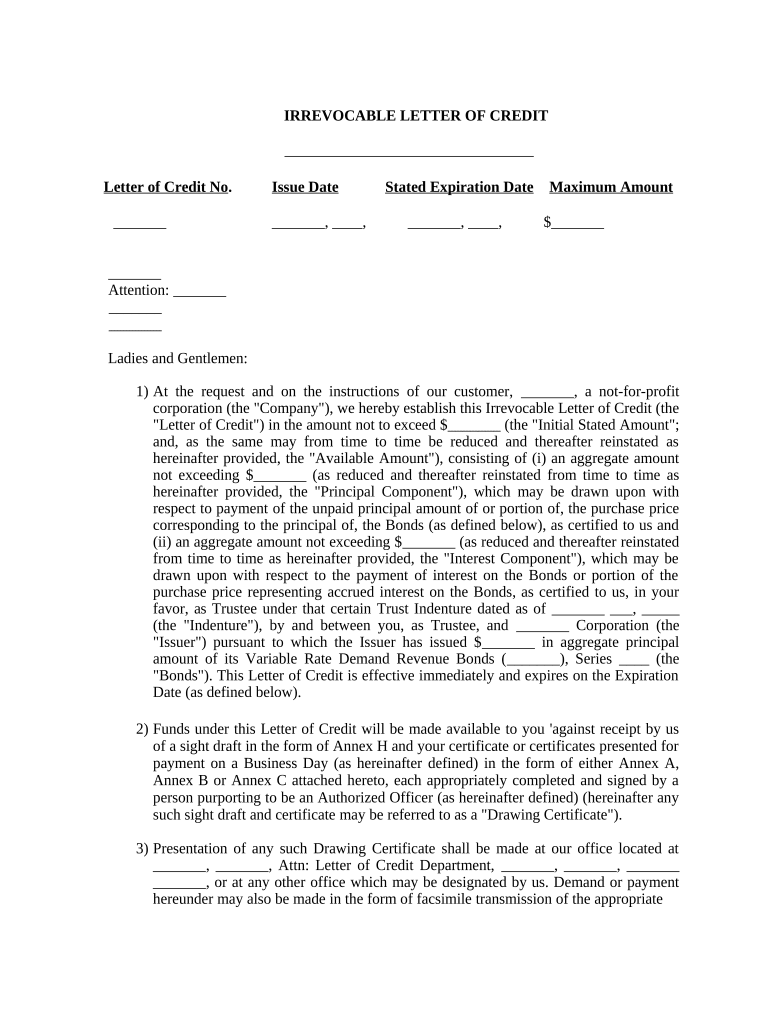

An irrevocable letter of credit is a financial document issued by a bank or financial institution that guarantees payment to a seller on behalf of a buyer. This document cannot be modified or canceled without the consent of all parties involved. It serves as a secure payment method in international trade, ensuring that the seller receives payment as long as they meet the specified terms and conditions outlined in the letter. This type of credit offers protection to both the buyer and the seller, as it reduces the risk of non-payment and provides assurance that funds are available for the transaction.

How to use the Irrevocable Letter Of Credit

Using an irrevocable letter of credit involves several steps to ensure that all parties understand their obligations. The buyer must apply for the letter through their bank, specifying the terms of the transaction, including the amount, the beneficiary (seller), and the conditions for payment. Once the bank issues the letter, it is sent to the seller's bank, which confirms receipt. The seller then prepares the required documentation, such as shipping documents, and submits them to their bank. Upon verification that the terms have been met, the seller's bank forwards the documents to the buyer's bank, which releases the payment to the seller.

Steps to complete the Irrevocable Letter Of Credit

Completing an irrevocable letter of credit involves a systematic approach to ensure compliance and accuracy. The following steps outline the process:

- Initiate the request with your bank, providing necessary details about the transaction.

- Specify the terms and conditions, including the amount and documentation required.

- Review the draft of the letter of credit from the bank for accuracy.

- Confirm the issuance of the letter with the seller and their bank.

- Prepare and submit the required documents upon shipment of goods.

- Ensure that all documents comply with the terms of the letter of credit.

- Receive payment once the documents are verified by the buyer's bank.

Key elements of the Irrevocable Letter Of Credit

Understanding the key elements of an irrevocable letter of credit is essential for both buyers and sellers. These elements typically include:

- Beneficiary: The party entitled to receive payment, usually the seller.

- Applicant: The buyer who requests the letter of credit.

- Issuing Bank: The bank that issues the letter on behalf of the buyer.

- Amount: The total sum guaranteed by the letter of credit.

- Expiration Date: The date by which the seller must present documents to receive payment.

- Terms and Conditions: Specific requirements that must be met for the payment to be released.

Legal use of the Irrevocable Letter Of Credit

The legal use of an irrevocable letter of credit is governed by various international regulations and banking standards. It is crucial for all parties to understand the legal implications of the document, which typically includes compliance with the Uniform Customs and Practice for Documentary Credits (UCP 600). This framework outlines the rights and obligations of all parties involved, ensuring that the letter of credit is enforceable in a court of law. Additionally, adherence to local laws and regulations is necessary to prevent disputes and ensure smooth transactions.

How to obtain the Irrevocable Letter Of Credit

Obtaining an irrevocable letter of credit involves a straightforward process. The buyer must approach their bank with a request, providing details about the transaction and any necessary documentation. The bank will assess the buyer's creditworthiness and the transaction's risk before issuing the letter. It is important for the buyer to communicate clearly with the bank about the terms and conditions required by the seller to ensure that the letter meets all necessary criteria. Once issued, the letter is sent to the seller's bank for confirmation.

Quick guide on how to complete irrevocable letter of credit

Complete Irrevocable Letter Of Credit effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly without any delay. Manage Irrevocable Letter Of Credit on any device with the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The simplest way to modify and electronically sign Irrevocable Letter Of Credit with ease

- Find Irrevocable Letter Of Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irrevocable Letter Of Credit and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Irrevocable Letter Of Credit?

An Irrevocable Letter Of Credit is a financial document where a bank guarantees payment to a seller, provided that the seller meets specific terms of the agreement. This ensures that both parties are protected in international trade transactions, making it a reliable payment method.

-

How does airSlate SignNow support the creation of an Irrevocable Letter Of Credit?

airSlate SignNow offers an easy-to-use platform that enables businesses to create, send, and eSign an Irrevocable Letter Of Credit digitally. You can customize your documents to include all necessary terms, ensuring compliance and security in your transactions.

-

What are the benefits of using an Irrevocable Letter Of Credit?

Using an Irrevocable Letter Of Credit helps eliminate payment risk for sellers and ensures that buyers receive their goods as promised. It promotes trust between parties in a transaction, which is crucial in international trade where regulations vary.

-

Are there any costs associated with setting up an Irrevocable Letter Of Credit?

Yes, there are fees typically associated with setting up an Irrevocable Letter Of Credit, which may include bank fees and charges related to document processing. However, airSlate SignNow provides a cost-effective solution that can help manage these expenses efficiently.

-

Can I integrate airSlate SignNow with other software to manage my Irrevocable Letter Of Credit?

Absolutely! airSlate SignNow allows for seamless integrations with various financial software and CRM systems. This integration helps streamline your processes for creating, managing, and tracking your Irrevocable Letters Of Credit.

-

What features does airSlate SignNow offer for handling Irrevocable Letters Of Credit?

airSlate SignNow offers features such as customizable templates, eSigning capabilities, and secure document storage for managing Irrevocable Letters Of Credit. These features enhance the efficiency and security of your transactions.

-

How can using an electronic Irrevocable Letter Of Credit save time?

Switching to an electronic Irrevocable Letter Of Credit through airSlate SignNow signNowly reduces the time spent on paperwork and approvals. Automation of signatures and document management speeds up the entire transaction process, allowing for quicker payments.

Get more for Irrevocable Letter Of Credit

- Dor motor carrier forms and applications

- File ampamp pay washington department of revenue form

- 2020 511 packet instructions oklahoma resident individual income tax forms and instructions

- 2020 form 502 pass through entity return of income and return of nonresident withholding tax

- 2021 confidential personal property return 150 553 004 form

- Dor business tax forms ingov 536056509

- Dor business tax ingov form

- Dor tax talk ingov form

Find out other Irrevocable Letter Of Credit

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT