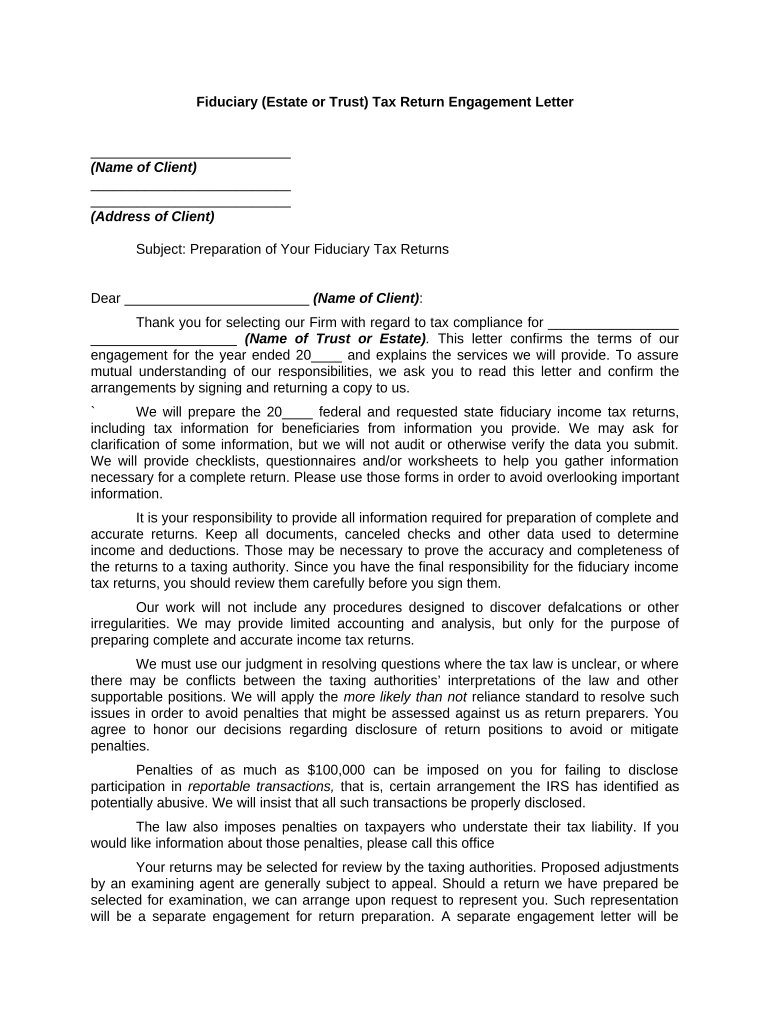

Fiduciary Tax Return Form

What is the fiduciary tax return?

The fiduciary tax return is a tax document filed by a fiduciary, typically an executor or trustee, on behalf of an estate or trust. This return reports the income generated by the estate or trust and calculates any taxes owed. Unlike individual tax returns, the fiduciary tax return focuses on the financial activities of the estate or trust rather than personal income. Understanding this form is vital for ensuring compliance with tax regulations and managing the financial responsibilities associated with estates and trusts.

Steps to complete the fiduciary tax return

Completing the fiduciary tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements, expense records, and prior tax returns. Next, determine the applicable tax year and ensure you have the correct version of the fiduciary tax return form. Carefully fill out the form, reporting all income and deductions accurately. After completing the form, review it for any errors before submitting it to the IRS, either electronically or by mail. Keeping copies of all submitted documents is essential for future reference.

Legal use of the fiduciary tax return

The fiduciary tax return must adhere to specific legal guidelines to be considered valid. This includes compliance with IRS regulations and state laws governing estates and trusts. The fiduciary must ensure that all information reported is truthful and complete, as inaccuracies can lead to penalties or legal challenges. Additionally, the fiduciary must maintain proper records and documentation to support the information provided on the return, which may be required in case of an audit.

Filing deadlines / important dates

Filing deadlines for the fiduciary tax return are crucial to avoid penalties. Generally, the return is due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the return is typically due by April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any state-specific deadlines that may apply, as these can vary.

Required documents

To successfully complete the fiduciary tax return, several documents are required. These typically include:

- Income statements for the estate or trust, such as interest and dividends.

- Records of any deductions, including administrative expenses and distributions to beneficiaries.

- Prior year tax returns for the estate or trust, if applicable.

- Documentation supporting any claims made on the return, such as receipts and invoices.

Having these documents organized and readily available will facilitate a smoother filing process.

Form submission methods (online / mail / in-person)

The fiduciary tax return can be submitted through various methods, providing flexibility for fiduciaries. Electronic submission is available and often recommended for its efficiency and speed. This method allows for quicker processing and confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address, which varies based on the state of residence. In-person submissions are generally not common for tax returns but may be possible in certain circumstances, such as specific tax assistance centers. It is essential to verify the submission method that best suits your needs and complies with IRS guidelines.

Quick guide on how to complete fiduciary tax return

Complete Fiduciary Tax Return effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Fiduciary Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Fiduciary Tax Return with ease

- Find Fiduciary Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a standard wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fiduciary Tax Return to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a fiduciary return, and why is it important?

A fiduciary return is a tax return filed by an entity that holds assets on behalf of another. Understanding fiduciary returns is crucial for compliance with tax laws and ensuring accurate reporting on income generated from those assets. Proper filing can help fiduciaries avoid penalties and streamline the process of asset management.

-

How can airSlate SignNow assist with the fiduciary return process?

airSlate SignNow streamlines the signing and submission of fiduciary returns by providing an easy-to-use eSignature platform. With features that ensure document security and compliance, businesses can confidently manage the necessary paperwork for fiduciary returns. The solution simplifies the process, reducing time spent on administrative tasks and enhancing accuracy.

-

What are the pricing options for airSlate SignNow when handling fiduciary returns?

airSlate SignNow offers a variety of pricing tiers to accommodate different business needs when managing fiduciary returns. Whether you are a small firm or a large institution, there’s a plan that can fit your budget while providing essential features for effective document management. For detailed pricing, it's best to contact our sales team.

-

Are there any benefits to using airSlate SignNow for fiduciary returns?

Using airSlate SignNow for fiduciary returns offers several benefits, including increased efficiency and reduced error rates. The platform's intuitive interface makes it easy to prepare and sign documents, ensuring that fiduciary returns are filed promptly. Additionally, automated reminders help keep the filing process on track.

-

What features does airSlate SignNow provide for managing fiduciary returns?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time tracking of document status, all of which facilitate the efficient management of fiduciary returns. The platform also offers robust compliance measures, ensuring that all documents meet legal standards for fiduciary accounting. These features combine to streamline the entire workflow process.

-

Can I integrate airSlate SignNow with my existing accounting software for fiduciary returns?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easier to handle fiduciary returns alongside your existing systems. This integration allows for a more cohesive workflow and reduces the need for manual data entry. Streamlining these processes ensures you can focus more on fiduciary management rather than administrative tasks.

-

Is airSlate SignNow compliant with regulations for fiduciary returns?

Absolutely. airSlate SignNow is designed with compliance in mind, conforming to legal standards necessary for fiduciary returns. Our platform utilizes advanced encryption and security measures to protect sensitive information, ensuring your documents are handled with the utmost confidentiality and integrity throughout the signing process.

Get more for Fiduciary Tax Return

Find out other Fiduciary Tax Return

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter