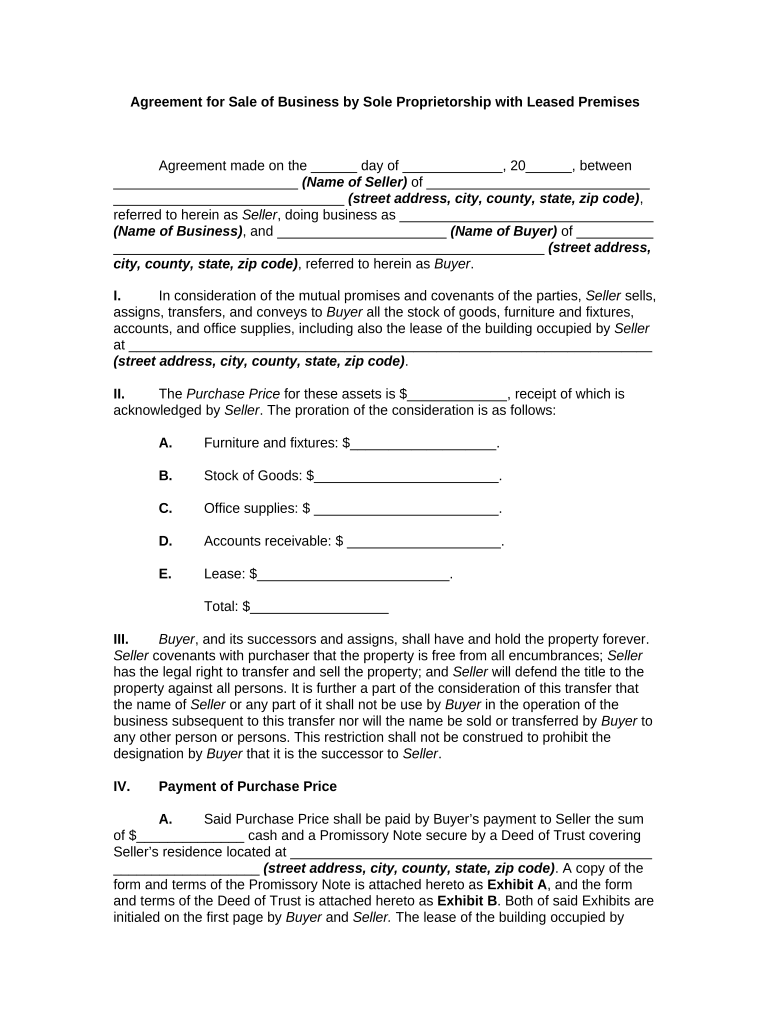

Business Sole Proprietorship Form

What is the Business Sole Proprietorship

A sole proprietorship is a simple and common business structure in which a single individual owns and operates the business. This structure allows the owner to retain complete control over decision-making and profits. In a sole proprietorship, there is no legal distinction between the owner and the business, meaning the owner is personally liable for all debts and obligations incurred by the business. This structure is often favored for its ease of setup and minimal regulatory requirements, making it an attractive option for many small business owners.

Key Elements of the Business Sole Proprietorship

Understanding the key elements of a sole proprietorship is crucial for anyone considering this business structure. The primary elements include:

- Ownership: The business is owned by one individual who has full control over operations.

- Liability: The owner is personally liable for all business debts, meaning personal assets are at risk.

- Taxation: Income generated by the business is reported on the owner's personal tax return, simplifying the tax process.

- Regulatory Requirements: Fewer formalities and regulations are required compared to other business structures, such as corporations.

Steps to Complete the Business Sole Proprietorship

Completing the necessary steps to establish a sole proprietorship involves several straightforward actions:

- Choose a Business Name: Select a unique name that reflects your business and check for availability.

- Register Your Business: Depending on your state, you may need to register your business name with local or state authorities.

- Obtain Necessary Permits: Research and acquire any licenses or permits required for your specific business type.

- Open a Business Bank Account: Keep personal and business finances separate by opening a dedicated business account.

- Maintain Records: Keep accurate financial records to simplify tax reporting and compliance.

Legal Use of the Business Sole Proprietorship

The legal use of a sole proprietorship involves adhering to local, state, and federal regulations. While this structure is relatively easy to manage, it is essential to comply with the following:

- Business Licenses: Obtain any necessary licenses or permits specific to your industry or location.

- Taxes: Ensure timely payment of income taxes and self-employment taxes as required by the IRS.

- Employment Laws: If hiring employees, comply with labor laws, including wage and hour regulations.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for sole proprietorships, primarily regarding tax obligations. Key points include:

- Tax Reporting: Sole proprietors report business income on Schedule C, which is filed with their personal tax return (Form 1040).

- Self-Employment Tax: Owners must pay self-employment tax on net earnings, which covers Social Security and Medicare taxes.

- Deductions: Eligible expenses related to the business can be deducted to reduce taxable income.

Required Documents

When establishing a sole proprietorship, several documents may be necessary to ensure compliance and proper operation:

- Business Registration: Depending on your state, you may need to file a fictitious business name statement.

- Tax Identification Number: While not always required, obtaining an Employer Identification Number (EIN) can help with tax reporting.

- Licenses and Permits: Maintain copies of all relevant licenses and permits for your business operations.

Quick guide on how to complete business sole proprietorship 497330922

Complete Business Sole Proprietorship effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Business Sole Proprietorship on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Business Sole Proprietorship with ease

- Find Business Sole Proprietorship and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and eSign Business Sole Proprietorship and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sole proprietorship business structure?

A sole proprietorship business structure is the simplest form of business entity, where an individual owns and operates the business. This structure allows for complete control of business decisions and easy tax reporting, as profits are typically subject to personal income tax. It's an ideal choice for freelancers, consultants, and small business owners seeking a straightforward setup.

-

What are the benefits of using airSlate SignNow for a sole proprietorship business structure?

For a sole proprietorship business structure, airSlate SignNow offers convenience and efficiency by allowing business owners to easily send and eSign important documents electronically. This can streamline operations, improve client relationships, and save time and money by reducing the need for physical paperwork. Additionally, the user-friendly interface makes it easy for sole proprietors to manage their documentation.

-

How does airSlate SignNow support document management for small sole proprietorships?

AirSlate SignNow provides a comprehensive platform for document management tailored for sole proprietorships. Users can store, organize, and retrieve documents securely, ensuring that all essential paperwork is readily accessible. The integration of eSigning features allows for quick approvals, making it easier than ever to handle business transactions efficiently.

-

What pricing options are available for airSlate SignNow users operating as sole proprietors?

AirSlate SignNow offers competitive pricing plans suitable for sole proprietorship business structure users. These plans vary based on features and user needs, allowing entrepreneurs to choose a package that fits their budget and requirements. The transparent pricing structure ensures no hidden fees, making it easier for sole proprietors to manage their expenses.

-

Can airSlate SignNow integrate with other tools I use for my sole proprietorship?

Yes, airSlate SignNow offers a robust integration capability with various tools commonly used by sole proprietorships, such as CRM systems and project management applications. This ensures that document workflows remain seamless and that users can automate processes effectively. Such integrations enhance productivity and facilitate better management of business operations.

-

How secure is airSlate SignNow for a sole proprietorship business structure?

Security is a top priority for airSlate SignNow, especially for users operating within a sole proprietorship business structure. The platform employs advanced encryption and secure data storage practices to protect sensitive information. This ensures that all documents signed and shared through the platform remain confidential and are safe from unauthorized access.

-

What features does airSlate SignNow include that cater specifically to sole proprietorships?

AirSlate SignNow includes features tailored for sole proprietorships, such as customizable templates, bulk sending options, and audit trails for tracking document status. These tools empower sole proprietors to manage their documentation efficiently while keeping clients informed about the processes. The simplicity and effectiveness of these features make them ideal for small business owners navigating their operations.

Get more for Business Sole Proprietorship

- Annexure e1 hssc form

- Form 941 x rev october 2020 internal revenue service

- Ae form 608 10 1a june 2014 lcd vers 0100 child youth and school services health assessmentsports physical

- C4 3 form

- Forms with

- Get the building code enforcement addressname change request form

- Student allowance independent circumstances allowance applicationslicaw complete this form if youre applying or independent

- How to make an online application for an irish visa form

Find out other Business Sole Proprietorship

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History