Tax Year End of NOL 2020

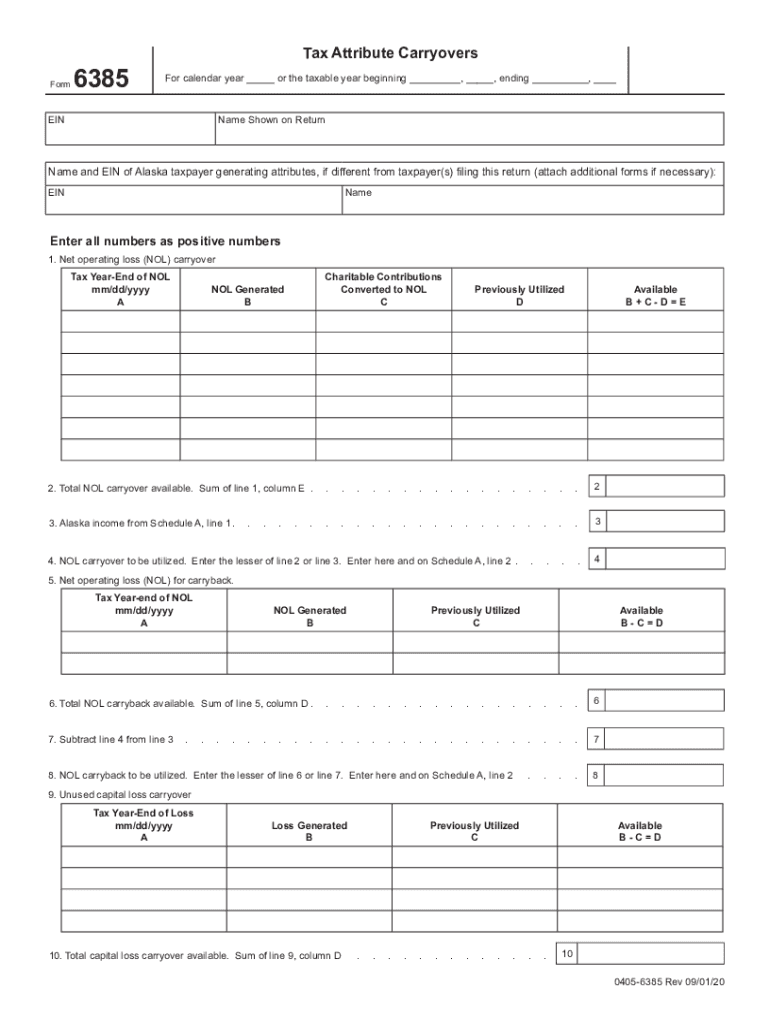

What is the AK Form?

The AK form, also known as the AK carryovers, is a crucial document used in the context of tax filings and financial reporting. It is primarily designed for individuals and businesses to report net operating losses (NOL) that can be carried forward to offset future taxable income. This form is essential for taxpayers seeking to maximize their deductions and minimize their tax liabilities in subsequent years.

How to Use the AK Form

Using the AK form involves several steps to ensure accurate reporting of carryover amounts. Taxpayers must first determine their net operating loss for the current tax year. This involves calculating total income, allowable deductions, and any losses incurred. Once the NOL is established, the taxpayer can fill out the AK form by providing necessary details such as the amount of the loss, the tax year it occurred, and any applicable carryover amounts. It is important to follow IRS guidelines to ensure compliance and accuracy.

Steps to Complete the AK Form

Completing the AK form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and prior tax returns.

- Calculate your net operating loss for the applicable tax year.

- Fill out the AK form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or via mail.

Legal Use of the AK Form

The AK form is legally binding when completed correctly and submitted in compliance with IRS regulations. It is essential to ensure that all information provided is accurate and truthful to avoid potential penalties. The form must be filed within the designated timeframe to qualify for carryover deductions in future tax years. Understanding the legal implications of the form helps taxpayers make informed decisions regarding their tax strategies.

Filing Deadlines / Important Dates

Filing deadlines for the AK form are critical to ensure that taxpayers do not miss out on potential deductions. Generally, the form must be submitted along with the annual tax return. Taxpayers should be aware of the specific deadlines, which may vary based on individual circumstances, such as extensions or amendments. Keeping track of these dates is essential for effective tax planning and compliance.

Required Documents

To complete the AK form accurately, several documents are required. These typically include:

- Previous year’s tax returns to establish a baseline for income and losses.

- Financial statements detailing income, expenses, and deductions.

- Any supporting documentation for losses claimed, such as business records or receipts.

Having these documents readily available can streamline the process of filling out the AK form and ensure that all information is accurate.

Examples of Using the AK Form

Understanding practical applications of the AK form can help taxpayers navigate their financial situations more effectively. For instance, a self-employed individual who incurs significant losses in one year can use the AK form to carry those losses forward to offset income in profitable years. Similarly, a business that experiences a downturn can utilize the form to reduce tax liabilities in subsequent years, providing essential financial relief.

Quick guide on how to complete tax year end of nol

Effortlessly Prepare Tax Year End Of NOL on Any Device

The management of documents online has become favored among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Tax Year End Of NOL on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The Easiest Way to Modify and eSign Tax Year End Of NOL Seamlessly

- Obtain Tax Year End Of NOL and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose your preferred delivery method for your form: via email, SMS, invitation link, or download it directly to your PC.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Alter and eSign Tax Year End Of NOL while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year end of nol

Create this form in 5 minutes!

How to create an eSignature for the tax year end of nol

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What are ak carryovers in the context of airSlate SignNow?

AK carryovers refer to the specific provisions that allow users to maintain access to signed documents and previous transaction histories within airSlate SignNow. This feature is particularly beneficial for businesses that need to track historical agreements and ensure compliance with documentation requirements.

-

How can I benefit from using ak carryovers with airSlate SignNow?

Using ak carryovers enables businesses to retain crucial signed documents and manage them more efficiently. This not only streamlines processes but also enhances record-keeping, making it easier to retrieve important documents when needed. Ultimately, it contributes to better operational efficiency.

-

Is there a cost associated with utilizing ak carryovers in airSlate SignNow?

The use of ak carryovers is included in the subscription plans for airSlate SignNow, which offers various pricing tiers based on your business needs. It’s advisable to review the pricing details on our site to find a plan that suits your requirements while ensuring you have access to all the features, including ak carryovers.

-

Are there any limits to the number of ak carryovers I can have?

In airSlate SignNow, there are no strict limits on the number of ak carryovers. However, it is essential to choose the appropriate subscription plan that best fits your document management needs. This will help you maximize the benefits while optimizing your workspace for efficiency.

-

Can ak carryovers be integrated with other tools or platforms?

Yes, ak carryovers can integrate seamlessly with various tools and platforms available in airSlate SignNow. This enhances the usability of your signed documents across different applications, allowing for improved workflow and collaboration within your business ecosystem.

-

How does airSlate SignNow ensure the security of ak carryovers?

airSlate SignNow prioritizes the security of all documents, including ak carryovers, by utilizing advanced encryption and secure storage practices. We ensure that your signed documents are protected against unauthorized access, thus maintaining compliance with industry standards and regulations.

-

Can I easily track my ak carryovers within airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly features that allow you to easily track your ak carryovers. You can access detailed logs and histories of all signed documents, making it simple to stay organized and maintain visibility over your agreements.

Get more for Tax Year End Of NOL

- Hearing name change 497431201 form

- Notice hearing name 497431202 form

- Order change name form

- Minutes family name change wisconsin form

- Wi note form

- Wisconsin unsecured installment payment promissory note for fixed rate wisconsin form

- Notice of option for recording wisconsin form

- Wisconsin documents search form

Find out other Tax Year End Of NOL

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online