Liquidating Trust Form

What is the liquidating trust?

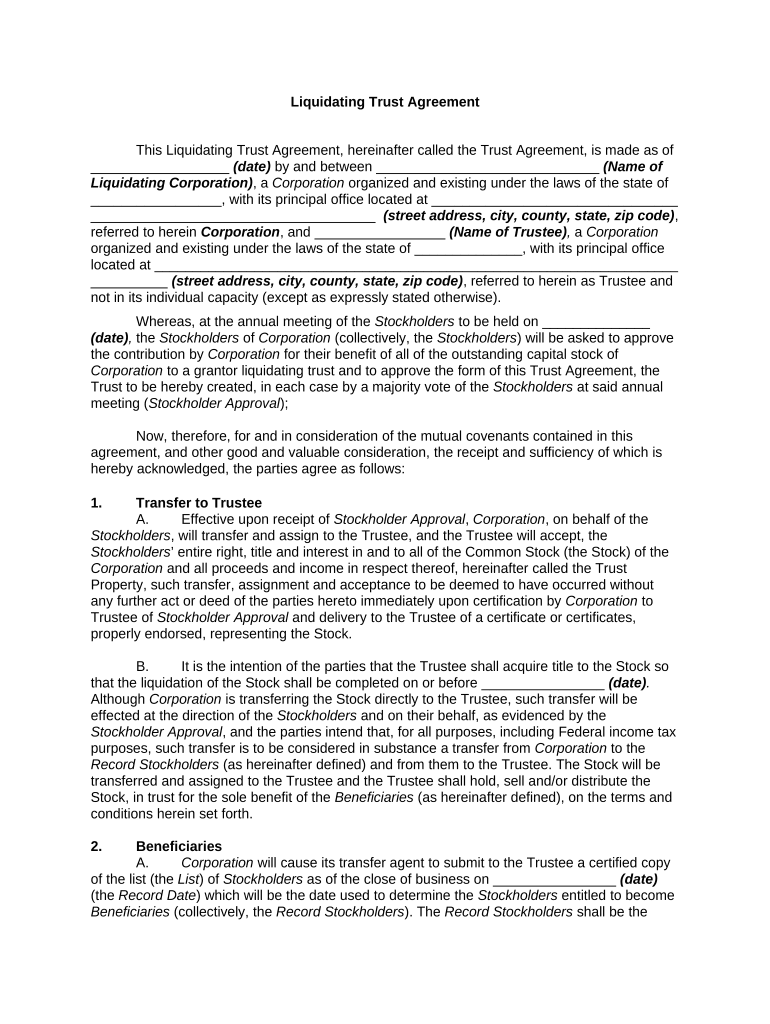

A liquidating trust is a legal arrangement that allows for the orderly winding down of a business or estate. It is typically established to manage and distribute assets to beneficiaries after liabilities have been settled. This type of trust is often used in bankruptcy proceedings or when a company is dissolving. The trustee is responsible for overseeing the liquidation process, ensuring that all debts are paid, and that remaining assets are distributed according to the terms outlined in the liquidating trust agreement.

How to use the liquidating trust

Using a liquidating trust involves several key steps. First, the trust must be properly established through a legal document that outlines the terms and conditions of the trust. This includes identifying the trustee, beneficiaries, and the assets involved. Once the trust is set up, the trustee will begin the process of liquidating assets, which may involve selling property, collecting debts, and managing any ongoing business operations. Throughout this process, it is essential to maintain clear records and communicate with beneficiaries regarding the status of the trust and distributions.

Steps to complete the liquidating trust

Completing a liquidating trust involves a series of organized steps:

- Draft the liquidating trust agreement, detailing the roles of the trustee and beneficiaries.

- Transfer assets into the trust, ensuring all legal requirements are met.

- Notify creditors and settle any outstanding debts or obligations.

- Liquidate the assets, which may include selling property or collecting receivables.

- Distribute the remaining assets to beneficiaries as specified in the trust agreement.

- Keep thorough records of all transactions and communications throughout the process.

Legal use of the liquidating trust

The legal use of a liquidating trust is governed by state and federal laws. It is crucial to ensure compliance with relevant regulations, such as the Uniform Trust Code and bankruptcy laws if applicable. The trust must be established with a clear purpose and must adhere to the terms set forth in the trust agreement. Proper legal guidance is recommended to navigate the complexities of creating and managing a liquidating trust, ensuring that all actions taken by the trustee are lawful and in the best interest of the beneficiaries.

Required documents

Establishing a liquidating trust requires several essential documents:

- Liquidating trust agreement, outlining the terms and conditions.

- List of assets and liabilities to be managed by the trust.

- Identification of the trustee and beneficiaries.

- Documentation of any prior agreements or contracts related to the assets.

- Records of notifications sent to creditors and beneficiaries.

IRS guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding liquidating trusts, particularly concerning tax implications. A liquidating trust may be treated as a grantor trust, meaning that the income generated by the trust is reported on the personal tax returns of the grantor. It is essential to understand the tax obligations associated with the trust, including any potential tax liabilities for both the trust and its beneficiaries. Consulting a tax professional can provide clarity on how to comply with IRS regulations and optimize tax outcomes.

Quick guide on how to complete liquidating trust

Complete Liquidating Trust effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and store it securely online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Liquidating Trust on any device using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The easiest way to edit and eSign Liquidating Trust without any hassle

- Find Liquidating Trust and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Liquidating Trust and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a liquidating trust and how does it work?

A liquidating trust is a fiduciary arrangement where assets are transferred to a trust for the purpose of liquidating or selling them. The trust then manages the sale of these assets, distributing the proceeds to beneficiaries. This method is often utilized to efficiently resolve claims and distribute assets in an orderly manner.

-

How can airSlate SignNow assist in creating a liquidating trust?

airSlate SignNow provides an easy-to-use platform that allows you to prepare and sign documents securely online. With our eSignature solutions, you can create the necessary documentation for establishing a liquidating trust quickly and efficiently. This eliminates delays and ensures compliance with legal requirements.

-

What are the benefits of using airSlate SignNow for liquidating trust transactions?

Using airSlate SignNow for liquidating trust transactions streamlines the process by allowing quick document preparation and secure eSigning. The platform enhances efficiency and reduces the risk of errors, ensuring that all parties can execute necessary documents from anywhere. This increases the overall productivity of managing a liquidating trust.

-

Are there any costs associated with setting up a liquidating trust through airSlate SignNow?

Yes, while airSlate SignNow offers cost-effective solutions, there are fees associated with the creation and management of a liquidating trust, including potential document preparation costs. However, using airSlate SignNow can save you money by minimizing paperwork and administrative burdens. It's always best to review your pricing options to find the right fit for your needs.

-

What features does airSlate SignNow provide for managing liquidating trusts?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and document tracking, all of which are essential for managing a liquidating trust. These tools ensure that you can efficiently handle the paperwork involved and maintain compliance throughout the liquidation process. Additionally, our platform allows for seamless collaboration among all parties involved.

-

Can airSlate SignNow integrate with other software for managing liquidating trusts?

Absolutely! airSlate SignNow offers integrations with various software solutions to help you manage liquidating trusts more effectively. Whether you use accounting software or case management tools, our platform can be integrated to streamline your workflows and improve overall efficiency.

-

How secure is the process of creating a liquidating trust with airSlate SignNow?

Security is a top priority for airSlate SignNow. We employ robust encryption methods to safeguard your documents and data throughout the entire process of creating a liquidating trust. Additionally, our platform is compliant with various security standards, ensuring that your sensitive information remains protected.

Get more for Liquidating Trust

Find out other Liquidating Trust

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract