Performance Escrow

What is the performance escrow?

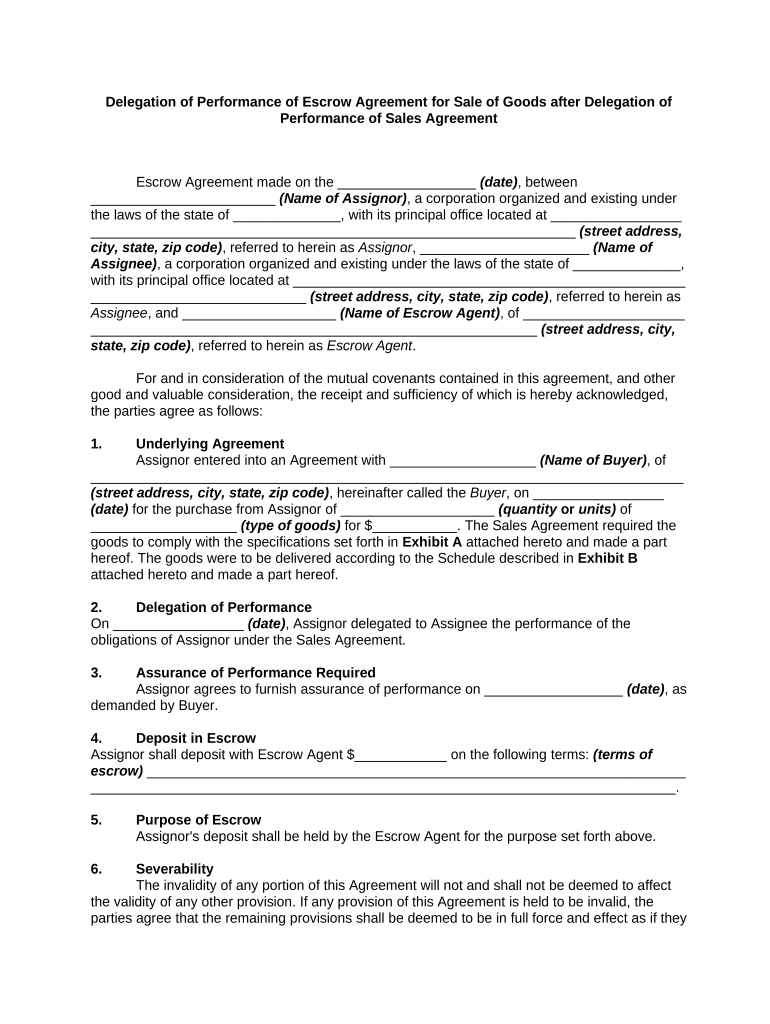

The performance escrow is a financial arrangement designed to ensure that contractual obligations are fulfilled before funds are released. It acts as a safeguard for both parties involved in a transaction, typically in real estate or business agreements. In this arrangement, a neutral third party holds the funds until the specified conditions of the escrow agreement are met. This ensures that all parties adhere to the terms outlined in the contract, providing security and peace of mind throughout the process.

How to use the performance escrow

Using a performance escrow involves several key steps to ensure that the process is smooth and compliant with legal standards. First, both parties must agree on the terms of the escrow agreement, detailing the conditions that must be met for the release of funds. Next, select a reputable escrow agent or company to manage the transaction. Once the agreement is established, the buyer deposits the funds into the escrow account. The escrow agent will then monitor the fulfillment of the contract terms, releasing the funds to the seller once all conditions are satisfied.

Steps to complete the performance escrow

Completing a performance escrow involves a systematic approach to ensure compliance and security. Follow these steps:

- Draft a detailed escrow agreement outlining the terms and conditions.

- Select a licensed escrow agent or company to oversee the transaction.

- Deposit the agreed-upon funds into the escrow account.

- Ensure all parties fulfill their obligations as outlined in the agreement.

- Request the escrow agent to release funds upon successful completion of the terms.

Legal use of the performance escrow

The legal use of a performance escrow is governed by various laws and regulations that ensure its validity and enforceability. In the United States, the escrow agreement must comply with state laws, which may vary. It is essential to include specific language in the agreement that clearly outlines the conditions for fund release. Additionally, utilizing a licensed escrow agent can help ensure compliance with relevant regulations, providing an added layer of protection for all parties involved.

Key elements of the performance escrow

Several key elements are crucial for a successful performance escrow. These include:

- Clear Terms: The escrow agreement must specify the conditions under which funds will be released.

- Neutral Third Party: A licensed escrow agent must manage the funds to ensure impartiality.

- Deposited Funds: The buyer must deposit the agreed-upon amount into the escrow account.

- Compliance with Laws: The agreement must adhere to state and federal regulations governing escrow transactions.

Examples of using the performance escrow

Performance escrows are commonly used in various scenarios, including:

- Real Estate Transactions: Buyers may use performance escrows to ensure that sellers complete repairs or improvements before closing.

- Business Sales: In mergers and acquisitions, performance escrows can protect buyers by holding funds until certain performance metrics are met.

- Construction Contracts: Contractors may require performance escrows to ensure that projects are completed on time and within budget.

Quick guide on how to complete performance escrow

Complete Performance Escrow effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly without delays. Handle Performance Escrow on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Performance Escrow without hassle

- Locate Performance Escrow and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Performance Escrow and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is performance escrow and how does it work?

Performance escrow is a financial arrangement designed to protect all parties involved in a transaction. With airSlate SignNow, you can efficiently manage performance escrow agreements by securely holding funds until specified conditions are met. This ensures that both the service provider and the client fulfill their obligations, providing peace of mind throughout the process.

-

How can airSlate SignNow help with performance escrow agreements?

airSlate SignNow offers a streamlined solution for creating, managing, and signing performance escrow agreements digitally. Our platform allows you to easily send and eSign documents while ensuring compliance and security. This simplifies the escrow process and protects your interests, making it an invaluable tool for businesses.

-

What are the pricing options for using airSlate SignNow for performance escrow?

airSlate SignNow provides flexible pricing plans tailored to suit different business needs, including options specifically for performance escrow management. Our competitive pricing ensures that you get a cost-effective solution without compromising on quality and features. Contact our sales team for a detailed quote that best fits your requirements.

-

What features does airSlate SignNow offer for performance escrow?

With airSlate SignNow, you have access to a variety of features beneficial for performance escrow management, including electronic signatures, document templates, and automated workflows. These tools allow for quicker transactions and enhanced tracking capabilities. This ensures that you can easily monitor the status of your agreements at any time.

-

How can performance escrow benefit my business?

Utilizing performance escrow through airSlate SignNow can help protect your business by ensuring that funds are only released when both parties fulfill their contractual obligations. This builds trust and promotes transparency in business dealings. Additionally, it reduces the risk of disputes, ultimately leading to smoother transactions.

-

Is airSlate SignNow compliant with performance escrow regulations?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that our performance escrow solutions meet industry regulations and standards. Our platform incorporates security protocols to safeguard sensitive information and maintain legal validity in your transactions. This helps you operate confidently, knowing your agreements are legally sound.

-

Can I integrate airSlate SignNow with other software for performance escrow?

Absolutely! airSlate SignNow offers various integrations with popular business tools that can enhance your performance escrow processes. By connecting our platform with your existing software, you can streamline workflows and improve efficiency across your organization. This ensures you can manage your performance escrow agreements effectively.

Get more for Performance Escrow

Find out other Performance Escrow

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement