Loan Ngif Form

What is the Loan Ngif

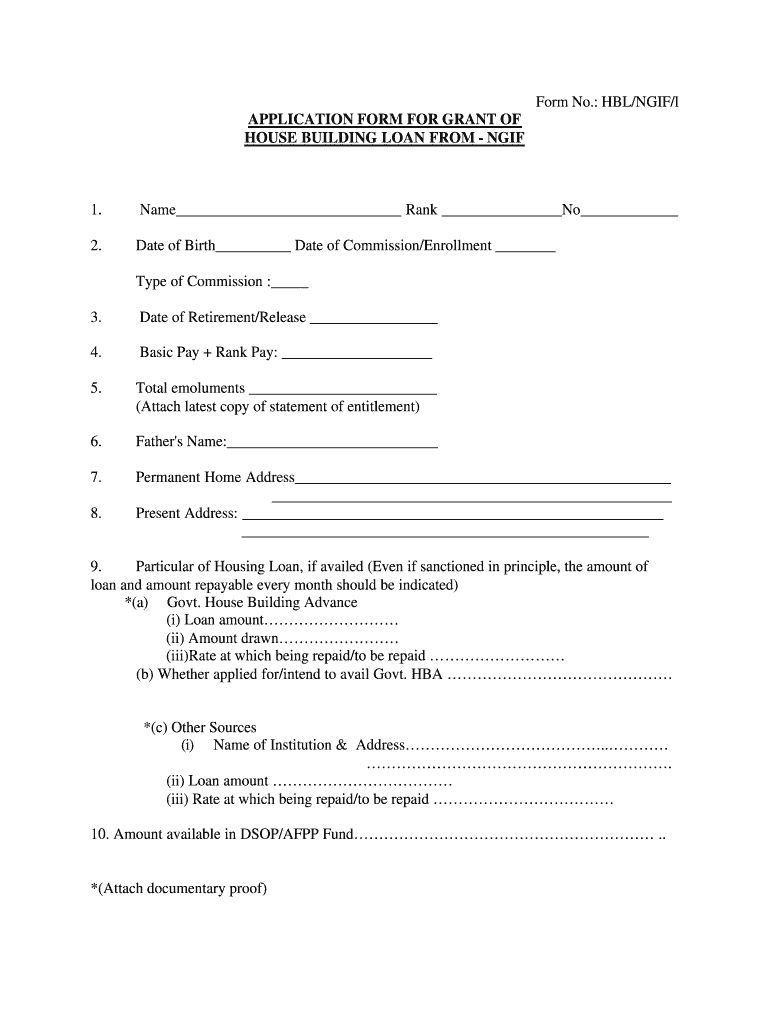

The Loan Ngif, specifically the india ngif1 loan, is a financial product designed to assist individuals and families in securing necessary funding for various purposes, such as purchasing a home or financing significant expenses. This loan type is often characterized by its structured repayment terms and specific eligibility criteria, making it essential for applicants to understand its components fully. The loan aims to provide accessible financial support while ensuring compliance with relevant regulations.

How to Use the Loan Ngif

Utilizing the Loan Ngif involves a straightforward process that begins with understanding your financial needs and eligibility. Applicants should gather necessary documentation, such as proof of income and identification. Once the required information is collected, individuals can proceed to fill out the application form accurately. It is crucial to review the completed form to ensure all details are correct, as inaccuracies can lead to delays or denials.

Steps to Complete the Loan Ngif

Completing the Loan Ngif application requires careful attention to detail. Follow these steps:

- Gather necessary documents, including identification and financial statements.

- Access the hblngif 1 template online to begin filling out the application.

- Provide accurate information in all required fields, ensuring no sections are left incomplete.

- Review the application for any errors or omissions before submission.

- Submit the completed application through the designated method, whether online or by mail.

Legal Use of the Loan Ngif

The legal use of the Loan Ngif is governed by specific regulations that ensure the protection of both the lender and the borrower. It is essential for applicants to comply with these laws to validate their loan agreements. Understanding the legal implications of the loan, including the terms of repayment and the consequences of default, is crucial. This knowledge helps borrowers make informed decisions and maintain compliance throughout the loan period.

Eligibility Criteria

Eligibility for the Loan Ngif is determined by several factors, including credit history, income level, and employment status. Typically, lenders assess the applicant's ability to repay the loan based on these criteria. It is advisable for potential borrowers to check their credit reports and ensure they meet the necessary requirements before applying. Understanding these criteria can help streamline the application process and improve the chances of approval.

Required Documents

When applying for the Loan Ngif, specific documents are required to verify the applicant's identity and financial status. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of income, which may include pay stubs or tax returns.

- Bank statements to demonstrate financial stability.

- Any additional documentation requested by the lender to support the application.

Application Process & Approval Time

The application process for the Loan Ngif typically involves submitting the completed form along with the required documents. Once submitted, the lender reviews the application, which may take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application. Applicants are encouraged to remain patient during this period and ensure they are reachable for any follow-up questions from the lender.

Quick guide on how to complete ngif home loan foam pdf form

A concise manual on how to create your Loan Ngif

Locating the right template can be a challenge when you are required to provide formal international paperwork. Even if you have the necessary form, it can be tedious to swiftly prepare it according to all specifications if you use hard copies rather than handling everything digitally. airSlate SignNow is the web-based eSignature solution that assists you in overcoming all of that. It allows you to select your Loan Ngif and swiftly fill it out and sign it on the spot without the need to reprint documents whenever you make an error.

Here are the procedures you need to follow to create your Loan Ngif with airSlate SignNow:

- Click the Get Form button to upload your document to our editor immediately.

- Begin with the first blank field, input your information, and continue with the Next option.

- Complete the empty boxes using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Loan Ngif requires it.

- Use the right-side panel to add more fields for you or others to fill in if necessary.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Complete the modifications to the form by clicking the Done button and selecting your file-sharing preferences.

Once your Loan Ngif is ready, you can share it in any way you choose - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also safely store all your completed documents in your account, organized in folders as per your preferences. Don’t spend time on manual form completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

Create this form in 5 minutes!

How to create an eSignature for the ngif home loan foam pdf form

How to make an eSignature for your Ngif Home Loan Foam Pdf Form online

How to generate an eSignature for the Ngif Home Loan Foam Pdf Form in Chrome

How to create an eSignature for putting it on the Ngif Home Loan Foam Pdf Form in Gmail

How to create an electronic signature for the Ngif Home Loan Foam Pdf Form right from your smart phone

How to make an electronic signature for the Ngif Home Loan Foam Pdf Form on iOS devices

How to create an electronic signature for the Ngif Home Loan Foam Pdf Form on Android devices

People also ask

-

What is the hblngif 1 template in airSlate SignNow?

The hblngif 1 template is a customizable document template designed for efficient electronic signing and document management. This template streamlines your workflow, allowing you to send and sign documents effortlessly. With the hblngif 1 template, you can enhance productivity and ensure secure transactions.

-

How much does the hblngif 1 template cost?

The hblngif 1 template comes as part of the airSlate SignNow subscription plans. Pricing varies depending on the features and the number of users you need. For detailed pricing information, visiting our pricing page is advisable to find the best plan that includes the hblngif 1 template.

-

What are the features of the hblngif 1 template?

The hblngif 1 template includes customizable fields, signature blocks, and the ability to include multiple signers. It also supports various file formats, ensuring you're equipped for any documentation needs. Users can easily edit and save the hblngif 1 template for repeated use.

-

How can the hblngif 1 template benefit my business?

Utilizing the hblngif 1 template can signNowly simplify your document signing processes, saving you time and reducing errors. It enhances collaboration among teams, allowing for quicker approvals and transactions. Overall, this template leads to better organizational efficiency and improved client satisfaction.

-

Is the hblngif 1 template secure?

Yes, the hblngif 1 template adheres to top security standards to ensure your documents are protected. airSlate SignNow employs encryption, audit trails, and secure data storage to maintain confidentiality. You can rest assured that using the hblngif 1 template keeps your sensitive information safe.

-

Can I integrate the hblngif 1 template with other applications?

Absolutely! The hblngif 1 template can seamlessly integrate with a variety of business applications, enhancing your workflow. Whether you use CRM systems, cloud storage, or other document management tools, integration is straightforward, helping you optimize your processes.

-

How do I create and customize the hblngif 1 template?

Creating and customizing the hblngif 1 template is easy with airSlate SignNow's user-friendly interface. You can add text, fields, and signing areas according to your requirements. The intuitive design makes it simple for anyone to tailor the hblngif 1 template to meet specific business needs.

Get more for Loan Ngif

- 90 day notice lease form

- Assignment of deed of trust by individual mortgage holder maryland form

- Maryland deed 497310287 form

- 60 day notice to terminate month to month lease montgomery county only residential from landlord to tenant maryland form

- Lease landlord violation form

- Notice cure default form

- Maryland terminate form

- Notice terminate lease tenant form

Find out other Loan Ngif

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe