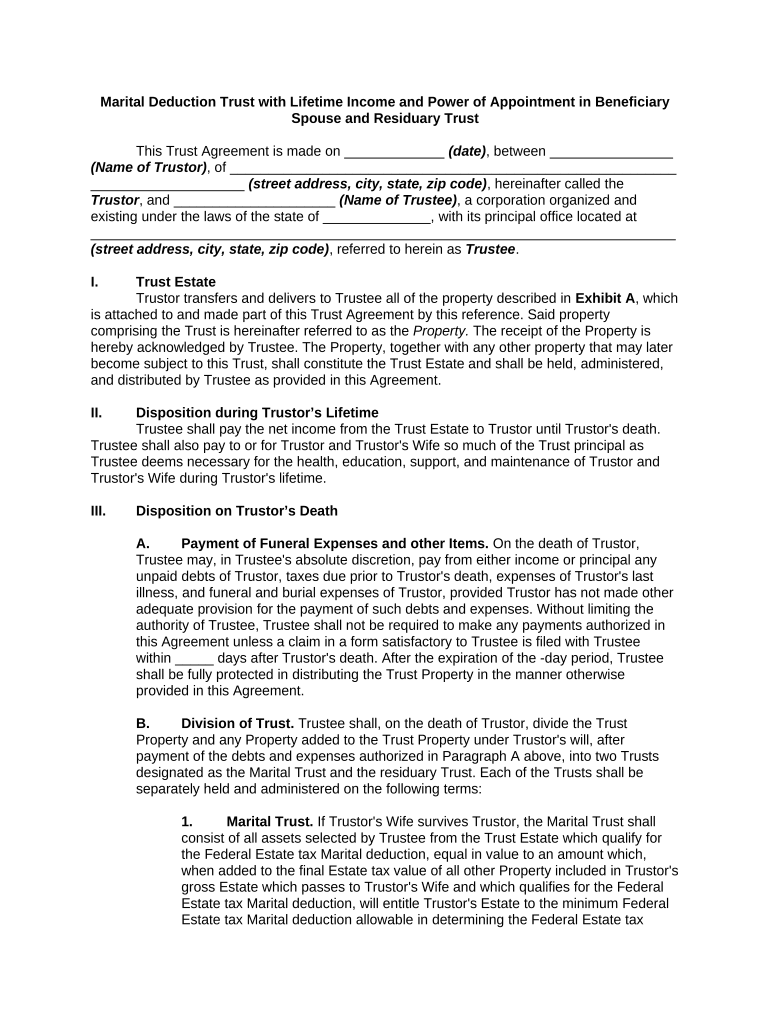

Marital Trust Form

What is the marital trust?

A marital trust is a legal arrangement designed to manage and protect assets for the benefit of a surviving spouse. This trust allows the income generated from the trust assets to be distributed to the beneficiary spouse during their lifetime, while the principal remains intact for future distribution to other beneficiaries, such as children or other heirs. The primary purpose of a marital trust is to provide financial security for the surviving spouse, ensuring they have access to necessary funds while preserving the estate for future generations.

Key elements of the marital trust

Understanding the key elements of a marital trust is essential for effective estate planning. The main components include:

- Trustee: The individual or entity responsible for managing the trust assets and ensuring that the terms of the trust are followed.

- Beneficiary spouse: The surviving spouse who receives income from the trust during their lifetime.

- Principal: The original assets placed into the trust, which are preserved for future distribution after the beneficiary spouse's death.

- Distribution terms: Specific guidelines outlining how and when the income and principal will be distributed to beneficiaries.

Steps to complete the marital trust

Completing a marital trust involves several important steps to ensure it is legally binding and effective. These steps typically include:

- Consultation: Meet with an estate planning attorney to discuss your goals and understand the implications of a marital trust.

- Drafting the trust document: Work with your attorney to create a comprehensive trust document that outlines the terms, conditions, and beneficiaries.

- Funding the trust: Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Signing and notarizing: Ensure that the trust document is signed by all parties involved and notarized to meet legal requirements.

Legal use of the marital trust

The legal use of a marital trust is governed by specific laws and regulations that vary by state. Generally, a marital trust must comply with federal and state laws regarding estate planning and taxation. This includes adhering to the Internal Revenue Service (IRS) guidelines, which may affect tax implications for both the trust and its beneficiaries. Proper legal use ensures that the trust serves its intended purpose of protecting and managing assets for the beneficiary spouse while minimizing tax liabilities.

Required documents

To establish a marital trust, several key documents are typically required. These may include:

- Trust agreement: The primary document that outlines the terms and conditions of the trust.

- Asset inventory: A detailed list of all assets being transferred into the trust.

- Identification documents: Personal identification for all parties involved, including the trustee and beneficiaries.

- Tax identification number: An Employer Identification Number (EIN) may be necessary for tax purposes if the trust generates income.

IRS guidelines

The IRS provides specific guidelines regarding the taxation of marital trusts. Generally, income generated by the trust is taxed to the beneficiary spouse, who must report it on their individual tax return. Additionally, the trust may qualify for certain tax benefits, such as the marital deduction, which allows assets transferred to the surviving spouse to be exempt from estate taxes. Understanding these guidelines is crucial for effective tax planning and compliance.

Quick guide on how to complete marital trust 497331447

Effortlessly Prepare Marital Trust on Any Device

The management of online documents has gained traction among companies and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files swiftly and without delays. Handle Marital Trust on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and eSign Marital Trust with Ease

- Obtain Marital Trust and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with specialized tools provided by airSlate SignNow.

- Formulate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced files, time-consuming form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Marital Trust to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is marital income and how does it affect eSigning documents?

Marital income refers to the combined earnings of spouses during a marriage. When using airSlate SignNow, understanding your marital income can help you efficiently manage financial documents that require electronic signatures, especially regarding joint accounts or shared investments.

-

Can airSlate SignNow help manage documents related to marital income?

Yes, airSlate SignNow provides a seamless way to manage documents related to marital income, such as tax returns or joint bank statements. By securely signing and sharing these documents electronically, couples can streamline their financial management processes.

-

What features does airSlate SignNow offer for managing marital income documents?

airSlate SignNow offers features like customizable templates, advanced editing tools, and secure electronic signatures tailored for marital income documents. These features make it easy to create, send, and store important financial documents securely.

-

Is airSlate SignNow cost-effective for couples managing marital income?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for managing documents, including those related to marital income. With flexible pricing plans, couples can choose a package that best fits their needs without breaking the bank.

-

How does airSlate SignNow ensure the security of marital income documents?

airSlate SignNow uses advanced encryption and secure cloud storage to protect your marital income documents. This ensures that sensitive financial information remains confidential and is accessible only to authorized users.

-

Can airSlate SignNow integrate with financial management tools to track marital income?

Yes, airSlate SignNow can integrate with various financial management tools to help couples track marital income effectively. This integration simplifies the process of managing and signing financial documents, allowing you to focus on your finances.

-

What are the benefits of using airSlate SignNow for marital income documentation?

Using airSlate SignNow for marital income documentation offers numerous benefits, including ease of use, time-saving capabilities, and enhanced security. Couples can quickly create, eSign, and share documents, making it easier to manage their financial lives together.

Get more for Marital Trust

Find out other Marital Trust

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document