Objection Accounting Form

What is the objection accounting?

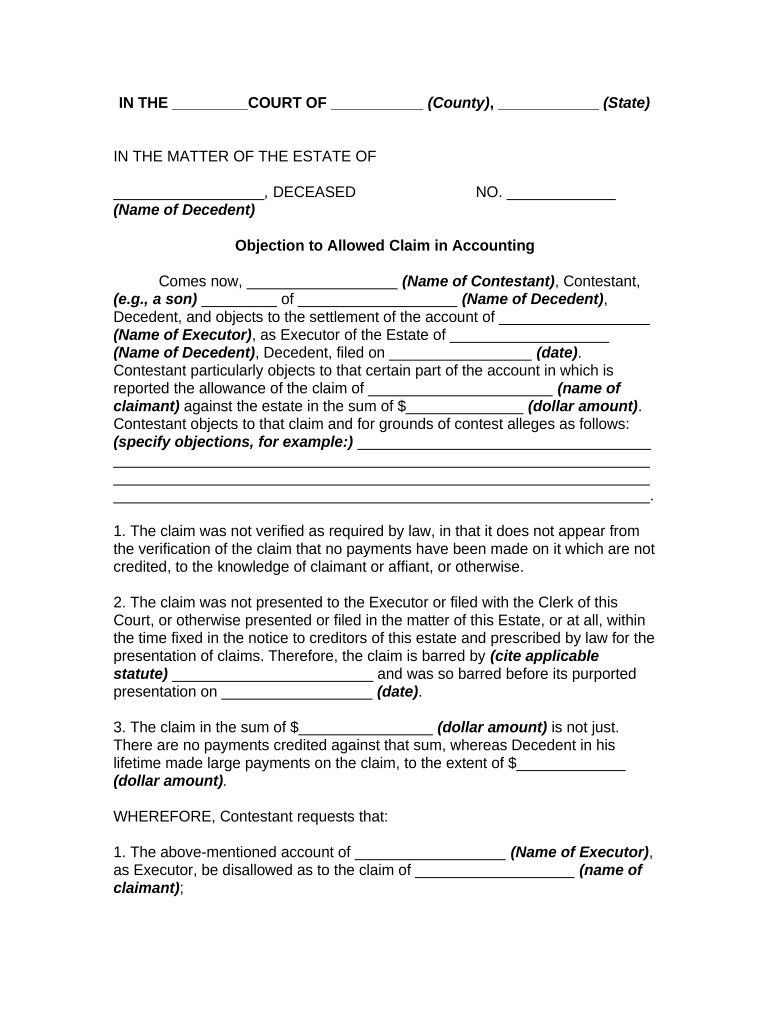

The objection accounting is a formal process used by individuals or businesses to dispute or challenge an accounting decision or claim. This process allows parties to present their arguments and evidence in a structured manner, ensuring that their concerns are addressed appropriately. The objection accounting serves as a critical tool in maintaining transparency and fairness in financial dealings, particularly in situations involving discrepancies or disagreements over financial statements, tax assessments, or other accounting matters.

Steps to complete the objection accounting

Completing the objection accounting involves several key steps to ensure that the submission is thorough and effective. Follow these steps for a successful process:

- Gather relevant documentation: Collect all necessary documents that support your objection, including financial statements, correspondence, and any other pertinent records.

- Draft your objection: Clearly outline the reasons for your objection, referencing specific accounting practices or regulations that support your case.

- Review state-specific guidelines: Ensure that your objection complies with any state-specific rules or regulations that may apply.

- Submit your objection: Choose your preferred submission method, whether online, by mail, or in person, and ensure that you keep a copy for your records.

- Follow up: After submission, monitor the status of your objection and be prepared to provide additional information if requested.

Legal use of the objection accounting

The legal use of the objection accounting is governed by various regulations and laws that ensure its validity. For an objection to be considered legally binding, it must adhere to specific requirements, including proper documentation and adherence to submission timelines. Understanding the legal framework surrounding objection accounting is essential for ensuring that your submission is taken seriously by relevant authorities. Compliance with federal and state laws, such as the Internal Revenue Code, is crucial in maintaining the integrity of the objection process.

Key elements of the objection accounting

Several key elements are essential for a successful objection accounting submission. These elements include:

- Clear statement of objection: A concise explanation of what is being disputed and why.

- Supporting evidence: Documentation that substantiates your claims, such as financial records or correspondence.

- Compliance with deadlines: Adherence to any filing deadlines to ensure that your objection is considered.

- Signature and date: Properly signed and dated forms to validate the submission.

Examples of using the objection accounting

Examples of objection accounting can vary widely based on the context. Common scenarios include:

- Disputing a tax assessment: An individual may file an objection to contest a tax bill they believe is incorrect.

- Challenging financial statements: A business may object to financial statements that inaccurately reflect their financial position.

- Addressing discrepancies: An objection may be filed to address discrepancies found during an audit or review process.

Required documents for objection accounting

When preparing to submit an objection accounting, specific documents are typically required to support your case. These may include:

- Copies of relevant financial statements.

- Correspondence related to the claim or dispute.

- Any previous rulings or decisions relevant to the objection.

- Identification documents, if necessary, to verify your identity.

Quick guide on how to complete objection accounting

Complete Objection Accounting effortlessly on any device

Online document management has become increasingly preferable for companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly and without delays. Manage Objection Accounting on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Objection Accounting with ease

- Locate Objection Accounting and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Objection Accounting to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is objection accounting and how can airSlate SignNow assist with it?

Objection accounting refers to the tracking and resolution of disputes related to financial transactions. airSlate SignNow helps streamline the objection accounting process by enabling businesses to quickly eSign and send documents for review, ensuring that all necessary parties can respond promptly.

-

How does airSlate SignNow improve the objection accounting process?

airSlate SignNow simplifies objection accounting by providing an intuitive platform for managing documentation. With features such as templates and real-time collaboration, teams can efficiently address objections and maintain clear communication throughout the resolution process.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit diverse business needs, including options tailored for small businesses to larger enterprises. Each plan allows for efficient handling of objection accounting without additional overhead, ensuring you get the best value for your investment.

-

Can airSlate SignNow integrate with other accounting software for better objection tracking?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your objection accounting processes. This integration allows for automatic updates and synchronized data, helping you keep your financial records accurate and up-to-date.

-

What are the key features of airSlate SignNow that support objection accounting?

Key features of airSlate SignNow that enhance objection accounting include customizable templates, an intuitive eSigning process, and audit trails. These tools help ensure that all financial documents are properly managed, and objections are efficiently recorded and resolved.

-

Is airSlate SignNow secure for handling sensitive objection accounting documents?

Yes, airSlate SignNow prioritizes security with robust encryption and compliance with industry standards. This ensures that all objection accounting documents are handled securely, allowing businesses to confidently manage their financial disputes without risking sensitive information.

-

How does airSlate SignNow enhance collaboration during the objection accounting process?

By offering real-time collaboration features, airSlate SignNow facilitates effective communication between team members involved in objection accounting. Users can comment, edit, and track document changes, ensuring everyone stays aligned on issues that need resolution.

Get more for Objection Accounting

- Travelex travellers cheque encashment procedure fill form

- Applicationpermit for temporary importation of firearms and ammunition by nonimmigrant aliens form

- Fda form 3514

- Ca 590 form 2021

- For service abroad of judicial or form

- Application to register as an importer of us munitions import list articles form

- Notice of firearms manufactured or imported notice of firearms manufactured or imported form

- Atf eforms

Find out other Objection Accounting

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer