Private Annuity Agreement with Payments to Last for Life of Annuitant Form

What is the Private Annuity Agreement With Payments To Last For Life Of Annuitant

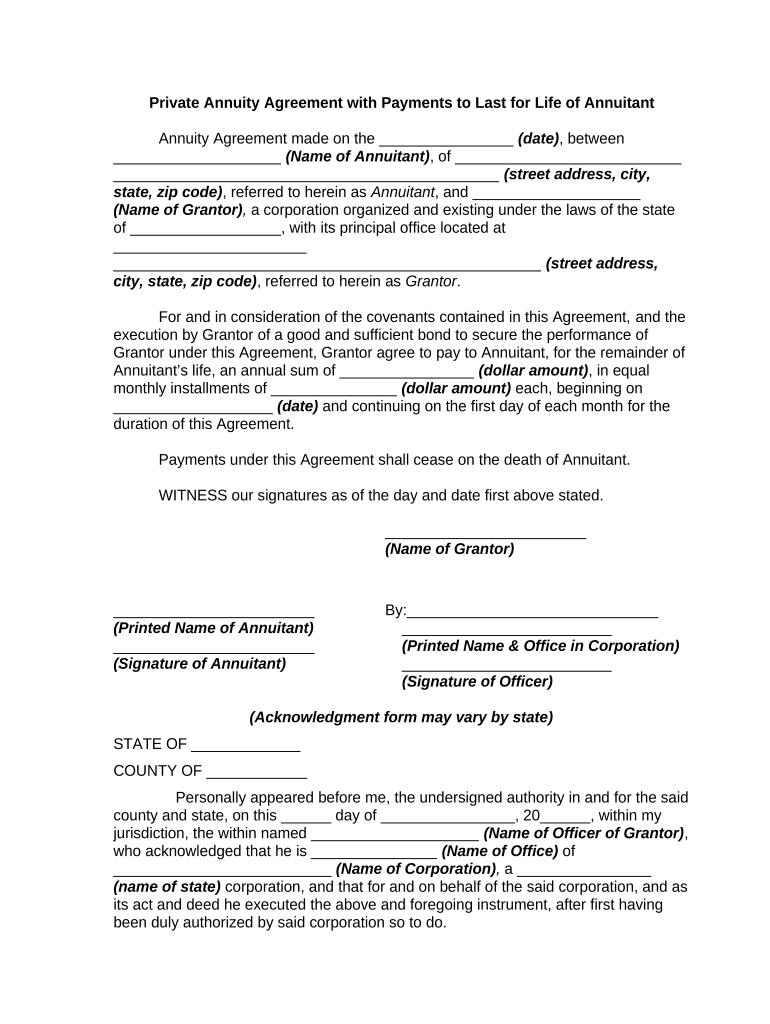

A Private Annuity Agreement With Payments To Last For Life Of Annuitant is a legal contract between two parties, typically involving a seller and a buyer. This agreement allows the buyer to make periodic payments to the seller for the remainder of the seller's life. The primary purpose of this arrangement is to provide the seller with a steady income stream while allowing the buyer to acquire an asset, often real estate, without immediate payment in full. The agreement outlines the terms of the payments, the duration, and other essential details that govern the relationship between the parties involved.

Key Elements of the Private Annuity Agreement With Payments To Last For Life Of Annuitant

Several key elements are crucial in a Private Annuity Agreement With Payments To Last For Life Of Annuitant. These include:

- Parties Involved: Identification of the seller (annuitant) and buyer.

- Payment Terms: Details on the amount, frequency, and duration of payments.

- Life Expectancy: Consideration of the annuitant's life expectancy to determine payment structure.

- Asset Description: Clear identification of the asset involved in the agreement.

- Transfer of Ownership: Terms regarding when and how ownership of the asset transfers to the buyer.

Steps to Complete the Private Annuity Agreement With Payments To Last For Life Of Annuitant

Completing a Private Annuity Agreement With Payments To Last For Life Of Annuitant involves several steps:

- Consultation: Engage with legal and financial advisors to understand implications.

- Drafting the Agreement: Prepare the document outlining all terms and conditions.

- Review: Both parties should review the agreement for completeness and accuracy.

- Signatures: Ensure both parties sign the document, preferably in the presence of a notary.

- Record Keeping: Keep copies of the signed agreement for future reference.

Legal Use of the Private Annuity Agreement With Payments To Last For Life Of Annuitant

The legal use of a Private Annuity Agreement With Payments To Last For Life Of Annuitant is governed by various laws and regulations. It is essential to ensure that the agreement complies with state and federal laws, including tax implications. The IRS has specific guidelines regarding the treatment of annuity payments, including potential tax liabilities for both the buyer and seller. Proper legal counsel can help navigate these complexities to ensure the agreement is enforceable and beneficial for both parties.

How to Use the Private Annuity Agreement With Payments To Last For Life Of Annuitant

Using a Private Annuity Agreement With Payments To Last For Life Of Annuitant effectively requires understanding its purpose and structure. Once the agreement is in place, the buyer will begin making payments to the seller as outlined in the contract. It is crucial for both parties to adhere to the terms, including timely payments and any conditions related to the asset. Regular communication between the parties can help manage expectations and resolve any issues that may arise during the term of the agreement.

State-Specific Rules for the Private Annuity Agreement With Payments To Last For Life Of Annuitant

Each state may have specific regulations governing Private Annuity Agreements With Payments To Last For Life Of Annuitant. These rules can affect various aspects of the agreement, including tax treatment, required disclosures, and the enforceability of the contract. It is important for both parties to be aware of their state's laws to ensure compliance and avoid potential legal issues. Consulting with a local attorney familiar with estate planning and annuity contracts can provide valuable guidance.

Quick guide on how to complete private annuity agreement with payments to last for life of annuitant

Complete Private Annuity Agreement With Payments To Last For Life Of Annuitant effortlessly on any device

Digital document management has become increasingly favored among companies and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Private Annuity Agreement With Payments To Last For Life Of Annuitant on any platform with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and eSign Private Annuity Agreement With Payments To Last For Life Of Annuitant without hassle

- Find Private Annuity Agreement With Payments To Last For Life Of Annuitant and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Private Annuity Agreement With Payments To Last For Life Of Annuitant and guarantee smooth communication at every stage of your form filling process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

A Private Annuity Agreement With Payments To Last For Life Of Annuitant is a contractual arrangement where one party agrees to make payments to another for the lifetime of the annuitant. This type of agreement is typically used in estate planning to provide income while transferring assets.

-

What are the benefits of a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

The primary benefits include a steady income stream for the annuitant and potential tax advantages during estate transfer. Additionally, this type of agreement can help reduce estate taxes and protect assets from creditors.

-

How does pricing work for a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Pricing for a Private Annuity Agreement is determined based on the age of the annuitant, payment terms, and the total amount agreed upon. Factors such as interest rates and market conditions also play a role in the overall cost of the agreement.

-

Can I customize the terms of my Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Yes, you can customize various terms of your Private Annuity Agreement, including payment amounts, frequency, and duration. Customization ensures the agreement fits your specific financial needs and goals.

-

Are there any risks associated with a Private Annuity Agreement With Payments To Last For Life Of Annuitant?

While a Private Annuity Agreement can provide benefits, there are risks involved, including the possibility of the payer defaulting on payments. It’s essential to assess the financial stability of the paying party to mitigate these risks.

-

How does a Private Annuity Agreement affect estate taxes?

A Private Annuity Agreement With Payments To Last For Life Of Annuitant can signNowly reduce estate taxes by shifting assets away from the estate. This arrangement allows the annuitant to receive income while potentially avoiding heavy taxation upon death.

-

What integrations does airSlate SignNow offer for managing Private Annuity Agreements?

airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to track and manage Private Annuity Agreements. This functionality enhances workflow efficiency and ensures all documents are well-organized.

Get more for Private Annuity Agreement With Payments To Last For Life Of Annuitant

- Accredited investor form leighdoc image fonkoze

- 4340 w form

- Deferred salary agreement template form

- And distributions form

- Please cancel my loans for academic year form

- Child care plus acclarisbenefitscom form

- Garagekeeper auto service insurance application fill out the amtrust application for garagekeeper and auto service insurance form

- Fidelity solo 401k contribution form

Find out other Private Annuity Agreement With Payments To Last For Life Of Annuitant

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later