What Do Non Profit Organizers Do Form

What do non profit organizers do

Non profit organizers play a crucial role in establishing and managing organizations that serve the public good. Their responsibilities typically include:

- Developing a mission statement that articulates the organization's purpose.

- Creating and implementing strategic plans to achieve goals and objectives.

- Fundraising and securing grants to support operations and programs.

- Recruiting and managing volunteers and staff to carry out the organization's activities.

- Ensuring compliance with federal, state, and local regulations.

- Building relationships with stakeholders, including community members, donors, and government agencies.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for non profit organizations to maintain their tax-exempt status. Key points include:

- Non profits must operate primarily for exempt purposes, such as charitable, educational, or religious activities.

- They must not distribute profits to members or shareholders.

- Annual reporting is required through Form 990, which details financial information and activities.

- Compliance with public support tests to ensure that the organization receives a substantial part of its support from the public.

Required Documents

To establish a non profit organization, several key documents are necessary. These typically include:

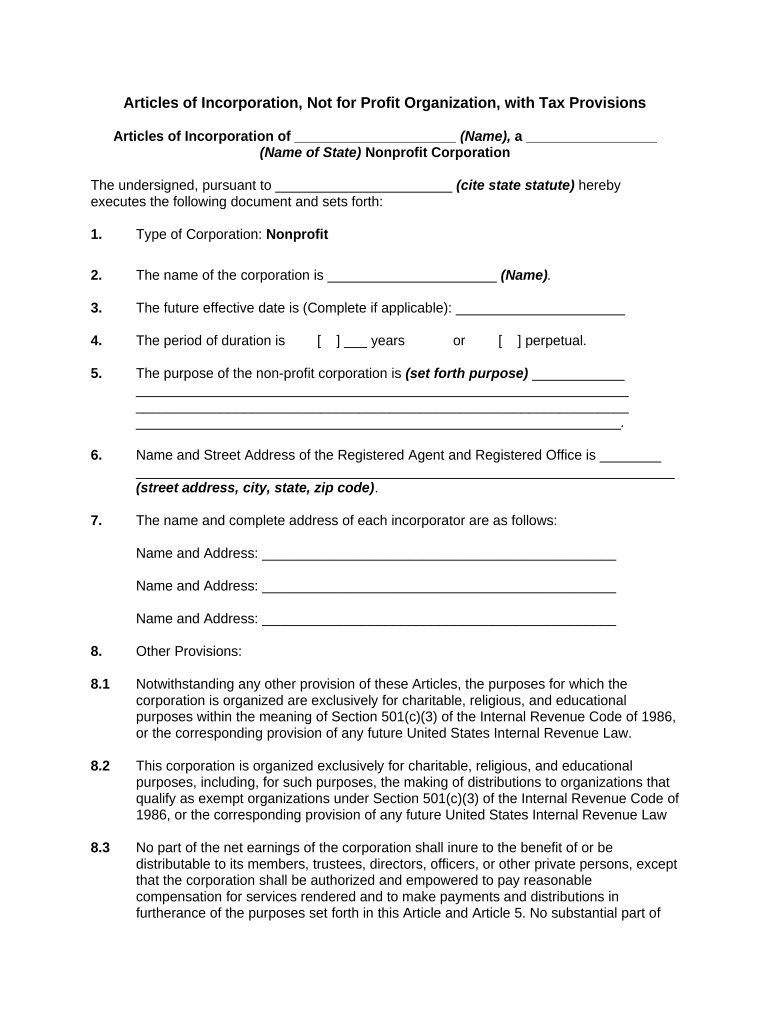

- Articles of Incorporation, which officially create the organization.

- Bylaws that outline the governance structure and operational procedures.

- Employer Identification Number (EIN) application to obtain a tax ID.

- Form 1023 or Form 1023-EZ for applying for 501(c)(3) tax-exempt status.

Application Process & Approval Time

The application process for establishing a non profit organization involves several steps:

- Drafting and filing the Articles of Incorporation with the state.

- Creating bylaws and holding an initial board meeting.

- Applying for an EIN through the IRS.

- Submitting Form 1023 or Form 1023-EZ for tax-exempt status.

Approval time for tax-exempt status can vary, typically ranging from three to six months, depending on the complexity of the application and the IRS workload.

Penalties for Non-Compliance

Non profit organizations must adhere to various regulations to avoid penalties. Potential consequences for non-compliance include:

- Loss of tax-exempt status, requiring the organization to pay federal income tax.

- Fines and penalties for failing to file required forms, such as Form 990.

- Legal action from state authorities for violations of state laws governing non profits.

State-specific rules for the What Do Non Profit Organizers Do

Each state has its own regulations governing non profit organizations. Important considerations include:

- State registration requirements for non profits, which may differ from federal requirements.

- Specific fundraising regulations, including licensing and reporting obligations.

- State tax exemptions that may apply in addition to federal tax-exempt status.

Quick guide on how to complete what do non profit organizers do

Complete What Do Non Profit Organizers Do effortlessly on any device

Online document handling has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage What Do Non Profit Organizers Do on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign What Do Non Profit Organizers Do with ease

- Find What Do Non Profit Organizers Do and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks on your preferred device. Edit and eSign What Do Non Profit Organizers Do to ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the changes in accounting standards for government and not for profit entities?

The changes in accounting standards for government and not for profit entities refer to updates in guidelines that impact how these organizations report their financial activities. These changes aim to improve transparency, accountability, and uniformity in financial reporting in order to better reflect the unique operations of non-profit and government organizations.

-

How can airSlate SignNow assist with compliance regarding the changes in accounting standards for government and not for profit entities?

airSlate SignNow streamlines the document management process, making it easier to maintain compliance with the changes in accounting standards for government and not for profit entities. Our platform allows for secure eSigning and management of essential contracts, ensuring that all documents are properly handled and stored according to regulatory guidelines.

-

What features does airSlate SignNow offer to help manage changes in accounting standards for government and not for profit entities?

airSlate SignNow offers features like customizable templates, document workflows, and real-time tracking, which are crucial for managing changes in accounting standards for government and not for profit entities. These features ensure that all documentation flows smoothly and adheres to the necessary compliance requirements.

-

Is airSlate SignNow a cost-effective solution for addressing changes in accounting standards for government and not for profit entities?

Yes, airSlate SignNow is a cost-effective solution tailored for organizations needing to adapt to the changes in accounting standards for government and not for profit entities. Our pricing plans are designed to provide maximum value without compromising on the essential features required for effective document management.

-

How does airSlate SignNow integrate with other systems used for the changes in accounting standards for government and not for profit entities?

airSlate SignNow offers seamless integrations with various accounting and document management systems, helping organizations navigate the changes in accounting standards for government and not for profit entities. This compatibility ensures that users can incorporate eSigning directly into their existing workflows without disruption.

-

What are the benefits of using airSlate SignNow in light of changes in accounting standards for government and not for profit entities?

The benefits of using airSlate SignNow include enhanced efficiency, faster contract processing, and improved document security, which are vital for organizations facing changes in accounting standards for government and not for profit entities. Our platform simplifies the signing process, saving valuable time and resources.

-

Can airSlate SignNow help improve transparency in light of the changes in accounting standards for government and not for profit entities?

Absolutely, airSlate SignNow enhances transparency by providing a complete audit trail and document history, which is essential for compliance with the changes in accounting standards for government and not for profit entities. This accountability feature ensures that every action on a document is logged and accessible.

Get more for What Do Non Profit Organizers Do

- Generic company resignation form

- Il bca 1 35 form

- Exhibition cyberdrive illinois form

- Business broker cyberdriveillinoiscom form

- Illinois certificate partnership form

- Form bca 525 illinois secretary of state

- Application for amended certificate of authority cyberdrive illinois form

- 1 corporate name 2 state or country of incor form

Find out other What Do Non Profit Organizers Do

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast