Aging of Accounts Receivable Form

What is the Aging Of Accounts Receivable

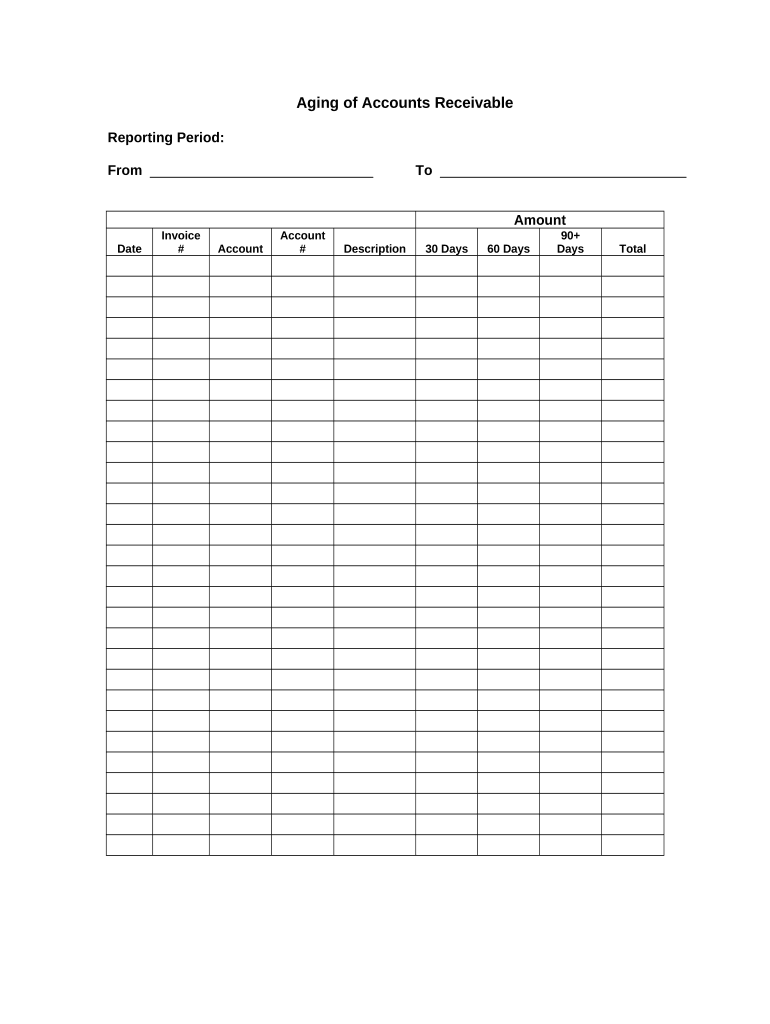

The aging of accounts receivable is a financial report that categorizes a company's accounts receivable based on the length of time an invoice has been outstanding. This report helps businesses assess the collectability of their receivables and manage cash flow effectively. Typically, accounts are divided into categories such as current, 30 days past due, 60 days past due, and 90 days past due. By analyzing these categories, businesses can identify which accounts may require follow-up and which customers are consistently late in their payments.

How to use the Aging Of Accounts Receivable

To utilize the aging of accounts receivable effectively, businesses should regularly generate and review the report. This involves inputting all outstanding invoices into the system and assigning them to the appropriate aging categories. Once the report is generated, management can prioritize collections based on the age of the receivables. For instance, accounts that are 90 days past due may require immediate attention, while those that are current may not need urgent follow-up. Regularly updating this report can help businesses maintain healthy cash flow and reduce the risk of bad debts.

Key elements of the Aging Of Accounts Receivable

Several key elements are essential for a comprehensive aging of accounts receivable report. These include:

- Customer Name: Identifies the debtor for each outstanding invoice.

- Invoice Date: Indicates when the invoice was issued.

- Invoice Amount: The total amount due for each invoice.

- Days Outstanding: The number of days since the invoice was issued, categorized into time frames.

- Status: Indicates whether the invoice is current, overdue, or in collections.

These elements provide a clear view of the company's receivables and help in making informed decisions regarding collections.

Steps to complete the Aging Of Accounts Receivable

Completing the aging of accounts receivable involves several straightforward steps:

- Gather Data: Collect all outstanding invoices and customer information.

- Input Information: Enter the data into an accounting software or spreadsheet.

- Categorize Invoices: Sort the invoices based on their due dates into appropriate aging categories.

- Review the Report: Analyze the aging report to identify overdue accounts and prioritize follow-ups.

- Follow Up: Contact customers with overdue invoices to discuss payment options.

Following these steps ensures that the aging of accounts receivable is accurate and actionable.

Legal use of the Aging Of Accounts Receivable

The aging of accounts receivable is not only a financial tool but also has legal implications. Businesses must ensure that their collection practices comply with the Fair Debt Collection Practices Act (FDCPA) and other relevant laws. This includes maintaining accurate records of communications with debtors and ensuring that any collection efforts are conducted fairly and ethically. Properly documenting the aging of accounts receivable can serve as evidence in case of disputes regarding payment or collection practices.

Examples of using the Aging Of Accounts Receivable

Businesses across various industries utilize the aging of accounts receivable in different ways. For instance:

- Retailers: Use the report to manage customer credit accounts and identify which customers may need to be placed on a cash-only basis.

- Service Providers: Analyze overdue invoices to prioritize follow-ups and ensure timely payments for ongoing services.

- Manufacturers: Monitor customer payment trends to adjust credit terms and manage production schedules accordingly.

These examples illustrate how the aging of accounts receivable can be tailored to meet specific business needs and improve overall financial health.

Quick guide on how to complete aging of accounts receivable

Effortlessly Complete Aging Of Accounts Receivable on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Aging Of Accounts Receivable on any device with airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign Aging Of Accounts Receivable with Ease

- Find Aging Of Accounts Receivable and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worry about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Aging Of Accounts Receivable and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of tracking the Aging Of Accounts Receivable?

Tracking the Aging Of Accounts Receivable is crucial for businesses as it helps monitor outstanding invoices and assess cash flow. Understanding this aging report can aid in identifying customers who are consistently late with payments, allowing for proactive collection efforts. By tracking receivables, businesses can improve their financial health and mitigate the risks associated with high outstanding balances.

-

How does airSlate SignNow help in managing the Aging Of Accounts Receivable?

airSlate SignNow streamlines invoice management and facilitates faster payment collection, directly impacting the Aging Of Accounts Receivable. With features like eSigning, businesses can send invoices more efficiently and reduce turnaround times for approvals. This ensures that outstanding payments are addressed promptly, thus optimizing overall account receivable management.

-

What features does airSlate SignNow provide to improve the Aging Of Accounts Receivable?

airSlate SignNow offers features such as automated reminders, eSigning, and integration with accounting software which are essential for managing the Aging Of Accounts Receivable. These tools help automate workflows, ensure timely follow-ups, and provide real-time insights into outstanding invoices. This comprehensive approach minimizes the aging period of accounts and improves cash flow.

-

Is airSlate SignNow cost-effective for managing the Aging Of Accounts Receivable?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage the Aging Of Accounts Receivable. By reducing the time spent on manual processes and improving payment collection rates, the platform delivers signNow savings over time. This affordability combined with its rich features makes it an ideal choice for businesses of all sizes.

-

How can I integrate airSlate SignNow with my existing accounting software for better Aging Of Accounts Receivable management?

airSlate SignNow provides seamless integrations with popular accounting software solutions, making it easier to manage the Aging Of Accounts Receivable. Through these integrations, businesses can automatically sync invoices and payment statuses, improving accuracy and reducing manual entry errors. This connectivity ensures a holistic view of accounts receivable, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for the Aging Of Accounts Receivable?

Using airSlate SignNow for the Aging Of Accounts Receivable offers multiple benefits, including increased efficiency, faster payment cycles, and improved cash flow. The platform enables businesses to automate document workflows and reduce delays caused by postal and manual processes. Overall, it enhances the overall receivables process, leading to better financial management.

-

Can airSlate SignNow help reduce the time invoicing takes, therefore impacting the Aging Of Accounts Receivable?

Absolutely! airSlate SignNow signNowly reduces the time invoicing takes through features such as template management and automated sending of invoices for eSigning. This expedited process can greatly impact the Aging Of Accounts Receivable by ensuring that invoices are sent quickly, leading to faster payments and reduced aging periods. Businesses can directly see the positive effects on their cash flow.

Get more for Aging Of Accounts Receivable

Find out other Aging Of Accounts Receivable

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip