Profit Sharing Agreement Form

What is the Profit Sharing Agreement

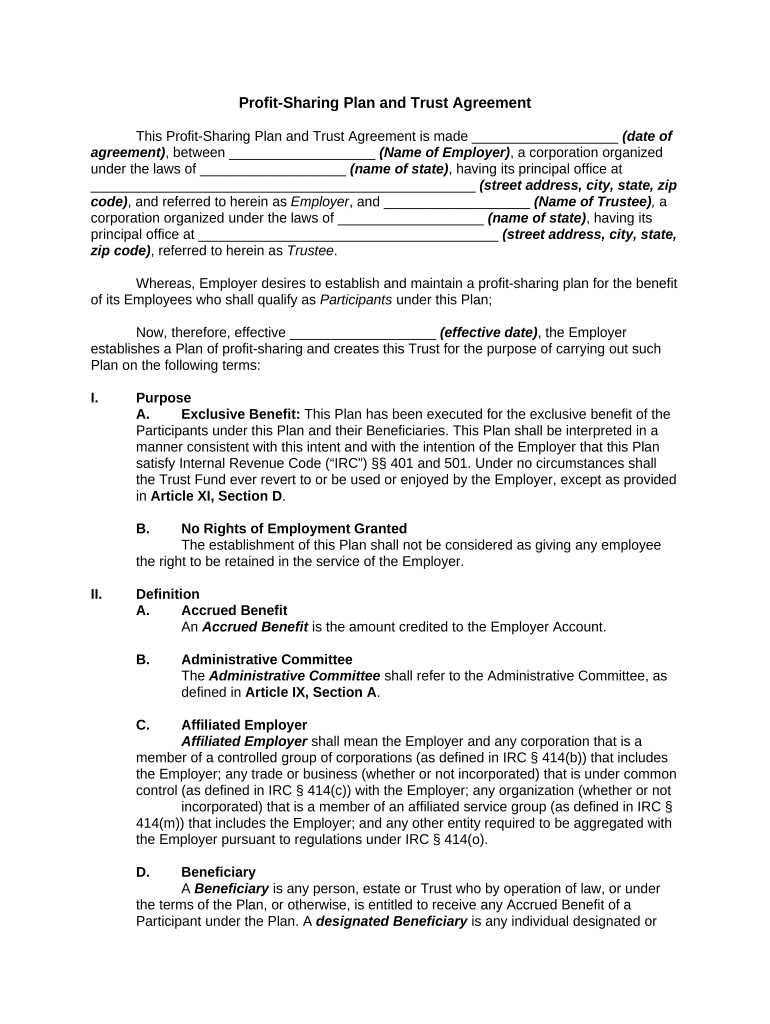

A profit sharing agreement is a legal document that outlines how profits will be distributed among business partners or employees. This type of agreement is essential for ensuring clarity and fairness in profit distribution, which can help maintain positive relationships within a business. It typically specifies the percentage of profits allocated to each party, the calculation method, and the timeline for distribution. By formalizing these details, a profit sharing agreement helps prevent misunderstandings and disputes.

Key Elements of the Profit Sharing Agreement

When drafting a profit sharing agreement, several key elements should be included to ensure its effectiveness and legal validity:

- Parties Involved: Clearly identify all parties participating in the agreement.

- Profit Distribution Method: Specify how profits will be calculated and distributed, whether based on percentage, performance, or other metrics.

- Duration: Define the time frame for which the agreement is valid, including any renewal terms.

- Conditions for Termination: Outline the circumstances under which the agreement may be terminated.

- Dispute Resolution: Include provisions for resolving disputes that may arise regarding profit distribution.

Steps to Complete the Profit Sharing Agreement

Completing a profit sharing agreement involves several steps to ensure it meets all legal requirements and accurately reflects the intentions of the parties involved:

- Gather Information: Collect necessary details about all parties, including their roles and contributions to the business.

- Draft the Agreement: Use a profit sharing agreement template to create a draft, incorporating all key elements.

- Review and Revise: Have all parties review the draft for accuracy and fairness, making necessary revisions.

- Obtain Signatures: Ensure all parties sign the agreement, either physically or electronically, to make it legally binding.

- Store the Document: Keep a copy of the signed agreement in a secure location for future reference.

Legal Use of the Profit Sharing Agreement

For a profit sharing agreement to be legally enforceable, it must comply with relevant laws and regulations. This includes adhering to state-specific requirements and ensuring that all parties have the legal capacity to enter into the agreement. Additionally, the agreement should be clear and unambiguous to avoid potential disputes. Utilizing a reputable platform for electronic signatures can enhance the document's validity by providing a secure and compliant method for signing.

How to Obtain the Profit Sharing Agreement

Obtaining a profit sharing agreement can be done through various means. Many legal and business websites offer templates that can be customized to fit specific needs. Additionally, consulting with a legal professional can provide tailored guidance and ensure that the agreement complies with applicable laws. Once the agreement is drafted, it can be filled out and signed digitally, streamlining the process and ensuring all parties have access to the document.

Quick guide on how to complete profit sharing agreement

Easily Prepare Profit Sharing Agreement on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, alter, and eSign your files swiftly without delays. Handle Profit Sharing Agreement on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Profit Sharing Agreement with Ease

- Obtain Profit Sharing Agreement and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and press the Done button to save your modifications.

- Select your preferred method for delivering your form, either via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign Profit Sharing Agreement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a profit sharing agreement?

A profit sharing agreement is a legal document that outlines how profits will be distributed among business partners or employees. This agreement ensures transparency and clarity in profit distribution, making it easier for all parties to understand their financial entitlements. By using airSlate SignNow, you can create, manage, and eSign profit sharing agreements efficiently.

-

How can airSlate SignNow assist in creating a profit sharing agreement?

airSlate SignNow provides intuitive templates and tools to draft your profit sharing agreement quickly and accurately. With our easy-to-use interface, you can customize the document to fit your business needs. This ensures that every aspect of the profit sharing agreement is tailored to your specific arrangement, simplifying the process of legal documentation.

-

What are the benefits of using airSlate SignNow for a profit sharing agreement?

Using airSlate SignNow for your profit sharing agreement offers several benefits, such as improved efficiency, reduced costs, and secure document management. Our platform allows for easy collaboration and signatures from all parties involved. Additionally, you have access to real-time tracking, ensuring you never miss a deadline related to your profit sharing agreement.

-

Is airSlate SignNow cost-effective for creating a profit sharing agreement?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to create a profit sharing agreement. Our pricing plans accommodate various business sizes, making it accessible for startups and established companies alike. With our solution, you save time and resources in document management, ultimately enhancing your profitability.

-

Can I integrate airSlate SignNow with other applications for profit sharing agreements?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing the functionality of your profit sharing agreement process. You can connect it with project management tools, CRMs, and more, allowing for a centralized workflow. This integration helps in streamlining communication and ensuring that all information is readily accessible.

-

What security features does airSlate SignNow provide for profit sharing agreements?

airSlate SignNow prioritizes the security of your profit sharing agreements by providing advanced encryption and secure cloud storage. All documents are protected with multi-factor authentication, ensuring that only authorized users can access sensitive information. This gives you peace of mind while managing your profit sharing agreements online.

-

How long does it take to set up a profit sharing agreement using airSlate SignNow?

Setting up a profit sharing agreement with airSlate SignNow is quick and straightforward, often taking just a few minutes. With pre-made templates and an intuitive editor, you can customize and finalize your agreement in no time. Once completed, you can send it out for e-signatures, expediting the entire process of agreement execution.

Get more for Profit Sharing Agreement

- Alternative break info packet suny oswego form

- Liberty university transcripts form

- Official mail and distribution center fort rucker us army form

- Admission status change from conditional to regular gram form

- 3 gc mccollum administration building centralsan form

- Consortium agreement georgia college amp state university gcsu form

- Meal plan exemption request gonzaga university gonzaga form

- Grambling state university cheerleaders form

Find out other Profit Sharing Agreement

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement