Creditors Debtor Form

What is the Creditors Debtor

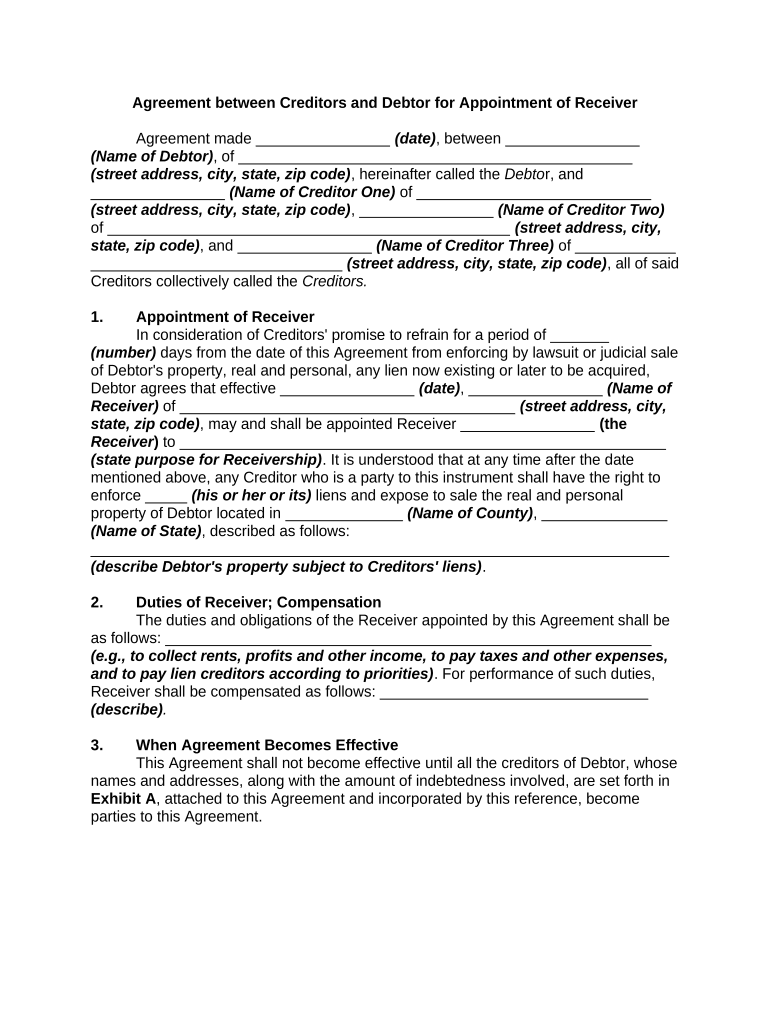

The creditors debtor refers to the relationship between a creditor, who is owed money, and a debtor, who owes that money. This relationship is often formalized through a written agreement that outlines the terms of the debt, including repayment schedules, interest rates, and consequences for non-payment. Understanding this dynamic is crucial for both parties to ensure clarity and legal compliance in financial transactions.

Key elements of the Creditors Debtor

Several key elements define the creditors debtor relationship:

- Debt Amount: The total sum of money owed by the debtor to the creditor.

- Interest Rate: The percentage of the debt that may be charged as interest over a specified period.

- Payment Terms: The schedule and conditions under which the debtor agrees to repay the debt.

- Consequences of Default: The actions that the creditor may take if the debtor fails to meet the repayment terms.

These elements are essential for creating a legally binding agreement that protects the interests of both parties involved.

Steps to complete the Creditors Debtor

Completing a creditors debtor agreement involves several important steps:

- Gather Necessary Information: Collect all relevant financial details, including the debtor's identification and the amount owed.

- Draft the Agreement: Clearly outline the terms of the debt, including payment schedules and interest rates.

- Review Legal Requirements: Ensure that the agreement complies with local laws and regulations.

- Sign the Agreement: Both parties should sign the document, ideally in the presence of a witness or notary.

- Store the Document Safely: Keep a copy of the signed agreement for records and future reference.

Following these steps helps ensure that the creditors debtor agreement is valid and enforceable.

Legal use of the Creditors Debtor

The legal use of a creditors debtor agreement is primarily to establish the terms of the debt and protect the rights of both parties. This agreement serves as a legal document that can be presented in court if disputes arise. It is important for both creditors and debtors to understand their rights and obligations under the law to avoid potential legal issues.

Examples of using the Creditors Debtor

There are various scenarios in which a creditors debtor agreement may be utilized:

- Personal Loans: Individuals borrowing money from friends or family may formalize the loan with a creditors debtor agreement.

- Business Loans: Companies often enter into creditors debtor agreements with banks or financial institutions for funding.

- Credit Card Debt: Creditors issue credit cards with terms that create a creditors debtor relationship with cardholders.

These examples illustrate the versatility of creditors debtor agreements across different contexts.

Digital vs. Paper Version

Both digital and paper versions of creditors debtor agreements are legally valid, provided they meet the necessary legal requirements. Digital agreements offer advantages such as ease of storage, quick access, and the ability to use electronic signatures for convenience. However, some individuals may prefer paper versions for their tangible nature. Understanding the benefits and limitations of each format can help parties choose the best option for their needs.

Quick guide on how to complete creditors debtor

Effortlessly Prepare Creditors Debtor on Any Device

Digital document management has gained traction among both companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to swiftly create, modify, and eSign your documents without any hitches. Manage Creditors Debtor on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Edit and eSign Creditors Debtor with Ease

- Obtain Creditors Debtor and click Get Form to begin.

- Employ the tools available to fill out your form.

- Select important sections of the documents or redact confidential information with the tools that airSlate SignNow offers for that specific purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Creditors Debtor and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of creditors and debtors in document management?

In document management, creditors and debtors play crucial roles as they are often involved in agreements needing eSigning. airSlate SignNow facilitates the exchange of documents between creditors and debtors, ensuring that all parties can sign securely and efficiently. This minimizes disputes and keeps the workflow smooth for both creditors and debtors.

-

How does airSlate SignNow benefit creditors and debtors?

airSlate SignNow offers signNow benefits to creditors and debtors by providing a streamlined process for electronic signatures. This solution saves time and reduces paperwork, enabling faster agreement finalization. Creditors and debtors can also track document status in real-time, enhancing transparency and trust in the transaction.

-

What features does airSlate SignNow provide for managing creditor-debtor documents?

airSlate SignNow includes essential features for managing creditor-debtor documents, such as customizable templates, bulk sending, and automatic reminders. These features simplify the signing process, ensuring that documents are completed promptly. Additionally, the platform maintains compliance with legal standards, protecting both creditors and debtors.

-

Is airSlate SignNow cost-effective for creditors and debtors?

Yes, airSlate SignNow is designed to be a cost-effective solution for creditors and debtors alike. Our pricing plans are competitive, ensuring that businesses of all sizes can leverage the benefits of eSigning without breaking the bank. With various tiers available, creditors and debtors can choose a plan that fits their needs and budget.

-

Can airSlate SignNow integrate with other platforms used by creditors and debtors?

Absolutely! airSlate SignNow integrates seamlessly with various platforms frequently used by creditors and debtors, such as CRM systems, accounting software, and document management tools. These integrations enhance the workflow, making it easy for creditors and debtors to access all necessary tools in one place. This interoperability helps streamline operations and improve productivity.

-

What security measures does airSlate SignNow use for creditor-debtor transactions?

airSlate SignNow prioritizes security for all creditor-debtor transactions through robust encryption and compliance with industry standards. Personal and financial information is securely managed, providing peace of mind for both creditors and debtors. Our platform ensures that all documents are safe, making it a trusted solution for sensitive transactions.

-

How can creditors and debtors track the status of their documents in airSlate SignNow?

Creditors and debtors can easily track the status of their documents using airSlate SignNow's intuitive dashboard. The platform provides real-time updates, allowing users to see when a document has been viewed and signed. This feature reduces uncertainty and allows both creditors and debtors to stay informed throughout the signing process.

Get more for Creditors Debtor

Find out other Creditors Debtor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors