Subcontractor Form

Understanding the Subcontractor

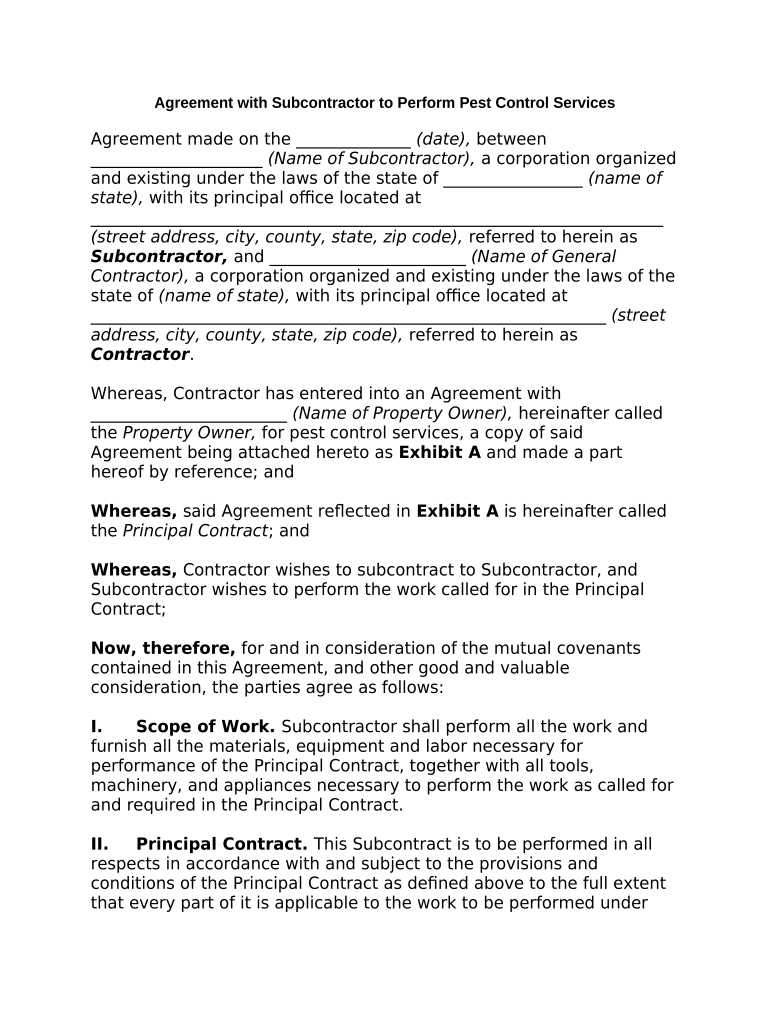

The subcontractor is a crucial component in various business agreements, particularly in construction and service industries. This form is used to outline the responsibilities, scope of work, and payment terms between a primary contractor and a subcontractor. It ensures that both parties have a clear understanding of their obligations, which helps to prevent disputes and promotes efficient project completion.

Steps to Complete the Subcontractor

Completing the subcontractor form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including the names and contact details of both the contractor and subcontractor.

- Clearly define the scope of work, including specific tasks, deadlines, and deliverables.

- Outline payment terms, including rates, payment schedule, and any conditions for payment.

- Include any relevant legal clauses, such as confidentiality agreements or liability limitations.

- Ensure all parties review the document thoroughly before signing.

Legal Use of the Subcontractor

For a subcontractor form to be legally binding, it must comply with relevant laws and regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that the signers consent to use electronic records. This means that when using a digital platform for signing, it is essential to ensure that the platform complies with these legal standards to maintain the enforceability of the agreement.

Key Elements of the Subcontractor

Several key elements must be included in the subcontractor form to ensure clarity and legal validity:

- Parties involved: Clearly identify the contractor and subcontractor.

- Scope of work: Detail the tasks to be performed by the subcontractor.

- Payment terms: Specify how and when the subcontractor will be compensated.

- Duration: State the timeline for the completion of work.

- Termination clauses: Outline conditions under which the agreement can be terminated.

Examples of Using the Subcontractor

Subcontractor forms are commonly used in various scenarios, such as:

- A construction company hiring a plumbing subcontractor to handle all plumbing work on a new build.

- A software development firm contracting a freelance developer to complete a specific module of a larger project.

- A marketing agency outsourcing graphic design work to a specialized design firm.

Required Documents

When preparing to complete the subcontractor form, certain documents may be required to support the agreement. These can include:

- Proof of insurance coverage for the subcontractor.

- Licenses and certifications relevant to the work being performed.

- Any previous agreements or contracts that may affect the current arrangement.

Quick guide on how to complete subcontractor 497332944

Effortlessly prepare Subcontractor on any device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Subcontractor on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to edit and electronically sign Subcontractor with ease

- Find Subcontractor and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Subcontractor to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is agreement control in airSlate SignNow?

Agreement control in airSlate SignNow refers to the ability to manage, monitor, and oversee the signing process of documents within a secure digital environment. This feature ensures that all agreements are handled efficiently, allowing users to track who signed, when they signed, and any changes made throughout the process.

-

How does airSlate SignNow facilitate agreement control?

airSlate SignNow facilitates agreement control through its intuitive interface that allows for easy document management and tracking. Users can create, send, and sign documents while receiving real-time notifications of changes or completions, ensuring that you have full oversight of your agreements.

-

What are the pricing options for using agreement control features?

The pricing for airSlate SignNow is competitive and designed to cater to various business needs. Customers can select from different plans that include access to advanced agreement control features, ensuring they only pay for what they need based on their document handling volume.

-

Can I integrate airSlate SignNow with other applications for better agreement control?

Yes, airSlate SignNow offers seamless integrations with various applications and tools that enhance your agreement control capabilities. You can integrate with CRM systems, cloud storage solutions, and other productivity software to streamline your document workflows.

-

What are the benefits of using airSlate SignNow for agreement control?

Using airSlate SignNow for agreement control provides numerous benefits such as increased efficiency, reduced paper usage, and enhanced security. The platform allows for easy tracking of document statuses, ensuring that all parties are informed and reducing the chance of errors or delays.

-

Is airSlate SignNow suitable for small businesses regarding agreement control?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses looking to enhance their agreement control. The platform helps you manage documents without the burden of costly paper-based processes.

-

How does eSigning work with airSlate SignNow to enhance agreement control?

eSigning with airSlate SignNow enhances agreement control by providing a legally binding digital signature process that is quick and easy. Users can sign documents from any device, ensuring that agreement completion is faster and more secure, reducing the time spent on manual tasks.

Get more for Subcontractor

Find out other Subcontractor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors