Change Resident Form

What is the Change Resident?

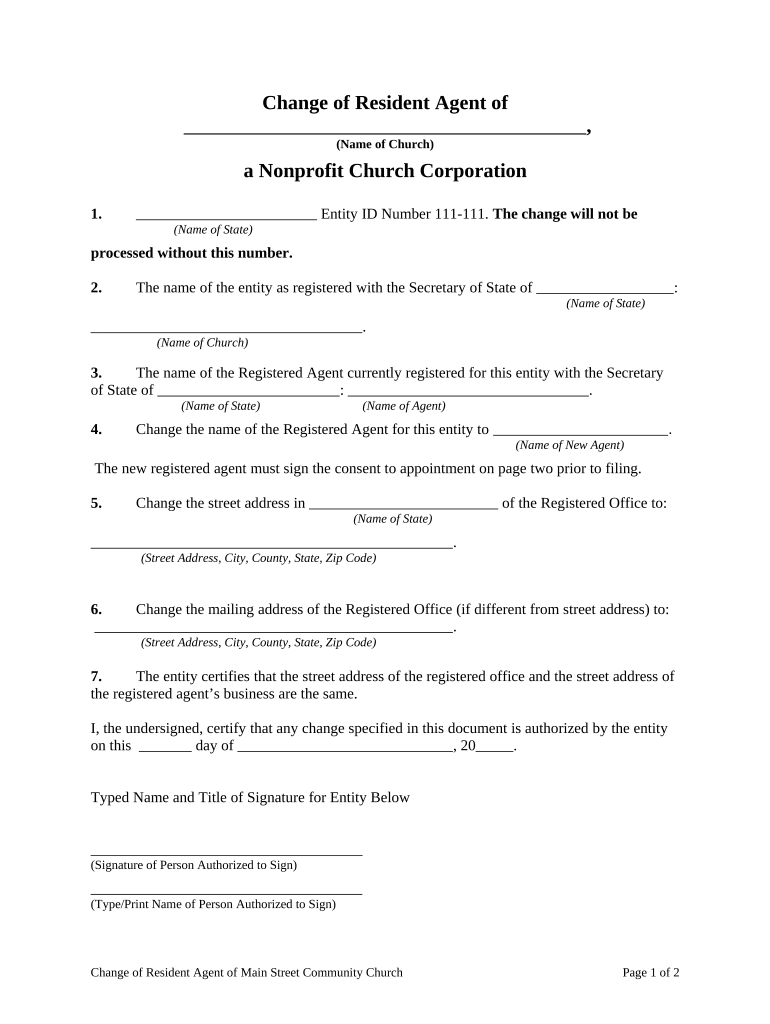

The change resident refers to the process of updating the designated resident agent for a business entity. A resident agent is an individual or business responsible for receiving legal documents, such as service of process, tax notices, and compliance-related correspondence. This change is essential for maintaining effective communication with state authorities and ensuring that the business remains compliant with local regulations. Understanding the role of a resident agent is crucial for business owners, as it directly impacts their legal standing and operational efficiency.

Steps to Complete the Change Resident

Completing the change resident agent form involves several key steps to ensure accuracy and compliance. Here’s a straightforward outline of the process:

- Gather necessary information about the current and new resident agents, including names, addresses, and contact details.

- Obtain the appropriate change resident agent form from the state’s business filing office or website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency, either online, by mail, or in person, depending on state regulations.

- Keep a copy of the submitted form for your records.

Legal Use of the Change Resident

The change resident agent form must be executed in compliance with state laws to be considered legally binding. This means that the form must be signed by authorized individuals within the business, and any required notarization must be completed. Additionally, it is important to adhere to the specific regulations set forth by the state regarding the timing and method of submission. Ensuring that the change is documented properly helps protect the business from potential legal complications and maintains its good standing with state authorities.

Required Documents

When filing a change resident agent form, certain documents may be required to support the application. Commonly required documents include:

- The completed change resident agent form.

- A copy of the current resident agent’s consent to resign, if applicable.

- Identification or proof of authority for the person submitting the form on behalf of the business.

- Any additional state-specific documents that may be mandated for the change process.

State-Specific Rules for the Change Resident

Each state in the United States has its own regulations regarding the change resident agent process. It is essential to familiarize yourself with the specific rules applicable in your state, as these can affect the filing process, required documentation, and deadlines. Some states may require additional forms or have distinct procedures for notifying the outgoing resident agent. Consulting your state’s business filing office or website can provide clarity on these requirements and help ensure compliance.

Examples of Using the Change Resident

Understanding practical scenarios can help clarify the importance of the change resident agent form. For instance, a business may need to change its resident agent when:

- The current resident agent moves out of state or is no longer available.

- The business undergoes a merger or acquisition, necessitating a new resident agent.

- The company decides to switch to a professional registered agent service for better compliance management.

These examples illustrate the various circumstances under which a business might need to initiate a change resident agent process, highlighting its relevance in maintaining operational integrity.

Quick guide on how to complete change resident

Effortlessly Prepare Change Resident on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents swiftly without delays. Manage Change Resident on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign Change Resident effortlessly

- Find Change Resident and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Forget about missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Change Resident and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to change resident in airSlate SignNow?

To change resident in airSlate SignNow refers to the process of updating your account to reflect a new location or address where you conduct business. This is essential for ensuring compliance with local laws and receiving important notifications. It's a straightforward process that keeps your documents accurate.

-

How can I change resident details in my SignNow account?

You can easily change resident details in your SignNow account by navigating to the account settings. There you will find an option to update your information. Make sure to save the changes to ensure that your documents reflect the new resident status.

-

Is there a fee to change resident information in airSlate SignNow?

No, there is no fee to change resident information in airSlate SignNow. This feature is included in your subscription at no additional cost, allowing you to maintain accurate records without incurring extra charges. It’s part of our commitment to providing a cost-effective solution for your business.

-

What benefits will I experience after I change resident information?

Changing resident information in airSlate SignNow ensures that your documents are legally compliant and reflect your current business location. This can enhance your credibility and customer trust. Additionally, it helps prevent any potential legal issues related to outdated information.

-

Can I change resident information after I’ve sent documents for signing?

Once documents are sent for signing in airSlate SignNow, you cannot change resident information on those specific documents. However, you can update your account's resident details for future use. This ensures that any new documents reflect your updated information.

-

Does changing resident status affect my integrations with other software?

Changing resident status in airSlate SignNow should not affect integrations with other software. Our system is designed to maintain seamless connections even when updates are made to your account information. However, it's always good to verify with your integrated applications.

-

Will my subscription price change if I change resident status?

Changing resident status in airSlate SignNow has no impact on your subscription price. Your pricing remains consistent regardless of address updates. This ensures you can focus on your business without worrying about unexpected costs.

Get more for Change Resident

- Secretary of state police form

- Illinois i will information form

- Illinois motor franchise form

- Use it and lose it study guide illinois secretary of state form

- Il sos form dop 1343

- Selective service registration form

- Il sos complaint form

- Publications of the state of illinois illinois secretary of state 6966715 form

Find out other Change Resident

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS