Sample Letter Tax Form

What is the Sample Letter Tax

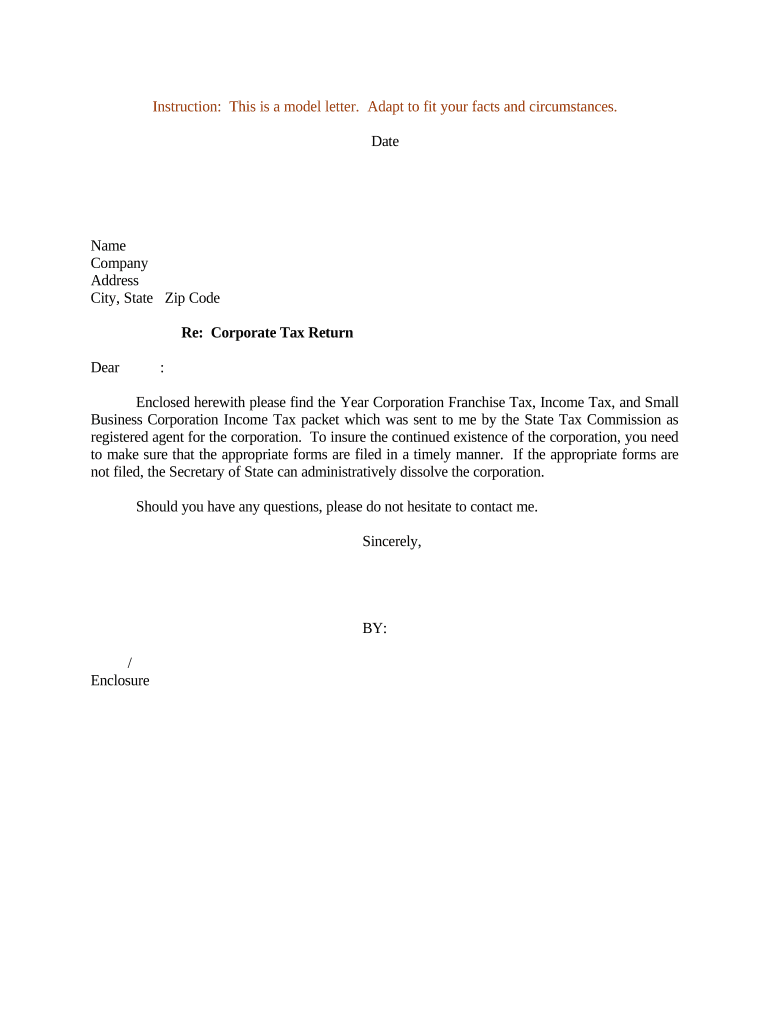

The Sample Letter Tax serves as a template for taxpayers who need to communicate with the Internal Revenue Service (IRS) or state tax authorities regarding various tax matters. This letter can be utilized for a range of purposes, including requesting tax information, clarifying tax obligations, or disputing tax assessments. By using a standardized format, taxpayers can ensure that their communications are clear and professional, which may facilitate a more efficient response from tax authorities.

How to use the Sample Letter Tax

Using the Sample Letter Tax involves several key steps to ensure that it meets the necessary requirements. First, identify the specific purpose of your letter, whether it is to request information, contest a tax bill, or address another tax-related issue. Next, personalize the template by filling in your details, including your name, address, and taxpayer identification number. Be sure to clearly state the reason for your correspondence and include any supporting documentation that may be relevant to your case. Finally, review the letter for accuracy and clarity before sending it to the appropriate tax authority.

IRS Guidelines

When drafting a Sample Letter Tax, it is essential to adhere to IRS guidelines to ensure compliance and effectiveness. The IRS recommends that letters be concise and to the point, clearly stating the purpose of the communication. Additionally, it is important to include your taxpayer identification number and any relevant tax years to help the IRS process your request efficiently. Following the IRS's guidelines can enhance the likelihood of a timely and favorable response.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial when submitting a Sample Letter Tax. The IRS has specific timelines for various tax-related communications, including requests for extensions, amendments, and disputes. Generally, letters addressing tax issues should be sent as soon as possible after the issue arises. For instance, if you are contesting a tax bill, it is advisable to submit your letter within thirty days of receiving the notice. Being aware of these deadlines helps ensure that your correspondence is considered timely and can prevent potential penalties.

Required Documents

When using the Sample Letter Tax, including the appropriate supporting documents is vital for substantiating your claims. Depending on the nature of your letter, you may need to attach copies of previous tax returns, notices received from the IRS, or other relevant financial documents. Ensure that all documents are organized and clearly labeled to facilitate easy review by tax authorities. Providing comprehensive documentation can strengthen your case and expedite the resolution process.

Penalties for Non-Compliance

Failure to comply with tax regulations can lead to significant penalties, making it essential to use the Sample Letter Tax correctly. Non-compliance may result in fines, interest on unpaid taxes, or even legal action. By communicating effectively and promptly with tax authorities using the Sample Letter Tax, you can mitigate the risk of penalties and ensure that your tax matters are resolved in a timely manner. Understanding the potential consequences of non-compliance emphasizes the importance of proper communication with the IRS.

Quick guide on how to complete sample letter tax 497333136

Prepare Sample Letter Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Handle Sample Letter Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Sample Letter Tax effortlessly

- Search for Sample Letter Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to preserve your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Sample Letter Tax and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a corporate tax return?

A corporate tax return is a form filed by businesses to report their income, expenses, and other financial information to the tax authorities. It is essential for calculating taxes owed for the fiscal year. Properly filing your corporate tax return can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with my corporate tax return?

airSlate SignNow simplifies the process of preparing and submitting your corporate tax return by allowing you to securely gather eSignatures and send documents effortlessly. Our user-friendly platform ensures that all stakeholders can collaborate efficiently, making tax filing quicker and easier.

-

What features does airSlate SignNow offer for corporate tax return preparation?

airSlate SignNow offers features such as document templates, secure eSignature capabilities, and real-time collaboration. These features streamline the preparation and submission of your corporate tax return, ensuring that all necessary documents are completed accurately and on time.

-

How much does airSlate SignNow cost for corporate tax return services?

airSlate SignNow offers various pricing plans tailored to business needs, starting from a cost-effective option designed for seamless document management, including corporate tax return submissions. Visit our pricing page for detailed information and choose the plan that suits your organization.

-

Is airSlate SignNow secure for handling corporate tax returns?

Yes, airSlate SignNow implements robust security measures, including encryption and secure cloud storage, to protect your sensitive information during the corporate tax return process. Our dedication to privacy ensures that your data is safe and compliant with regulations.

-

Can airSlate SignNow integrate with accounting software for corporate tax returns?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for a streamlined workflow when preparing corporate tax returns. This integration ensures accurate data transfer, which reduces the chances of errors during tax filing.

-

What are the benefits of using airSlate SignNow for corporate tax returns?

Using airSlate SignNow for corporate tax returns offers several benefits, including enhanced efficiency through automated document workflows, reduced turnaround times for eSignatures, and improved collaboration among team members. These advantages can signNowly simplify your tax preparation process.

Get more for Sample Letter Tax

- Certificate of financial resources form office of global

- Enhanced personal services a relationship t rowe price form

- Health card form fill online printable fillable blank

- Cg1280pdf vessel renewal notification application for renewal form

- Request for appt letter marlene delta dental of arkansas form

- Note to applicant please complete the top part of this form and sent it to wes with photocopies of your academic qualificat

- Ice form i 333 obligor change of address

- 2026 notarized citizenship affidavit notaryamp039s form

Find out other Sample Letter Tax

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract