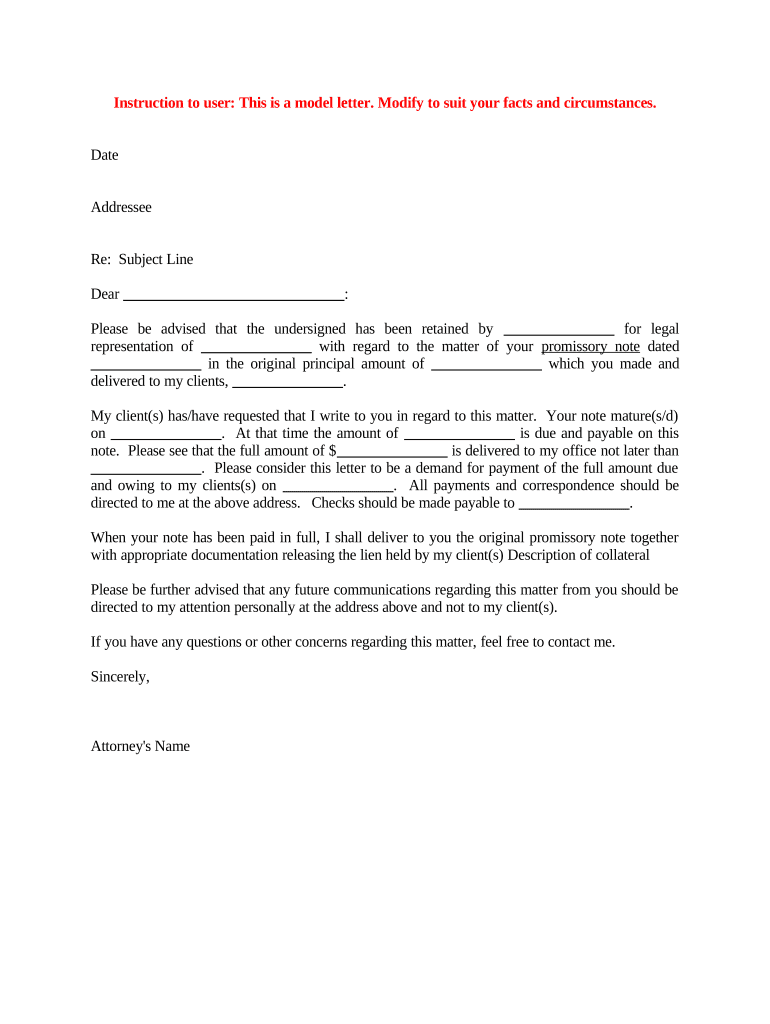

Demand Letter Form

What is the repayment promissory note?

A repayment promissory note is a legal document in which one party (the borrower) promises to repay a specified amount of money to another party (the lender) under agreed-upon terms. This document outlines the amount borrowed, the interest rate, the repayment schedule, and any other conditions that apply. It serves as a formal acknowledgment of debt and can be used in various lending situations, including personal loans, business loans, and real estate transactions.

Key elements of the repayment promissory note

Understanding the essential components of a repayment promissory note is crucial for both parties involved. Key elements typically include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, which can be fixed or variable.

- Repayment Schedule: Specific dates or intervals at which payments are due.

- Maturity Date: The final date by which the loan must be fully repaid.

- Signatures: The borrower and lender must sign the document to make it legally binding.

- Default Terms: Conditions that specify what happens if the borrower fails to make payments.

Steps to complete the repayment promissory note

Filling out a repayment promissory note involves several straightforward steps to ensure that all necessary information is accurately captured. Here’s a simple guide:

- Identify the Parties: Clearly state the names and addresses of both the borrower and lender.

- Specify the Loan Amount: Write the principal amount being borrowed.

- Determine the Interest Rate: Indicate the interest rate applicable to the loan.

- Outline the Repayment Terms: Detail the repayment schedule, including due dates and amounts.

- Include Default Provisions: Specify the consequences of missed payments.

- Sign the Document: Both parties should sign and date the note to validate it.

Legal use of the repayment promissory note

The repayment promissory note is a legally binding document, provided it meets specific requirements under U.S. law. For it to be enforceable, the note must include clear terms regarding the debt, the obligations of both parties, and must be signed by both the borrower and lender. Additionally, it is advisable to have the document notarized to further establish its authenticity and prevent disputes.

How to use the repayment promissory note

Once completed, the repayment promissory note serves as a reference for both parties regarding the loan terms. The lender can use it to track payments and ensure compliance with the repayment schedule. The borrower should retain a copy for their records, as it outlines their obligations and the terms of the loan. In case of any disputes, this document can be presented in court as evidence of the agreement.

Examples of using the repayment promissory note

Repayment promissory notes can be utilized in various scenarios, such as:

- Personal Loans: Friends or family members lending money to one another.

- Business Loans: Companies borrowing funds from banks or private investors.

- Real Estate Transactions: Buyers financing a property purchase through a loan agreement.

Quick guide on how to complete demand letter form

Accomplish Demand Letter Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage Demand Letter Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related tasks today.

How to modify and electronically sign Demand Letter Form with ease

- Locate Demand Letter Form and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Modify and electronically sign Demand Letter Form and guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter of repayment template?

A letter of repayment template is a pre-formatted document that outlines the terms of repayment between a borrower and a lender. It helps to ensure clear communication regarding the repayment process and can be easily customized to fit individual agreements.

-

How can airSlate SignNow help with a letter of repayment template?

airSlate SignNow enables users to create, send, and eSign a letter of repayment template efficiently. Its easy-to-use interface allows you to personalize the template, making it suitable for various financial arrangements.

-

Is there a cost associated with using a letter of repayment template in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to customizable templates, including a letter of repayment template. Subscriptions are designed to be cost-effective, making it accessible for businesses of all sizes.

-

What features are included with the letter of repayment template in airSlate SignNow?

The letter of repayment template includes essential features such as eSignature capabilities, cloud storage, and document tracking. These features simplify the repayment process, ensuring that both parties can easily access and sign the document.

-

Can I integrate the letter of repayment template with other tools?

Yes, airSlate SignNow offers integrations with various third-party applications, enabling you to seamlessly incorporate the letter of repayment template into your existing workflows. This enhances productivity and streamlines the repayment process.

-

What are the benefits of using a letter of repayment template?

Using a letter of repayment template minimizes misunderstandings and sets clear expectations regarding repayment terms. It also saves time and ensures compliance with necessary legal standards, providing peace of mind for both borrowers and lenders.

-

How can I customize my letter of repayment template?

With airSlate SignNow, users can easily customize a letter of repayment template by adding specific details such as loan amounts, repayment dates, and interest rates. The editing tools are user-friendly, allowing quick modifications to meet individual needs.

Get more for Demand Letter Form

Find out other Demand Letter Form

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement