Assignment Partnership Form

What is the assignment of partnership interest?

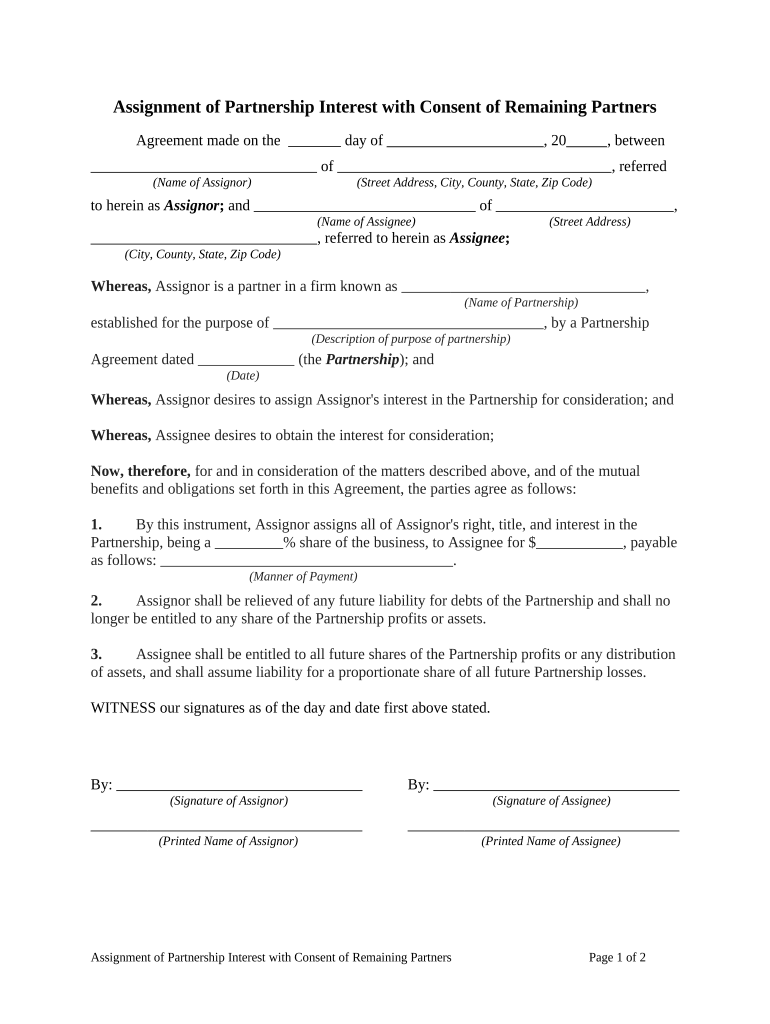

The assignment of partnership interest refers to the transfer of a partner's share in a partnership to another individual or entity. This transfer can include rights to profits, losses, and decision-making powers within the partnership. It is essential for partners to understand that such an assignment does not automatically release the original partner from obligations or liabilities unless explicitly stated in the partnership agreement.

Steps to complete the assignment of partnership interest

Completing the assignment of partnership interest form involves several key steps to ensure legality and clarity. First, the current partner must fill out the form accurately, detailing the specifics of the interest being assigned. Next, both the assignor (the partner transferring the interest) and the assignee (the new partner) should review the partnership agreement to confirm compliance with any existing terms regarding assignments. After that, signatures from both parties are required, and it is advisable to have the document notarized to enhance its legal standing. Finally, the completed form should be submitted to the partnership for record-keeping.

Legal use of the assignment of partnership interest

To ensure the legal validity of the assignment of partnership interest, it is crucial to comply with relevant laws and regulations. The assignment must be documented in writing, and both parties should retain copies for their records. Additionally, the partnership agreement may outline specific procedures for assignments, such as obtaining consent from other partners. Adhering to these guidelines helps protect the interests of all parties involved and mitigates potential disputes.

Key elements of the assignment of partnership interest

Several key elements must be included in the assignment of partnership interest form to ensure it is comprehensive and legally binding. These elements typically include:

- Names of the assignor and assignee: Clearly state the full legal names of both parties.

- Description of the interest being assigned: Specify the percentage of the partnership interest being transferred.

- Effective date: Indicate when the assignment will take effect.

- Signatures: Both parties must sign the document to validate the transfer.

State-specific rules for the assignment of partnership interest

Each state may have its own regulations regarding the assignment of partnership interest. It is important for partners to be aware of these specific rules, as they can affect the validity of the assignment. Some states may require additional documentation or specific language to be included in the assignment form. Consulting with a legal professional familiar with state laws can provide clarity and ensure compliance.

Required documents for the assignment of partnership interest

When completing the assignment of partnership interest, certain documents may be required to support the process. These can include:

- The original partnership agreement: This document outlines the terms of the partnership and any restrictions on assignments.

- Identification documents: Both parties may need to provide identification to verify their identities.

- Notarization: While not always required, having the document notarized can add an extra layer of legal protection.

Quick guide on how to complete assignment partnership

Complete Assignment Partnership effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Assignment Partnership on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Assignment Partnership with ease

- Obtain Assignment Partnership and click Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Assignment Partnership and ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment of partnership interest form?

An assignment of partnership interest form is a legal document used to transfer a partner's share in a partnership to another individual or entity. This form outlines the terms of the transfer, ensuring that all parties understand their rights and obligations. Using airSlate SignNow, you can easily create, send, and eSign this form with a streamlined process.

-

How can airSlate SignNow help with my assignment of partnership interest form?

airSlate SignNow simplifies the creation and signing process for your assignment of partnership interest form. Our platform allows you to customize your form, collect necessary signatures electronically, and track its status in real-time. This ensures a quick and efficient transfer of partnership interests.

-

Is there a cost associated with using airSlate SignNow for my assignment of partnership interest form?

AirSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. Depending on your needs, you can select a plan that includes features for managing documents such as the assignment of partnership interest form. A free trial is also available to get you started without any commitment.

-

What features does airSlate SignNow offer for managing partnership documents?

With airSlate SignNow, you can access a range of features for managing your partnership documents. Key features include customizable templates, secure eSigning, document tracking, and integration capabilities with various applications. These tools enhance your workflow and make handling the assignment of partnership interest form more efficient.

-

Is airSlate SignNow compliant with legal and security standards?

Yes, airSlate SignNow prioritizes compliance with legal and security standards for electronic signatures, including ESIGN and UETA regulations. When using the assignment of partnership interest form on our platform, you can trust that your documents are secure and legally binding. We use advanced encryption to protect your sensitive information.

-

Can I integrate airSlate SignNow with other software tools for my partnership documents?

Absolutely! airSlate SignNow offers seamless integrations with popular business tools like Google Workspace, Salesforce, and Microsoft Office. This allows you to manage your assignment of partnership interest form and related documents more effectively by consolidating your workflow across platforms.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides your business with a cost-effective solution to manage documents like the assignment of partnership interest form. Key benefits include increased efficiency, reduced paperwork, improved collaboration, and enhanced document security. This helps streamline your operations while minimizing the potential for errors.

Get more for Assignment Partnership

Find out other Assignment Partnership

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation