Beneficiaries Trust Form

What is the Beneficiaries Trust

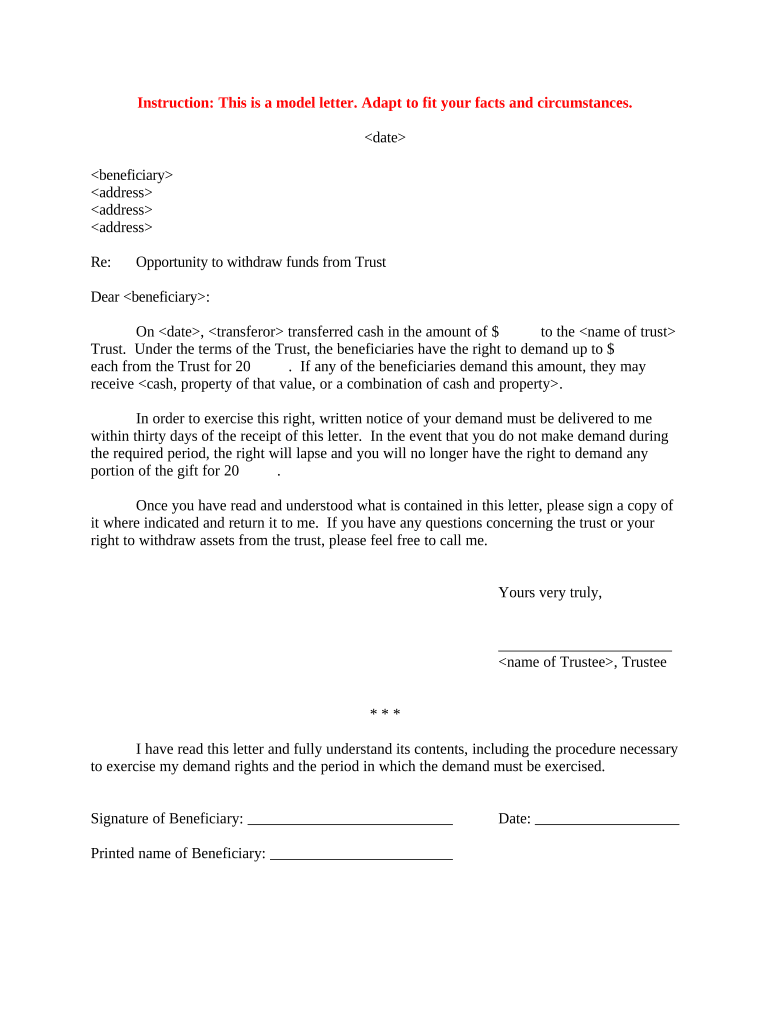

A Beneficiaries Trust is a legal arrangement that allows a trustee to manage assets on behalf of designated beneficiaries. This type of trust is often used to ensure that the assets are distributed according to the wishes of the grantor, providing financial security and support to the beneficiaries. The trust can be structured to meet specific needs, such as providing for minors or individuals with special needs, ensuring that the assets are protected and used for their intended purpose.

How to use the Beneficiaries Trust

Using a Beneficiaries Trust involves several steps to ensure that it operates effectively. First, the grantor must clearly define the terms of the trust, including the beneficiaries and the assets to be included. Next, the grantor appoints a trustee who will manage the trust according to its terms. It is essential to communicate the trust's purpose and guidelines to the beneficiaries to ensure they understand their rights and responsibilities. Regular reviews of the trust may be necessary to adapt to changes in circumstances or laws.

Steps to complete the Beneficiaries Trust

To complete a Beneficiaries Trust, follow these steps:

- Determine the purpose of the trust and identify the beneficiaries.

- Select a trustworthy and capable trustee to manage the trust.

- Draft the trust document, outlining the terms and conditions.

- Fund the trust by transferring assets into it.

- Ensure that all legal requirements are met for the trust to be valid.

- Communicate with beneficiaries about the trust's provisions and their roles.

Legal use of the Beneficiaries Trust

The legal use of a Beneficiaries Trust is governed by state laws, which may vary. It is crucial to ensure that the trust complies with applicable regulations to be enforceable. The trust document should clearly outline the rights of the beneficiaries and the responsibilities of the trustee. Additionally, the trust should be established in a manner that avoids unnecessary tax implications and complies with estate planning laws.

Key elements of the Beneficiaries Trust

Key elements of a Beneficiaries Trust include:

- The grantor, who creates the trust and defines its terms.

- The trustee, who manages the trust assets and ensures compliance with the trust's terms.

- The beneficiaries, who receive the benefits from the trust.

- The trust document, which outlines the rules governing the trust.

- The assets placed into the trust, which can include cash, property, or investments.

Quick guide on how to complete beneficiaries trust

Complete Beneficiaries Trust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Beneficiaries Trust on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Beneficiaries Trust with ease

- Find Beneficiaries Trust and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight key sections of your documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow accommodates all your document management needs in a few clicks from your preferred device. Edit and eSign Beneficiaries Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample trust form?

A sample trust form is a template that outlines the details of a trust agreement, facilitating the management of assets. These forms are essential for ensuring that trusts are legally binding and accurately reflect the intentions of the trustor. By utilizing a sample trust form, users can easily customize it to meet their specific needs.

-

How can I create a sample trust form using airSlate SignNow?

Creating a sample trust form with airSlate SignNow is simple and intuitive. You can choose from various templates, fill in the required information, and customize it according to your preferences. The platform allows easy editing and eSigning to ensure a smooth document workflow.

-

Is there a cost associated with using a sample trust form on airSlate SignNow?

airSlate SignNow offers a range of pricing plans to cater to different business needs, including options for using a sample trust form. You can choose a plan that best fits your budget and feature requirements, allowing for cost-effective document management.

-

What are the benefits of using a sample trust form?

Using a sample trust form helps streamline the process of setting up a trust, ensuring clarity and legal compliance. It saves time by providing a ready-made outline that minimizes errors and enhances document accuracy. Additionally, having a well-structured sample trust form can facilitate smoother discussions with beneficiaries.

-

Can I integrate my sample trust form with other applications?

Yes, airSlate SignNow supports integrations with various applications, enhancing the utility of your sample trust form. You can seamlessly connect it with tools such as CRM systems, cloud storage solutions, and project management software. This integration provides a cohesive workflow and improves efficiency.

-

How secure is my sample trust form in airSlate SignNow?

Security is a top priority at airSlate SignNow, ensuring that your sample trust form and sensitive data are protected. The platform employs advanced encryption and compliance with legal standards to safeguard your documents. You can confidently create and store your trust forms, knowing they are secure.

-

Can I track changes made to my sample trust form?

Absolutely! airSlate SignNow allows you to track changes and manage versions of your sample trust form. This feature enables you to maintain an audit trail, so you can quickly see who made changes and when, ensuring full document accountability.

Get more for Beneficiaries Trust

Find out other Beneficiaries Trust

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later