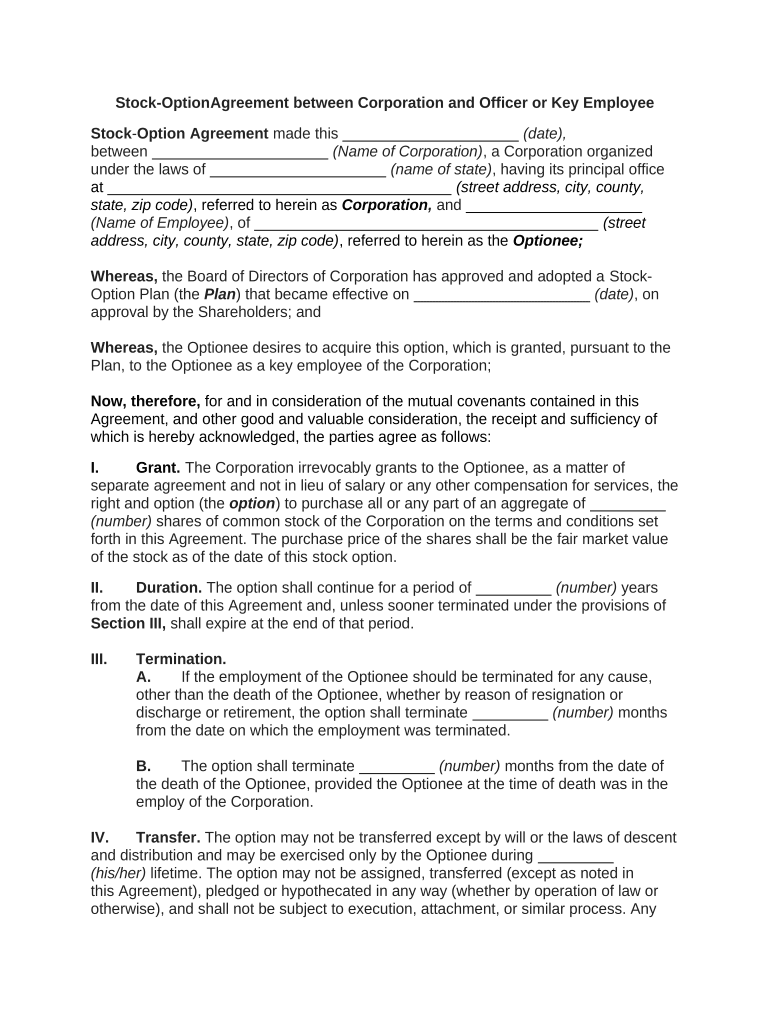

Stock Option Agreement Form

What is the Stock Option Agreement

A stock option agreement is a legal document that grants an employee the right to purchase shares of the company's stock at a predetermined price, known as the exercise price. This agreement outlines the terms under which the employee can buy the stock, including the number of shares, the vesting schedule, and the expiration date. It is an essential component of employee compensation packages, particularly in startups and publicly traded companies, as it aligns the interests of employees with those of shareholders.

Key Elements of the Stock Option Agreement

Understanding the key elements of a stock option agreement is crucial for both employers and employees. The main components typically include:

- Grant Date: The date on which the option is awarded to the employee.

- Exercise Price: The price at which the employee can purchase the stock, usually set at the market value on the grant date.

- Vesting Schedule: The timeline over which the employee earns the right to exercise the options, often based on continued employment.

- Expiration Date: The date by which the employee must exercise the option, or it will become void.

- Transferability: Conditions under which the options can be transferred to another party.

Steps to Complete the Stock Option Agreement

Completing a stock option agreement involves several steps to ensure that the document is executed correctly and legally binding. Here are the essential steps:

- Review the stock option agreement carefully to understand all terms and conditions.

- Fill out the required information, including your name, the number of shares, and the exercise price.

- Sign the agreement electronically using a trusted eSignature platform to ensure compliance with legal standards.

- Keep a copy of the signed agreement for your records, as it serves as proof of your rights under the agreement.

Legal Use of the Stock Option Agreement

To be legally binding, a stock option agreement must comply with applicable laws and regulations. In the United States, it is essential to adhere to the guidelines set forth by the Internal Revenue Service (IRS) regarding stock options. This includes understanding the tax implications of exercising stock options and reporting any income generated from them. Additionally, the agreement must meet the requirements of the Electronic Signatures in Global and National Commerce (ESIGN) Act to ensure that electronic signatures are legally recognized.

How to Use the Stock Option Agreement

Using a stock option agreement effectively involves understanding how to exercise your options. Once your options are vested, you can choose to exercise them by purchasing the shares at the exercise price. This can often be done through your employer’s stock plan administrator. It is important to consider the financial implications, including potential tax liabilities and the market value of the shares at the time of exercise. Keeping track of your options and their expiration dates is essential to maximize their value.

Eligibility Criteria

Eligibility for receiving stock options typically depends on your employment status and the company's policies. Generally, full-time employees are eligible, while part-time or contract workers may not qualify. Companies may also set additional criteria, such as performance metrics or tenure with the organization. Understanding these criteria is important for employees to know their potential benefits under the stock option agreement.

Quick guide on how to complete stock option agreement

Effortlessly prepare Stock Option Agreement on any device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Stock Option Agreement on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Stock Option Agreement with ease

- Find Stock Option Agreement and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Stock Option Agreement to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a stock option agreement?

A stock option agreement is a contract that grants employees the right to purchase shares of the company's stock at a predetermined price. This type of agreement is often used as part of employee compensation packages, incentivizing them to contribute to company growth.

-

How does airSlate SignNow facilitate the creation of stock option agreements?

airSlate SignNow streamlines the document creation process, allowing users to easily draft and customize stock option agreements. With our intuitive interface, businesses can quickly input necessary details and securely send them for eSignature, enhancing both efficiency and compliance.

-

What are the benefits of using airSlate SignNow for stock option agreements?

Using airSlate SignNow for stock option agreements offers numerous benefits, including time savings, improved accuracy, and enhanced security for sensitive documents. Our platform not only simplifies the signing process but also ensures that all agreements are legally binding and easily accessible.

-

Are there any costs associated with using airSlate SignNow for stock option agreements?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. We provide flexible options that focus on delivering value, ensuring your investment in streamlined stock option agreements pays off through increased efficiency and reduced administrative burdens.

-

Can I integrate airSlate SignNow with other software for managing stock option agreements?

Absolutely! airSlate SignNow offers integrations with various software solutions, such as CRMs and HR management tools. This ensures that stock option agreements can be seamlessly managed alongside your existing systems, enhancing workflow and data consistency.

-

What security measures does airSlate SignNow implement for stock option agreements?

At airSlate SignNow, we prioritize the security of your stock option agreements. Our platform employs advanced encryption protocols, secure cloud storage, and robust authentication processes to ensure that your sensitive documents remain protected at all times.

-

Can I track the status of my stock option agreements in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your stock option agreements. This feature allows you to monitor when a document is sent, opened, and signed, giving you peace of mind and better control over the signing process.

Get more for Stock Option Agreement

- Mail or fax to release of information 8101 w sam

- Va dermatology referral form dermatology referral form

- Acaria health gastroenterology referral form gastroenterology referral form

- Aetna prior authorization form

- Cvs form 14423 1010 standard

- Evicore pet form

- Release ampamp covenant agreement gull lake ministries form

- Chaparral naturopathic medicine naturopath san diego ca form

Find out other Stock Option Agreement

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter