Deed Conveying Property to Charity with Reservation of Life Estate Form

What is the Deed Conveying Property To Charity With Reservation Of Life Estate

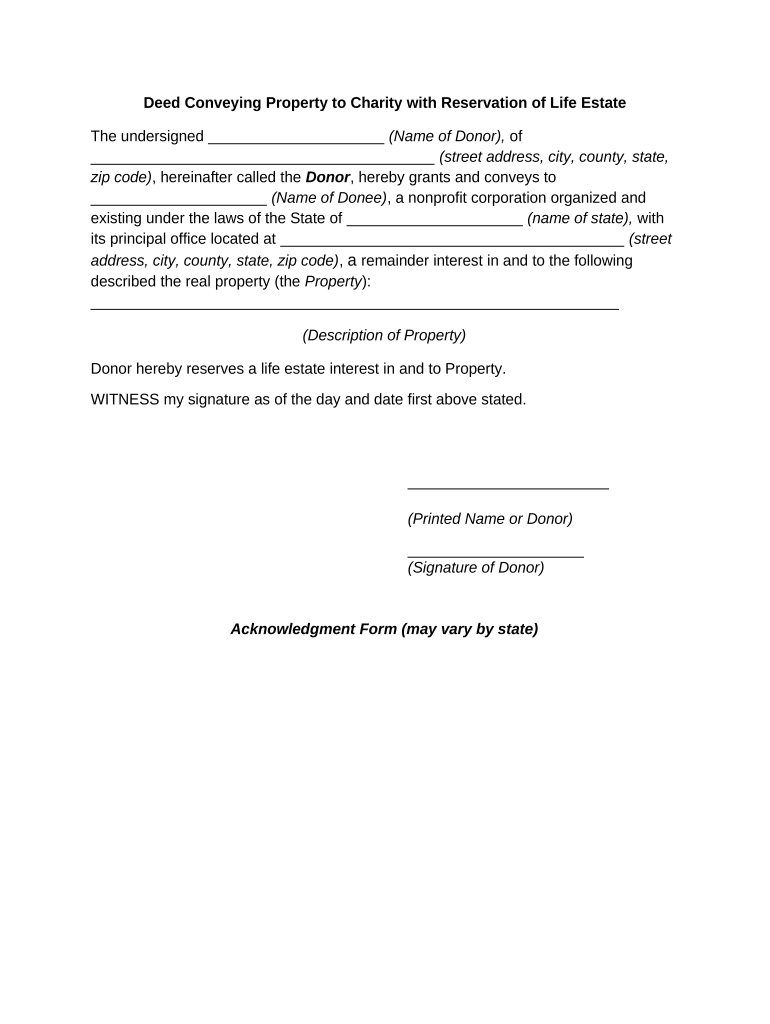

The deed conveying property to charity with reservation of life estate is a legal document that allows an individual to transfer ownership of real estate to a charitable organization while retaining the right to use the property for the duration of their life. This arrangement enables the property owner to enjoy the benefits of the property during their lifetime, while ensuring that the charity receives the property upon their passing. The deed outlines the specific terms of the transfer, including the rights and responsibilities of both parties involved.

Key Elements of the Deed Conveying Property To Charity With Reservation Of Life Estate

Several key elements must be included in the deed to ensure its validity and effectiveness. These elements typically include:

- Identification of Parties: Clearly state the names and addresses of both the property owner (grantor) and the charitable organization (grantee).

- Property Description: Provide a detailed description of the property being conveyed, including its legal description and physical address.

- Reservation of Life Estate: Explicitly state that the grantor retains the right to use and occupy the property during their lifetime.

- Terms of Transfer: Outline any conditions or stipulations regarding the transfer of ownership to the charity after the grantor's death.

- Signatures: Ensure that the deed is signed by the grantor and any required witnesses or notaries, as per state laws.

Steps to Complete the Deed Conveying Property To Charity With Reservation Of Life Estate

Completing the deed conveying property to charity with reservation of life estate involves several important steps:

- Gather Information: Collect all necessary information about the property, the grantor, and the charitable organization.

- Draft the Deed: Use a template or consult with a legal professional to draft the deed, ensuring all key elements are included.

- Review the Document: Carefully review the deed for accuracy and completeness, making any necessary adjustments.

- Obtain Signatures: Have the grantor sign the deed in the presence of required witnesses or a notary.

- File the Deed: Submit the signed deed to the appropriate local government office for recording, following state-specific requirements.

Legal Use of the Deed Conveying Property To Charity With Reservation Of Life Estate

This deed is legally recognized in the United States, provided it adheres to state laws regarding property transfers and life estates. It is essential to ensure compliance with local regulations to avoid any legal issues. The deed must be executed with proper formalities, including notarization, to be enforceable. Additionally, the grantor should consider consulting with a legal professional to navigate any complexities associated with the transfer.

State-Specific Rules for the Deed Conveying Property To Charity With Reservation Of Life Estate

Each state may have unique rules governing the execution and recording of a deed conveying property to charity with reservation of life estate. It is crucial to understand these state-specific regulations, as they can affect the validity of the deed. Common considerations include:

- Notarization Requirements: Some states require notarization for the deed to be legally binding.

- Witness Requirements: Certain jurisdictions may mandate that witnesses sign the deed.

- Filing Fees: Be aware of any fees associated with filing the deed with the local government.

Examples of Using the Deed Conveying Property To Charity With Reservation Of Life Estate

There are various scenarios in which individuals may choose to use this type of deed. For instance:

- An elderly homeowner may wish to donate their family home to a local charity while continuing to live there until their passing.

- A property owner may want to support a nonprofit organization while ensuring they have a place to live for the remainder of their life.

- Individuals may use this deed as part of their estate planning strategy to provide for charitable causes while retaining control over their property.

Quick guide on how to complete deed conveying property to charity with reservation of life estate

Easily Prepare Deed Conveying Property To Charity With Reservation Of Life Estate on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can effortlessly locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and seamlessly. Manage Deed Conveying Property To Charity With Reservation Of Life Estate on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

A Simple Way to Modify and eSign Deed Conveying Property To Charity With Reservation Of Life Estate with Ease

- Obtain Deed Conveying Property To Charity With Reservation Of Life Estate and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Deed Conveying Property To Charity With Reservation Of Life Estate to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Deed Conveying Property To Charity With Reservation Of Life Estate?

A Deed Conveying Property To Charity With Reservation Of Life Estate allows a property owner to transfer ownership to a charity while retaining the right to live in the property for their lifetime. This type of deed can provide signNow tax benefits and ensure that the property is used for charitable purposes after the owner's passing.

-

How does airSlate SignNow help with the Deed Conveying Property To Charity With Reservation Of Life Estate?

airSlate SignNow streamlines the process of creating and signing a Deed Conveying Property To Charity With Reservation Of Life Estate. Our software provides templates and eSigning capabilities, making it easy for you to draft, execute, and manage your documents securely online.

-

Are there any costs associated with using airSlate SignNow for this type of deed?

Yes, airSlate SignNow offers various pricing plans based on your needs, including options for individual users and teams. These plans provide access to essential features for managing documents like the Deed Conveying Property To Charity With Reservation Of Life Estate, all while remaining cost-effective.

-

What features does airSlate SignNow provide for eSigning a Deed Conveying Property To Charity With Reservation Of Life Estate?

airSlate SignNow offers features such as customizable templates, automated reminders for signers, secure cloud storage, and real-time document tracking. These tools simplify the process of eSigning a Deed Conveying Property To Charity With Reservation Of Life Estate, ensuring all parties can easily complete the transaction.

-

Can I integrate airSlate SignNow with other software for managing my Deed Conveying Property To Charity With Reservation Of Life Estate?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications like CRM software, cloud storage solutions, and productivity tools, making it easier to manage your documents related to the Deed Conveying Property To Charity With Reservation Of Life Estate within your existing workflow.

-

What are the benefits of using a Deed Conveying Property To Charity With Reservation Of Life Estate?

Using a Deed Conveying Property To Charity With Reservation Of Life Estate can provide signNow tax deductions and ensure that your property supports a cause you care about after your death. It allows for peace of mind knowing that while you retain enjoyment of the property, it will ultimately benefit a charity of your choice.

-

Is there customer support available for questions regarding my Deed Conveying Property To Charity With Reservation Of Life Estate?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or concerns you may have about your Deed Conveying Property To Charity With Reservation Of Life Estate. Our team is knowledgeable and ready to help you get the most out of our platform.

Get more for Deed Conveying Property To Charity With Reservation Of Life Estate

Find out other Deed Conveying Property To Charity With Reservation Of Life Estate

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter