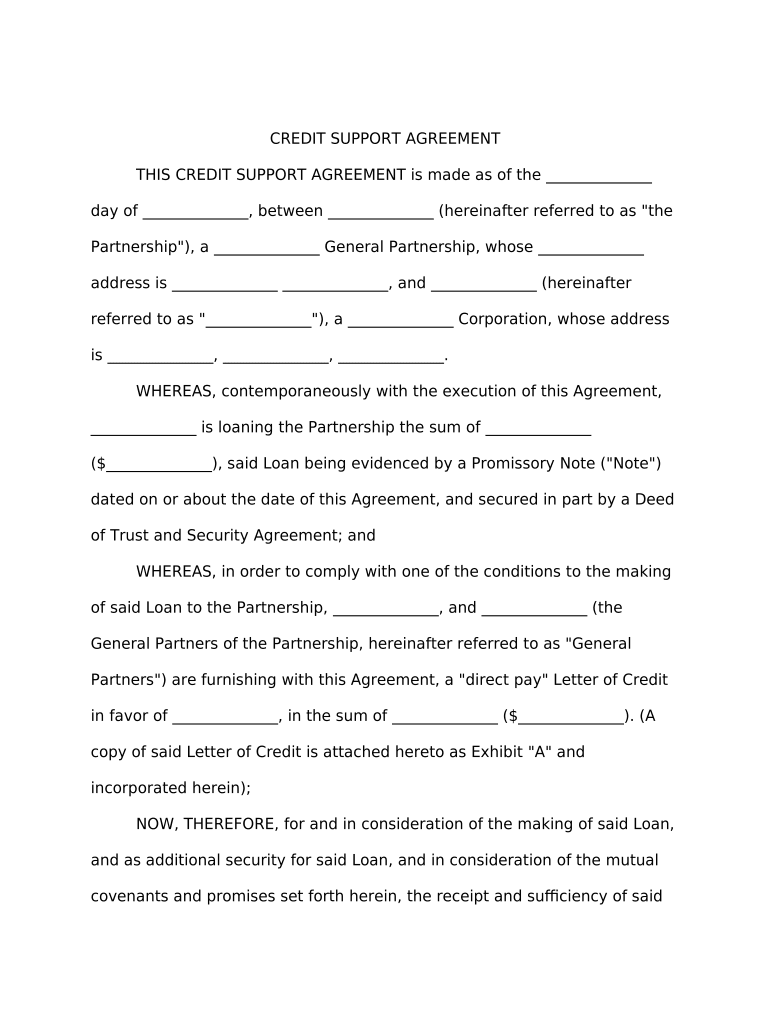

Credit Support Agreement Form

What is the Credit Support Agreement

A Credit Support Agreement is a legal document that outlines the terms under which one party provides financial support to another, typically in the context of securing obligations related to loans or credit facilities. This agreement serves to mitigate credit risk by specifying collateral requirements, the types of acceptable collateral, and the conditions under which the collateral may be called upon. It is commonly used in financial transactions, particularly in derivatives and other complex financial instruments, to ensure that the parties involved have a clear understanding of their obligations and rights.

How to use the Credit Support Agreement

Using a Credit Support Agreement involves several key steps. First, both parties must negotiate and agree on the terms, including the amount and type of collateral required. Once the terms are established, the agreement should be drafted and signed by both parties. It is essential to ensure that the document complies with relevant legal standards and regulations. After signing, the collateral should be transferred as specified in the agreement. This document serves as a reference point throughout the duration of the financial relationship, helping to manage risks associated with credit exposure.

Steps to complete the Credit Support Agreement

Completing a Credit Support Agreement involves a series of methodical steps:

- Identify the parties involved and their respective roles.

- Determine the financial obligations that require support.

- Negotiate the terms of the agreement, including collateral specifics.

- Draft the agreement, ensuring clarity and legal compliance.

- Review the document with legal counsel if necessary.

- Sign the agreement, ensuring all parties retain a copy.

- Implement the collateral transfer as outlined in the agreement.

Key elements of the Credit Support Agreement

Several key elements are essential in a Credit Support Agreement to ensure its effectiveness:

- Parties involved: Clearly identify all parties entering the agreement.

- Collateral requirements: Specify the type and amount of collateral needed.

- Conditions for collateral call: Outline the circumstances under which collateral can be demanded.

- Valuation methods: Define how the collateral will be valued over time.

- Default provisions: Include terms regarding what happens in the event of default.

Legal use of the Credit Support Agreement

The legal use of a Credit Support Agreement is governed by various regulations and laws that ensure its enforceability. In the United States, it is crucial to comply with the Uniform Commercial Code (UCC), which provides a framework for secured transactions. Additionally, the agreement must adhere to any applicable state laws that may impose specific requirements on collateral agreements. Ensuring that the document is properly executed and that all parties understand their obligations is vital for its legal standing.

Examples of using the Credit Support Agreement

Credit Support Agreements can be utilized in various scenarios, including:

- In a derivatives transaction where one party requires collateral to secure potential future exposure.

- In lending arrangements where a borrower must provide collateral to secure a loan.

- In structured finance transactions where multiple parties are involved, and collateral is necessary to mitigate risk.

Quick guide on how to complete credit support agreement

Accomplish Credit Support Agreement seamlessly on any device

Online document organization has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Credit Support Agreement on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-centric task today.

The easiest way to alter and eSign Credit Support Agreement without hassle

- Obtain Credit Support Agreement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choosing. Modify and eSign Credit Support Agreement and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Credit Support Agreement, and how does it work?

A Credit Support Agreement is a legal document that outlines the terms under which one party provides collateral to another to secure obligations. This agreement helps manage credit risks in financial transactions. With airSlate SignNow, you can easily create, send, and eSign Credit Support Agreements in a secure and streamlined manner.

-

How can I create a Credit Support Agreement using airSlate SignNow?

Creating a Credit Support Agreement with airSlate SignNow is straightforward. Simply select from our range of templates, customize the agreement as needed, and send it for eSignature. The platform guides you through each step, ensuring a hassle-free experience.

-

What are the benefits of using airSlate SignNow for a Credit Support Agreement?

Using airSlate SignNow for your Credit Support Agreement allows for quicker turnaround times and enhanced security. The eSigning feature streamlines the signing process, while our cloud storage ensures that your documents are safe and easily accessible. Additionally, you can track the status of your agreement in real time.

-

Is there a cost associated with using airSlate SignNow for my Credit Support Agreement?

Yes, there is a subscription fee for using airSlate SignNow, but it offers competitive pricing models that cater to businesses of all sizes. Our pricing is designed to provide cost-effective solutions for managing your Credit Support Agreements without compromising on features. You can explore various plans to find the one that suits your business needs.

-

Can I customize my Credit Support Agreement in airSlate SignNow?

Absolutely! airSlate SignNow provides numerous customization options for your Credit Support Agreement. You can edit terms, add clauses, and include specific provisions that suit your business requirements. The intuitive interface allows for seamless modifications.

-

What integrations does airSlate SignNow offer for Credit Support Agreements?

airSlate SignNow integrates with a variety of business applications, enhancing the management of your Credit Support Agreements. Popular integrations include CRM systems, document storage solutions, and project management tools. These integrations help streamline workflows and improve overall efficiency.

-

How secure is airSlate SignNow when handling Credit Support Agreements?

Security is a top priority for airSlate SignNow. We use encryption and secure data storage practices to ensure that your Credit Support Agreements are protected. Additionally, our platform complies with industry standards, providing you with peace of mind when handling sensitive documents.

Get more for Credit Support Agreement

- Accredited investor form leighdoc image fonkoze

- 4340 w form

- Deferred salary agreement template form

- And distributions form

- Please cancel my loans for academic year form

- Child care plus acclarisbenefitscom form

- Garagekeeper auto service insurance application fill out the amtrust application for garagekeeper and auto service insurance form

- Fidelity solo 401k contribution form

Find out other Credit Support Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself