D 1040nr Form 2010

What is the D 1040nr Form

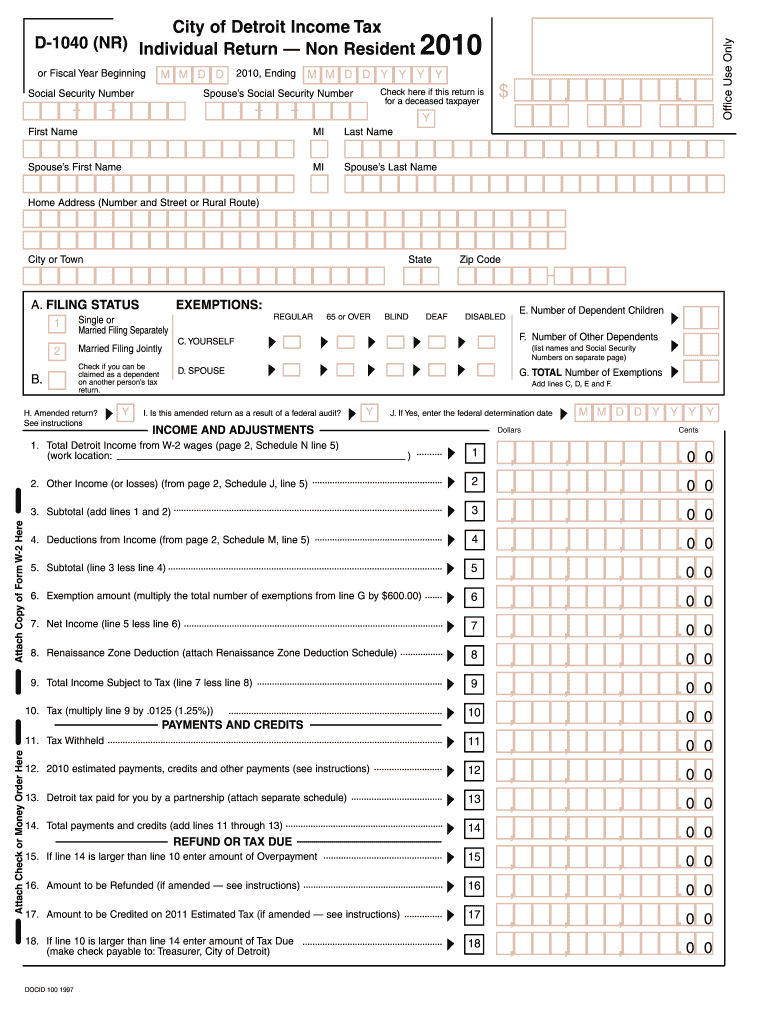

The D 1040nr Form is a tax document used by non-resident aliens in the United States to report their income and calculate their tax liability. This form is essential for individuals who are not U.S. citizens or residents but have earned income in the U.S. It allows these taxpayers to comply with U.S. tax laws while ensuring they are taxed appropriately based on their residency status.

How to use the D 1040nr Form

To use the D 1040nr Form, non-resident aliens must first gather all necessary income information, including wages, dividends, and other earnings sourced from the U.S. After collecting this data, taxpayers should accurately fill out the form, ensuring that they report all relevant income and applicable deductions. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or penalties.

Steps to complete the D 1040nr Form

Completing the D 1040nr Form involves several key steps:

- Gather documentation: Collect all income statements, such as W-2s or 1099s, and any other relevant financial documents.

- Fill out personal information: Enter your name, address, and taxpayer identification number at the top of the form.

- Report income: Accurately list all sources of income earned in the U.S. in the designated sections.

- Claim deductions: If applicable, include any deductions that may reduce your taxable income.

- Calculate tax liability: Use the provided tables or worksheets to determine your tax owed based on your income.

- Sign and date the form: Ensure that you sign and date the form before submission to validate it.

Legal use of the D 1040nr Form

The D 1040nr Form is legally binding when filled out correctly and submitted on time. It must adhere to the regulations set forth by the Internal Revenue Service (IRS). To ensure its legal validity, taxpayers should keep copies of their completed forms and any supporting documents. This can be crucial in case of audits or inquiries from the IRS regarding their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the D 1040nr Form are typically aligned with the U.S. tax season. Non-resident aliens must file their forms by April fifteenth of the following year after earning income. If the taxpayer is in a foreign country on the due date, they may qualify for an automatic two-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

When completing the D 1040nr Form, non-resident aliens should have the following documents ready:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Tax identification number or Social Security number

Quick guide on how to complete d 1040nr 2015 form

Complete D 1040nr Form effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle D 1040nr Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign D 1040nr Form without hassle

- Locate D 1040nr Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign D 1040nr Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 1040nr 2015 form

Create this form in 5 minutes!

How to create an eSignature for the d 1040nr 2015 form

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the D 1040nr Form?

The D 1040nr Form is a tax return form for non-resident aliens who need to report income earned in the United States. It is essential for anyone who falls under this category to accurately complete the D 1040nr Form to comply with IRS regulations.

-

How can airSlate SignNow help me with the D 1040nr Form?

airSlate SignNow provides an easy-to-use platform for signing and sending the D 1040nr Form digitally. With our solution, you can ensure that your form is completed correctly and securely, streamlining the filing process.

-

Is there a cost associated with using airSlate SignNow for the D 1040nr Form?

Yes, airSlate SignNow offers various pricing plans tailored for different needs, including features specifically for managing the D 1040nr Form. Our cost-effective solutions allow businesses and individuals to choose the right plan that fits their budget while ensuring compliance.

-

What features does airSlate SignNow offer for the D 1040nr Form?

airSlate SignNow offers features such as document templates, e-signatures, and secure cloud storage specifically designed for managing the D 1040nr Form. These features help ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other platforms when filling out the D 1040nr Form?

Yes, airSlate SignNow easily integrates with numerous third-party applications, making it simple to pull or send relevant information needed for the D 1040nr Form. This integration capability enhances efficiency and reduces the manual effort required.

-

What benefits does using airSlate SignNow provide when completing the D 1040nr Form?

Using airSlate SignNow for your D 1040nr Form offers several benefits, including enhanced security, convenience, and efficiency. With our digital platform, you can complete your tax forms from anywhere, anytime, ensuring timely submissions.

-

How secure is airSlate SignNow when handling the D 1040nr Form?

airSlate SignNow prioritizes your data security with advanced encryption methods and compliance with legal regulations. When dealing with sensitive documents like the D 1040nr Form, you can trust that your information is protected.

Get more for D 1040nr Form

- Ymca waiver 217099128 form

- Play school registration form doc

- Reset form ohio department of job and family servi

- Ged test application owens form

- Www chamberofcommerce comunited statesohiolisbon exempted village school board in lisbon oh 44432 form

- Payment method sample clauses 3k samples law insider form

- State archives archives ohio history connection form

- Infectious disease waiver ohio south youth soccer form

Find out other D 1040nr Form

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later