Mi 1040cr 2 Form 2020

What is the Mi 1040cr 2 Form

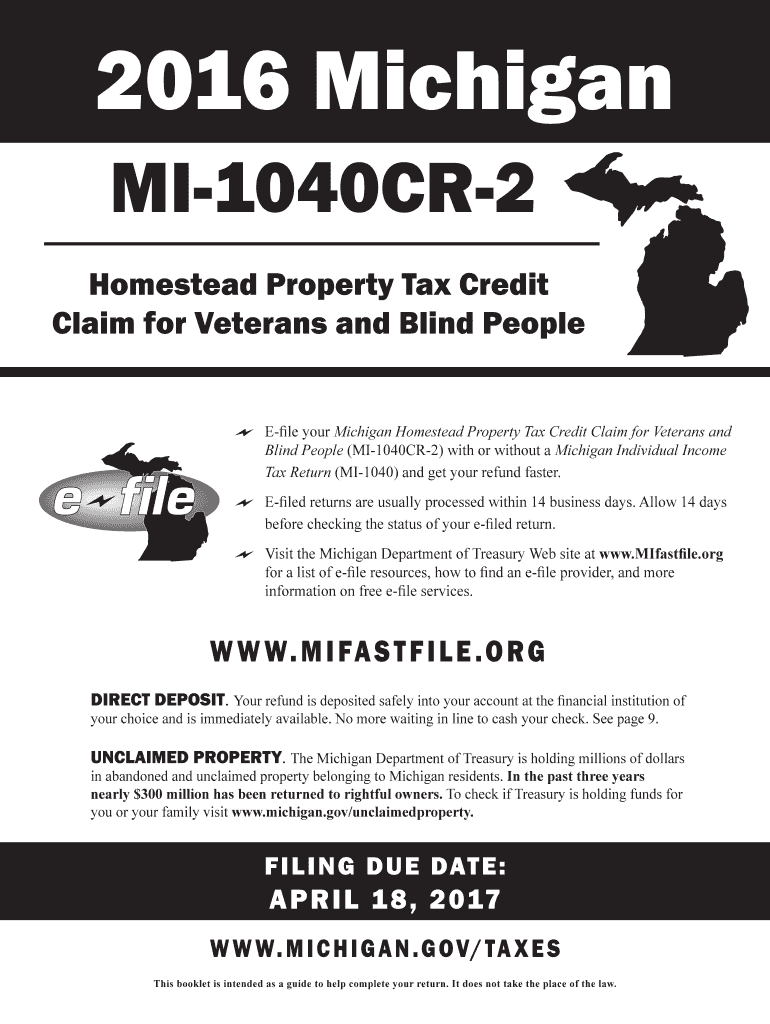

The Mi 1040cr 2 Form is a tax document used in the state of Michigan. It is specifically designed for individuals seeking a property tax credit. This form allows eligible residents to claim a reduction in their property taxes based on specific criteria, such as income level and residency status. Understanding this form is essential for taxpayers who wish to take advantage of available tax benefits and ensure compliance with state regulations.

How to use the Mi 1040cr 2 Form

Using the Mi 1040cr 2 Form involves several key steps. First, gather all necessary documentation, including proof of income and residency. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for errors before submission. Finally, submit the form to the appropriate local tax authority, either online or by mail, depending on your preference. This process helps ensure that you receive any eligible tax credits promptly.

Steps to complete the Mi 1040cr 2 Form

Completing the Mi 1040cr 2 Form requires attention to detail. Follow these steps for a successful submission:

- Gather your financial documents, including W-2s and 1099s, to verify your income.

- Obtain proof of residency, such as a utility bill or lease agreement.

- Fill out the form accurately, providing your personal information and income details.

- Calculate your property tax credit based on the provided guidelines.

- Review your completed form for any mistakes or missing information.

- Submit the form to your local tax authority by the designated deadline.

Legal use of the Mi 1040cr 2 Form

The Mi 1040cr 2 Form is legally binding when completed correctly and submitted to the appropriate tax authority. To ensure its validity, it must be filled out in accordance with Michigan tax laws and regulations. This includes providing accurate information regarding income and residency. Failure to comply with these legal requirements may result in penalties or denial of the property tax credit.

Filing Deadlines / Important Dates

Filing deadlines for the Mi 1040cr 2 Form are crucial for taxpayers to note. Typically, the form must be submitted by a specific date each year, often coinciding with the state income tax filing deadline. It is essential to stay informed about these dates to avoid late submissions, which could result in missed opportunities for tax credits.

Eligibility Criteria

To qualify for the property tax credit using the Mi 1040cr 2 Form, applicants must meet certain eligibility criteria. These may include income limits, residency requirements, and property ownership conditions. Understanding these criteria is vital for taxpayers to determine their eligibility and ensure that they complete the form accurately.

Quick guide on how to complete mi 1040cr 2 2016 form

Complete Mi 1040cr 2 Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Mi 1040cr 2 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Mi 1040cr 2 Form without hassle

- Locate Mi 1040cr 2 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential parts of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes moments and carries the same legal authenticity as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Mi 1040cr 2 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040cr 2 2016 form

Create this form in 5 minutes!

How to create an eSignature for the mi 1040cr 2 2016 form

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Mi 1040cr 2 Form and who needs it?

The Mi 1040cr 2 Form is a Michigan state tax form used to claim a homestead property tax credit. It is designed for homeowners and renters who meet specific income and residency requirements. Completing this form can signNowly reduce taxes owed or provide a refund, benefiting eligible individuals.

-

How can airSlate SignNow help with filling out the Mi 1040cr 2 Form?

airSlate SignNow streamlines the process of filling out the Mi 1040cr 2 Form by providing easy-to-use templates and eSignature capabilities. Users can complete and sign the document digitally, making it faster and more efficient. This simplifies the submission process and ensures that all necessary information is accurately captured.

-

What are the costs associated with using airSlate SignNow for the Mi 1040cr 2 Form?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to different needs. Users can choose from a monthly subscription or an annual plan, which provides full access to all features needed for handling the Mi 1040cr 2 Form. This investment can save time and money, especially during tax season.

-

Are there any special features of airSlate SignNow that enhance the Mi 1040cr 2 Form experience?

Yes, airSlate SignNow includes features such as document templates, collaborative editing, and real-time tracking. These tools are particularly beneficial when completing the Mi 1040cr 2 Form, as they allow multiple users to collaborate effectively. Additionally, automatic reminders ensure that deadlines are met.

-

Can I access the Mi 1040cr 2 Form from any device using airSlate SignNow?

Absolutely! airSlate SignNow is cloud-based and accessible from any device with internet connectivity. This flexibility allows users to fill out and submit the Mi 1040cr 2 Form anytime, anywhere, making it convenient for those with busy schedules. The platform supports mobile access for on-the-go filing.

-

Does airSlate SignNow integrate with other software for tax preparation alongside the Mi 1040cr 2 Form?

Yes, airSlate SignNow integrates with various accounting and tax preparation software. These integrations streamline the workflow for users completing the Mi 1040cr 2 Form. By connecting with other tools, you can enhance overall efficiency and ensure accurate data submission.

-

What security measures does airSlate SignNow implement for the Mi 1040cr 2 Form?

airSlate SignNow prioritizes user security by implementing robust encryption and security protocols. This ensures that all data related to the Mi 1040cr 2 Form is kept confidential and secure throughout the signing process. Users can confidently manage their sensitive tax information without concerns about unauthorized access.

Get more for Mi 1040cr 2 Form

- Application for disabled parking placard ma form

- Real estate rental lease form

- Cbc progress record pdf form

- Form t778 100115264

- Transient occupancy tax return form

- P 941 city of pontiac 2q form

- On going training packet for conferences form

- Igcse global perspectives the portfolio guidance for teachers form

Find out other Mi 1040cr 2 Form

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document