Reciprocity ExemptionAffidavit of Residency for Tax Year 2021

What is the Reciprocity Exemption Affidavit of Residency for Tax Year

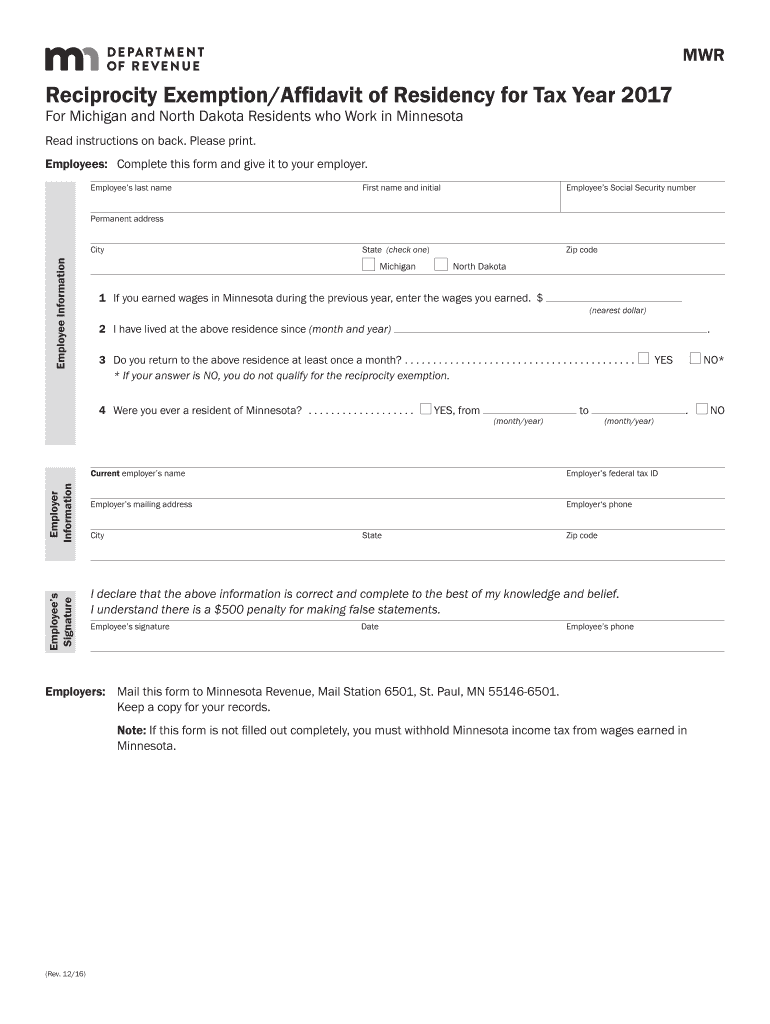

The Reciprocity Exemption Affidavit of Residency for Tax Year is a legal document that allows individuals to claim exemption from certain state taxes based on their residency status. This affidavit is particularly relevant for taxpayers who have income sourced from a state other than their state of residence. By completing this form, taxpayers can avoid double taxation and ensure compliance with state tax laws.

Steps to Complete the Reciprocity Exemption Affidavit of Residency for Tax Year

Completing the Reciprocity Exemption Affidavit of Residency involves several key steps. First, gather all necessary information, including your personal details, the state where you reside, and the state where your income is sourced. Next, accurately fill out the form, ensuring that all information is correct to prevent delays. After filling out the form, review it for accuracy, and then sign and date it. Finally, submit the affidavit to the appropriate state tax authority, either online or via mail, depending on the state's submission guidelines.

Legal Use of the Reciprocity Exemption Affidavit of Residency for Tax Year

This affidavit serves a crucial legal purpose by providing a formal declaration of residency status for tax purposes. It is essential for taxpayers to understand that this document must be filled out truthfully and submitted in accordance with state laws. Failure to do so may result in penalties, including back taxes and interest. The affidavit helps protect taxpayers from being taxed by multiple states on the same income, thereby ensuring fair taxation practices.

Key Elements of the Reciprocity Exemption Affidavit of Residency for Tax Year

Key elements of the Reciprocity Exemption Affidavit include personal identification information, residency details, and the specific income sources that qualify for exemption. The form typically requires the taxpayer's name, address, Social Security number, and the states involved. Additionally, it may ask for supporting documentation to verify residency claims, such as utility bills or lease agreements.

Eligibility Criteria for the Reciprocity Exemption Affidavit of Residency for Tax Year

To be eligible for the Reciprocity Exemption Affidavit, taxpayers must meet specific criteria. Generally, individuals must reside in a state that has a reciprocity agreement with the state where their income is sourced. Furthermore, they should not be considered a resident of the income-sourcing state for tax purposes. It is important for taxpayers to verify these criteria to ensure they qualify for the exemption before submitting the affidavit.

Form Submission Methods for the Reciprocity Exemption Affidavit of Residency for Tax Year

The submission methods for the Reciprocity Exemption Affidavit vary by state. Most states allow taxpayers to submit the form online through their tax authority's website, while others may require submission via mail or in-person. It is crucial to check the specific guidelines for the state in question to ensure proper submission and avoid any potential issues with processing the affidavit.

Quick guide on how to complete reciprocity exemptionaffidavit of residency for tax year 2017

Manage Reciprocity ExemptionAffidavit Of Residency For Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Reciprocity ExemptionAffidavit Of Residency For Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Reciprocity ExemptionAffidavit Of Residency For Tax Year easily

- Locate Reciprocity ExemptionAffidavit Of Residency For Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Reciprocity ExemptionAffidavit Of Residency For Tax Year to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reciprocity exemptionaffidavit of residency for tax year 2017

Create this form in 5 minutes!

How to create an eSignature for the reciprocity exemptionaffidavit of residency for tax year 2017

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is a Reciprocity Exemption Affidavit Of Residency For Tax Year?

A Reciprocity Exemption Affidavit Of Residency For Tax Year is a legal document used by individuals who want to claim tax exemptions based on their residency status. This affidavit helps in signNowing residency and allows taxpayers to take advantage of tax benefits in their state. Understanding its significance can help you reduce your tax liability.

-

How can airSlate SignNow assist me with the Reciprocity Exemption Affidavit Of Residency For Tax Year?

airSlate SignNow offers a seamless way to create, send, and eSign the Reciprocity Exemption Affidavit Of Residency For Tax Year. Our intuitive platform simplifies the entire process, ensuring you can manage your documents efficiently. Plus, the ability to track and store your affidavits securely is an added advantage.

-

What are the key features of airSlate SignNow for handling the Reciprocity Exemption Affidavit Of Residency For Tax Year?

Our platform includes features such as customizable templates for the Reciprocity Exemption Affidavit Of Residency For Tax Year, secure digital signatures, and real-time tracking of document status. These features streamline the signing process, making it easy to manage your tax-related documents. Additionally, templates can be reused to save time.

-

Is airSlate SignNow cost-effective for filing and managing the Reciprocity Exemption Affidavit Of Residency For Tax Year?

Yes, airSlate SignNow is designed to be a cost-effective solution for filing the Reciprocity Exemption Affidavit Of Residency For Tax Year. We offer competitive pricing plans that cater to businesses of all sizes, ensuring that you only pay for the features you need. Our affordable options can ultimately lead to savings in administrative costs.

-

What integrations does airSlate SignNow offer for managing the Reciprocity Exemption Affidavit Of Residency For Tax Year?

airSlate SignNow integrates with various applications including CRM systems, cloud storage services, and productivity tools to facilitate the management of the Reciprocity Exemption Affidavit Of Residency For Tax Year. This connectivity ensures you can easily access your documents from multiple platforms, enhancing your efficiency. With these integrations, transferring data is quick and seamless.

-

Can airSlate SignNow help me stay compliant when filing the Reciprocity Exemption Affidavit Of Residency For Tax Year?

Absolutely! Using airSlate SignNow ensures your Reciprocity Exemption Affidavit Of Residency For Tax Year is compliant with state regulations. Our platform is designed to guide users through compliance requirements, minimizing the risk of errors that could lead to audit issues. You can focus on your business while we handle the legalities.

-

What benefits can I expect from using airSlate SignNow for the Reciprocity Exemption Affidavit Of Residency For Tax Year?

Using airSlate SignNow provides various benefits such as time savings, increased productivity, and enhanced security for your Reciprocity Exemption Affidavit Of Residency For Tax Year. Our electronic signature solution eliminates the need for physical paperwork, allowing for faster processing times. Additionally, all documents are securely stored and easily accessible.

Get more for Reciprocity ExemptionAffidavit Of Residency For Tax Year

- Journal ad template form

- Azalea trail maid homeschool application moffett road christian mobilemrcs form

- Iep process cvf form

- Pdf gadsden city high school transcript request form

- Dangerous dog registration form and

- Get the lcps change of address form pdffiller

- Loan or lien payoff request form

- Church waiver release liability form

Find out other Reciprocity ExemptionAffidavit Of Residency For Tax Year

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free