Llc Interest Transfer Agreement Form

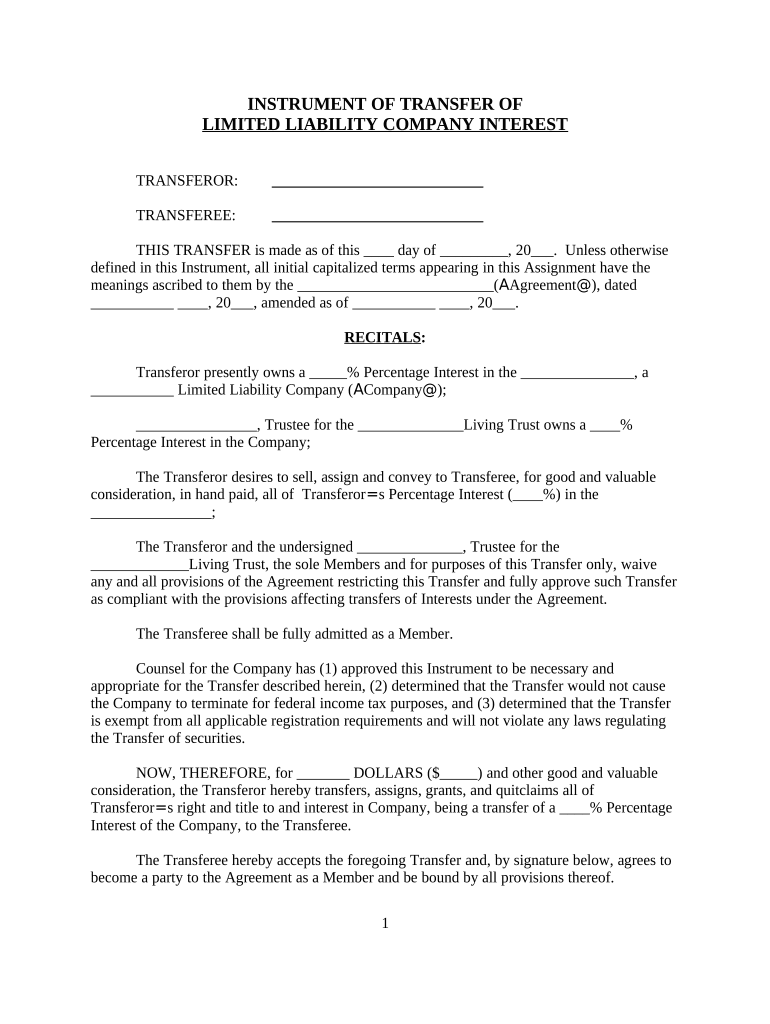

What is the LLC Membership Interest Transfer Agreement

The LLC membership interest transfer agreement is a legal document that facilitates the transfer of ownership interests in a limited liability company (LLC). This agreement outlines the terms under which a member can transfer their membership interest to another party, ensuring that both the transferor and transferee understand their rights and obligations. It is essential for maintaining clear records of ownership and for protecting the interests of all parties involved in the LLC.

Key Elements of the LLC Membership Interest Transfer Agreement

Several key elements should be included in an LLC membership interest transfer agreement to ensure its effectiveness and legality:

- Identification of Parties: Clearly state the names and addresses of the transferor and transferee.

- Description of Interest: Specify the percentage or portion of the membership interest being transferred.

- Consideration: Detail any compensation or payment involved in the transfer.

- Effective Date: Indicate when the transfer will take effect.

- Signatures: Ensure that both parties sign the agreement to validate the transfer.

Steps to Complete the LLC Membership Interest Transfer Agreement

Completing the LLC membership interest transfer agreement involves several important steps:

- Review the Operating Agreement: Check the LLC's operating agreement for any specific requirements regarding membership transfers.

- Draft the Agreement: Create the transfer agreement, including all necessary details and terms.

- Obtain Necessary Approvals: If required, get approval from other members of the LLC.

- Sign the Agreement: Have both the transferor and transferee sign the document.

- File with the State (if applicable): Depending on state laws, you may need to file the agreement with the appropriate state authority.

Legal Use of the LLC Membership Interest Transfer Agreement

The legal use of the LLC membership interest transfer agreement ensures that the transfer is recognized under state laws. For the agreement to be enforceable, it must comply with the relevant statutes governing LLCs in the state where the company is registered. This includes adhering to any specific provisions related to the transfer of membership interests and ensuring that all parties involved are legally capable of entering into the agreement.

How to Use the LLC Membership Interest Transfer Agreement

Using the LLC membership interest transfer agreement involves following the established procedures to ensure a smooth transfer process. Once the agreement is completed and signed, it should be distributed to all relevant parties, including the LLC's records. This helps maintain transparency and ensures that all members are aware of ownership changes. Additionally, it is advisable to keep a copy of the signed agreement for future reference.

Examples of Using the LLC Membership Interest Transfer Agreement

There are various scenarios in which an LLC membership interest transfer agreement may be utilized:

- A member decides to sell their interest to an outside party.

- A member wishes to transfer their interest to a family member or friend.

- In the event of a member's retirement, their interest may be transferred to a remaining member.

Each of these examples highlights the importance of having a well-drafted agreement to facilitate the transfer and protect the interests of all parties involved.

Quick guide on how to complete llc interest transfer agreement

Complete Llc Interest Transfer Agreement effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Llc Interest Transfer Agreement on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Llc Interest Transfer Agreement with minimal effort

- Find Llc Interest Transfer Agreement and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Llc Interest Transfer Agreement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an LLC interest transfer agreement?

An LLC interest transfer agreement is a legal document that outlines the terms under which an owner of an LLC transfers their ownership interest to another party. This agreement helps to ensure that the transfer is documented properly and complies with state laws, thereby protecting all parties involved in the transaction.

-

Why is an LLC interest transfer agreement important?

An LLC interest transfer agreement is crucial because it formalizes the transfer of ownership, providing clarity on the rights and obligations of both the transferor and the transferee. This prevents disputes and ensures that the LLC operates smoothly by documenting changes in ownership accurately.

-

How can airSlate SignNow assist with an LLC interest transfer agreement?

airSlate SignNow allows you to easily create, send, and eSign your LLC interest transfer agreement securely. With user-friendly templates and an intuitive interface, you can ensure that the agreement is filled out correctly and delivered to all parties involved efficiently.

-

What features does airSlate SignNow offer for LLC interest transfer agreements?

AirSlate SignNow offers robust features including customizable templates, secure electronic signatures, and tracking capabilities for your LLC interest transfer agreement. Additionally, collaboration tools make it easy for multiple parties to review and sign the agreement in real-time.

-

Is there a cost associated with creating an LLC interest transfer agreement on airSlate SignNow?

Yes, creating an LLC interest transfer agreement using airSlate SignNow comes with a subscription cost. However, many users find that the cost is outweighed by the time saved and the convenience of having a reliable platform for legal document management and eSignature.

-

How does airSlate SignNow ensure the security of my LLC interest transfer agreement?

AirSlate SignNow prioritizes the security of your LLC interest transfer agreement by utilizing robust encryption methods and secure cloud storage. All documents are stored securely, and access is controlled to ensure that only authorized individuals can view or sign the agreement.

-

Can I integrate airSlate SignNow with other business applications for managing my LLC interest transfer agreement?

Absolutely! airSlate SignNow offers seamless integration with a variety of business applications such as CRM systems, cloud storage services, and workflow automation tools. This allows you to streamline the process of managing your LLC interest transfer agreement alongside your other business operations.

Get more for Llc Interest Transfer Agreement

- Polst illinois form

- Is illinois dept of human services open form

- Cfs 717 g form

- In pasarr form

- What is an interim report form for state of kansas 2004

- Food assistant interim report form

- 2020 kentucky medical get form

- Long term personal care services lt pcs weekly services log single employee new dhh louisiana form

Find out other Llc Interest Transfer Agreement

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free