Subordination Agreement Subordinating Existing Mortgage to New Mortgage Form

What is the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

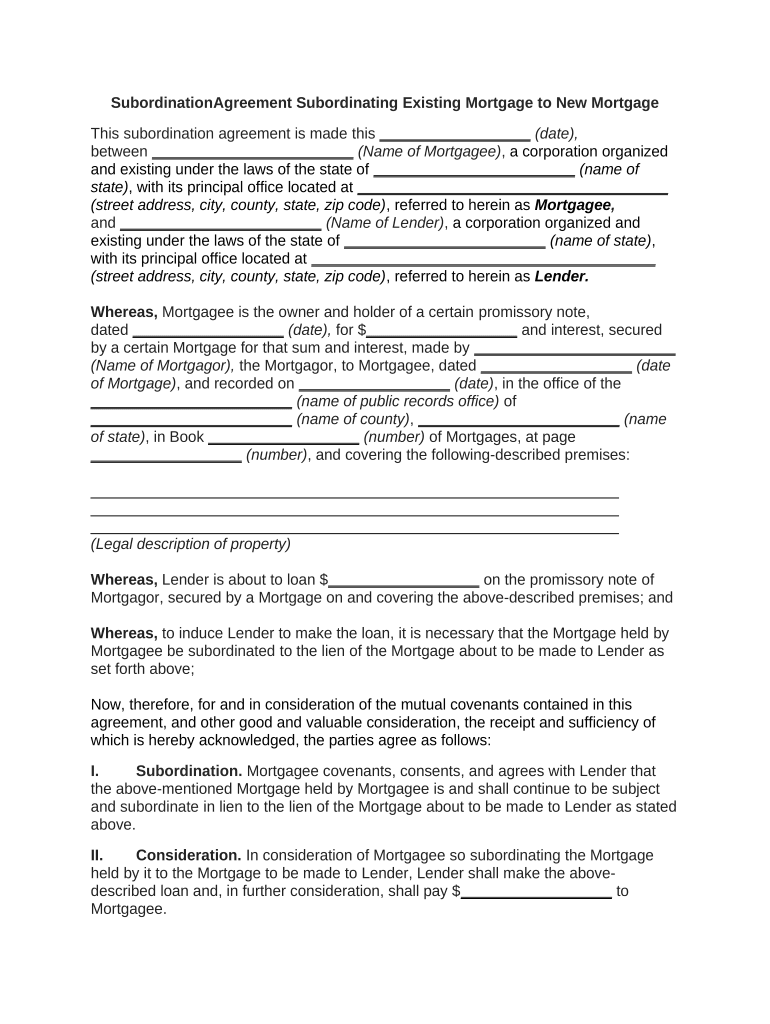

A subordination agreement subordinating existing mortgage to new mortgage is a legal document that establishes the priority of mortgage liens. This agreement allows a new mortgage to take precedence over an existing mortgage, which can be crucial for refinancing or obtaining additional financing. By signing this agreement, the lender of the existing mortgage agrees to subordinate their interest, thereby permitting the new lender to secure a first lien position on the property. This process is essential for homeowners seeking to leverage their equity or reduce interest rates through refinancing.

How to use the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

To effectively use the subordination agreement subordinating existing mortgage to new mortgage, homeowners should first consult with their mortgage lender and legal counsel. The process typically involves the following steps:

- Review the existing mortgage terms to understand any restrictions.

- Obtain a new mortgage offer that outlines the terms and conditions.

- Request a subordination agreement from the existing mortgage lender.

- Ensure that all parties involved understand the implications of the agreement.

- Sign and date the agreement, ensuring it is notarized if required.

Once completed, the agreement should be filed with the appropriate county office to ensure public record reflects the updated lien priority.

Steps to complete the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

Completing the subordination agreement subordinating existing mortgage to new mortgage involves several key steps:

- Gather necessary documentation, including the existing mortgage and new mortgage details.

- Contact the existing mortgage lender to request a subordination agreement.

- Review the agreement for accuracy, ensuring all terms are clear.

- Sign the agreement in the presence of a notary, if required.

- Submit the signed agreement to the new mortgage lender for their records.

- File the agreement with the local county clerk’s office to update public records.

Following these steps ensures that the agreement is legally binding and recognized by all parties involved.

Key elements of the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

The key elements of a subordination agreement subordinating existing mortgage to new mortgage include:

- Identification of parties: Clearly state the names and roles of all parties involved, including the existing and new lenders.

- Description of the property: Include a legal description of the property that is subject to the mortgages.

- Terms of subordination: Specify the conditions under which the existing mortgage is subordinated to the new mortgage.

- Signatures: Ensure that all parties sign the agreement, indicating their consent to the terms.

- Notarization: Include a notary section if required by state law to validate the agreement.

These elements are crucial for the enforceability and clarity of the agreement.

Legal use of the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

The legal use of the subordination agreement subordinating existing mortgage to new mortgage is governed by state laws and regulations. It is essential to ensure that the agreement complies with local statutes regarding mortgage liens and property rights. The agreement must be executed properly, with all required signatures and notarization, to be enforceable in a court of law. Additionally, it is advisable to consult with a legal professional to navigate any complexities associated with the agreement.

State-specific rules for the Subordination Agreement Subordinating Existing Mortgage To New Mortgage

State-specific rules regarding the subordination agreement subordinating existing mortgage to new mortgage can vary significantly. Some states may have particular requirements for the language used in the agreement, while others may mandate specific forms or filing procedures. It is important for homeowners and lenders to be aware of these regulations to ensure compliance. Consulting with a local attorney or mortgage professional can provide clarity on the applicable rules in a given state.

Quick guide on how to complete subordination agreement subordinating existing mortgage to new mortgage 497333486

Complete Subordination Agreement Subordinating Existing Mortgage To New Mortgage effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without delays. Manage Subordination Agreement Subordinating Existing Mortgage To New Mortgage on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Subordination Agreement Subordinating Existing Mortgage To New Mortgage with ease

- Obtain Subordination Agreement Subordinating Existing Mortgage To New Mortgage and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Subordination Agreement Subordinating Existing Mortgage To New Mortgage and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

A Subordination Agreement Subordinating Existing Mortgage To New Mortgage is a legal document that allows a new mortgage to take precedence over an existing one. This process helps homeowners to refinance while keeping their current loan intact. It essentially rearranges the priority of loans against the property.

-

How does a Subordination Agreement impact my refinancing process?

When you are refinancing, a Subordination Agreement Subordinating Existing Mortgage To New Mortgage is crucial as it ensures that the new lender is in the first lien position. This makes it easier for homeowners to manage multiple loans while taking advantage of better rates. Without this agreement, refinancing can become complicated or even impossible.

-

Are there any fees involved in creating a Subordination Agreement?

Yes, there may be fees associated with the process of drafting and recording the Subordination Agreement Subordinating Existing Mortgage To New Mortgage. These fees can vary depending on the lender and the complexity of your specific situation. It's advisable to check with your lender for a detailed fee structure.

-

What are the benefits of using airSlate SignNow for managing Subordination Agreements?

Using airSlate SignNow for Subordination Agreement Subordinating Existing Mortgage To New Mortgage streamlines the eSigning process. Our easy-to-use platform ensures that you can quickly send, sign, and store your agreements securely online. This efficiency can save you valuable time and reduce paperwork.

-

Can airSlate SignNow integrate with my existing mortgage management system?

Absolutely! airSlate SignNow offers seamless integrations with various mortgage management software. This capability allows you to incorporate the Subordination Agreement Subordinating Existing Mortgage To New Mortgage into your existing workflows efficiently.

-

How long does it take to process a Subordination Agreement?

The processing time for a Subordination Agreement Subordinating Existing Mortgage To New Mortgage can vary, but typically, it takes a few days to a few weeks. This duration depends on multiple factors, including the responsiveness of your lenders and the complexity of your mortgage structure. airSlate SignNow helps expedite this process with its efficient eSigning solutions.

-

Is a Subordination Agreement necessary for all refinancing scenarios?

Not necessarily. A Subordination Agreement Subordinating Existing Mortgage To New Mortgage is mainly required when you want to refinance with a new lender while keeping an existing loan. If you're paying off the old mortgage completely, this agreement may not be needed. Always consult with your lender to determine your specific requirements.

Get more for Subordination Agreement Subordinating Existing Mortgage To New Mortgage

Find out other Subordination Agreement Subordinating Existing Mortgage To New Mortgage

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free