Release Estate Form

What is the Release Estate Form

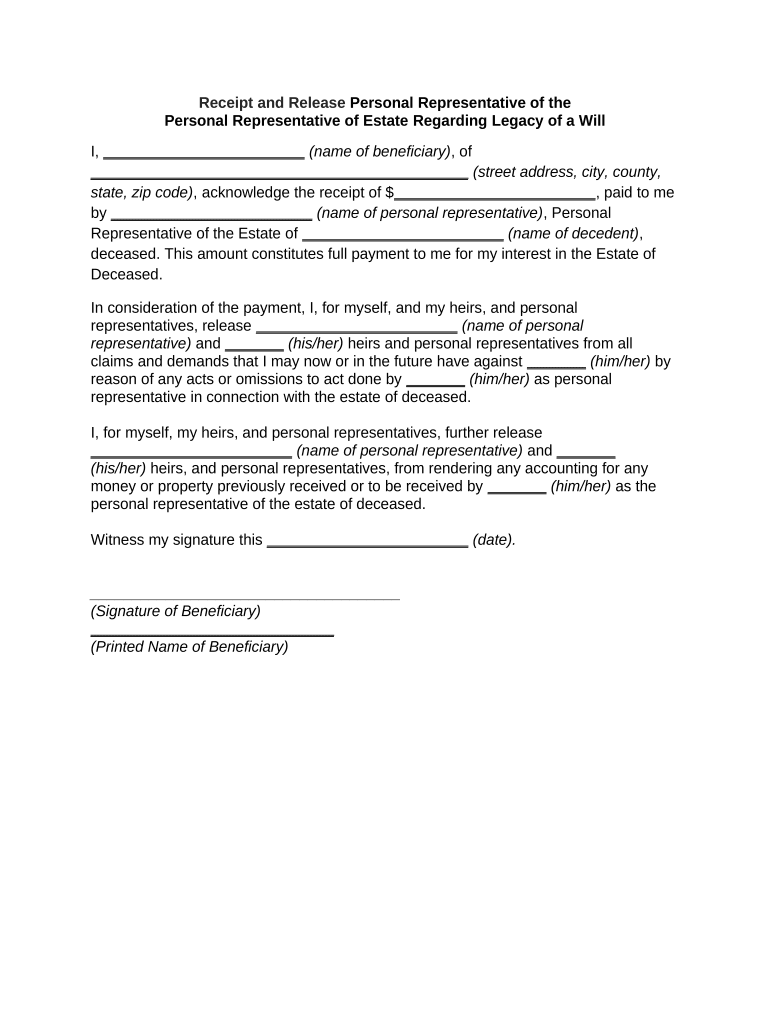

The release estate form is a legal document used to relinquish claims or rights to a specific property or asset. It serves as a formal declaration that one party has given up their interest in the estate, allowing for the transfer of ownership or rights to another party. This form is commonly utilized in real estate transactions, inheritance cases, and various legal situations where property rights are being transferred or waived.

How to Use the Release Estate Form

Using the release estate form involves several steps to ensure that it is completed accurately and legally. First, gather all necessary information regarding the property and the parties involved. Next, fill out the form with precise details, including the names of the individuals relinquishing and receiving rights, a clear description of the property, and any relevant dates. After completing the form, it must be signed by all parties involved, often in the presence of a notary public to enhance its legal validity.

Steps to Complete the Release Estate Form

Completing the release estate form requires careful attention to detail. Follow these steps:

- Identify the parties involved in the transaction.

- Provide a detailed description of the property, including its address and any identifying information.

- Clearly state the intention to release rights to the property.

- Include the date of the agreement.

- Ensure all parties sign the form, preferably in front of a notary.

Legal Use of the Release Estate Form

The release estate form is legally binding when executed correctly. To ensure its enforceability, it must comply with state laws governing property transfers. The form should clearly outline the terms of the release, and all parties must understand their rights and obligations. Proper execution, including notarization, adds an additional layer of legal protection, making it more likely to be upheld in court if contested.

Key Elements of the Release Estate Form

Several key elements must be included in the release estate form to ensure its effectiveness:

- Identifying Information: Names and addresses of all parties involved.

- Property Description: A detailed account of the property being released.

- Intent to Release: A clear statement indicating the relinquishment of rights.

- Signatures: Signatures of all parties, ideally witnessed or notarized.

- Date: The date when the form is executed.

State-Specific Rules for the Release Estate Form

Each state in the U.S. may have specific rules and requirements regarding the release estate form. It is essential to verify local regulations to ensure compliance. Some states may require additional documentation or specific language to be included in the form. Consulting with a legal professional familiar with state laws can provide clarity and help avoid potential issues during the property transfer process.

Quick guide on how to complete release estate form

Effortlessly Complete Release Estate Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and store it safely online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Release Estate Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and Electronically Sign Release Estate Form with Ease

- Find Release Estate Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Revise and electronically sign Release Estate Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a release estate form and how is it used?

A release estate form is a legal document that allows property owners to release their interest in a particular estate or property. It's primarily used in real estate transactions to clarify ownership and responsibilities. By utilizing an electronic signature solution like airSlate SignNow, users can easily eSign a release estate form, streamlining the entire process.

-

How does airSlate SignNow simplify the release estate form process?

airSlate SignNow simplifies the release estate form process by providing an intuitive platform for creating, sending, and eSigning documents. Users can easily upload their forms and send them for signatures, reducing paperwork and increasing efficiency. The platform also offers tracking features, ensuring all parties are informed throughout the signing process.

-

What are the pricing options available for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, allowing companies to choose the plan that best fits their requirements, including options for unlimited eSigning and document management. Each plan comes with affordable pricing, making it easy for businesses to manage their release estate form activities without breaking the bank. Additionally, a free trial is often available for new users to test the platform.

-

Can I integrate airSlate SignNow with other applications for managing release estate forms?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your ability to manage release estate forms and other documents. Whether you're using CRM systems, cloud storage services, or accounting software, integrations ensure that your workflow remains streamlined. This flexibility allows you to incorporate airSlate SignNow into your existing processes effortlessly.

-

What security measures does airSlate SignNow implement for release estate forms?

airSlate SignNow prioritizes security with features like bank-level encryption, two-factor authentication, and secure cloud storage for your release estate forms. This commitment to security ensures that sensitive information is protected at all times. Users can be confident that their documents and personal data remain safe when using the platform.

-

Is there a mobile app for eSigning release estate forms?

Yes, airSlate SignNow offers a mobile app that allows users to eSign release estate forms on the go. This feature is particularly useful for busy professionals who need to finalize documents quickly and efficiently from their mobile devices. The app maintains the same functionality as the web platform, ensuring a consistent experience across all devices.

-

What kind of support is available for users of airSlate SignNow?

airSlate SignNow provides robust customer support options for users, including live chat, email support, and an extensive knowledge base. Whether you need assistance with creating a release estate form or troubleshooting issues, the support team is available to help. This accessibility ensures that users can quickly resolve any challenges they encounter.

Get more for Release Estate Form

- Printable timber contract form

- Hunt permit taglicense application form arizona game and fish gf state az

- Az hunt application form

- Az change business address form

- To application for registration of foreign llc form

- Tulare county fictitious business name form

- Hcd 433a form 101283243

- Minimum financial requirements worksheet form 2602372

Find out other Release Estate Form

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF