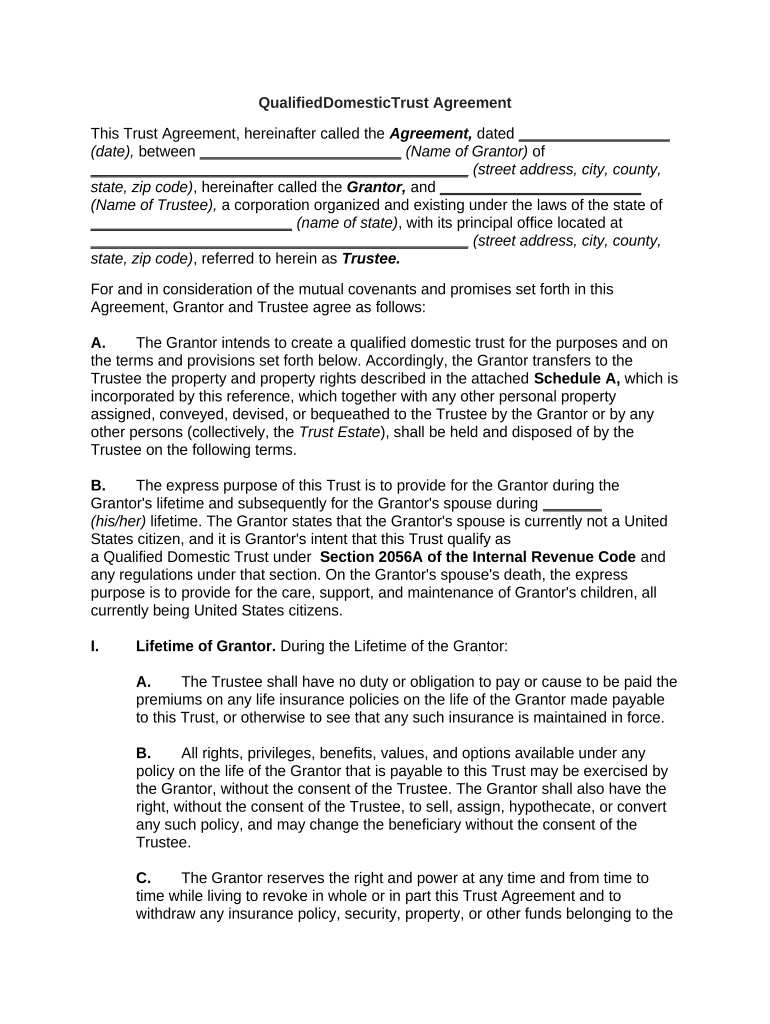

Qualified Domestic Trust Form

What is the Qualified Domestic Trust

The Qualified Domestic Trust (QDOT) is a special type of trust designed to allow non-citizen spouses of U.S. citizens to benefit from estate tax exemptions. When a U.S. citizen passes away, their estate may be subject to federal estate tax. However, if the surviving spouse is not a U.S. citizen, the estate tax exemption does not apply unless the assets are placed in a QDOT. This trust ensures that the non-citizen spouse can receive benefits while also complying with U.S. tax laws.

How to use the Qualified Domestic Trust

Using a Qualified Domestic Trust involves several key steps. First, the trust must be established by the U.S. citizen spouse, who will transfer assets into the trust. The trust must meet specific IRS requirements, including naming a U.S. trustee and ensuring that distributions to the non-citizen spouse are subject to estate tax. The QDOT can provide income to the surviving spouse while deferring estate taxes until the spouse's death. Proper management and compliance with IRS regulations are crucial for the trust's effectiveness.

Steps to complete the Qualified Domestic Trust

Completing a Qualified Domestic Trust involves a systematic approach:

- Consult a legal professional: Engage with an attorney who specializes in estate planning to ensure compliance with all legal requirements.

- Draft the trust document: This document should outline the terms of the trust, including the trustee's powers and the beneficiaries.

- Fund the trust: Transfer assets into the trust, ensuring they are properly titled in the name of the QDOT.

- File necessary tax forms: Submit IRS Form 706-QDT to report the trust's value and comply with estate tax regulations.

Legal use of the Qualified Domestic Trust

The legal use of a Qualified Domestic Trust is governed by specific IRS regulations. It must be established to ensure that the non-citizen spouse can benefit from the trust while also meeting estate tax obligations. The trust must have a U.S. trustee and adhere to rules regarding distributions. Failure to comply with these regulations can result in significant tax liabilities. Therefore, understanding the legal framework is essential for effective trust management.

Key elements of the Qualified Domestic Trust

Several key elements define a Qualified Domestic Trust:

- U.S. trustee: The trust must have at least one trustee who is a U.S. citizen or resident.

- Tax compliance: The trust must comply with IRS regulations to ensure tax deferment for the non-citizen spouse.

- Distribution restrictions: Distributions to the non-citizen spouse may be limited to ensure that estate taxes are properly assessed.

- Trust documentation: Proper documentation must be maintained to demonstrate compliance with tax laws.

Required Documents

Establishing a Qualified Domestic Trust requires specific documentation to ensure compliance with IRS regulations. Key documents include:

- Trust agreement: This outlines the terms and conditions of the trust.

- IRS Form 706-QDT: This form is necessary for reporting the trust's value for estate tax purposes.

- Asset documentation: Records of the assets being transferred into the trust must be maintained.

Quick guide on how to complete qualified domestic trust

Complete Qualified Domestic Trust effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can conveniently locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without any delays. Handle Qualified Domestic Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Qualified Domestic Trust with ease

- Locate Qualified Domestic Trust and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Qualified Domestic Trust and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the aa promises pdf feature in airSlate SignNow?

The aa promises pdf feature in airSlate SignNow allows users to create and share legally binding documents quickly and efficiently. With this feature, you can easily embed the aa promises pdf into your workflow, ensuring that your agreements are properly managed and executed.

-

How much does airSlate SignNow cost?

airSlate SignNow offers several pricing plans to meet diverse business needs, allowing you to choose one that fits your budget. You can access the aa promises pdf feature across different plans, ensuring cost-effective document signing solutions for all.

-

What are the benefits of using airSlate SignNow for aa promises pdf?

Using airSlate SignNow for your aa promises pdf helps streamline the signing process, leading to faster transactions and increased efficiency. Businesses can easily manage their documents and track the status of their agreements, enhancing collaboration and reducing time spent on paperwork.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports numerous integrations with popular business applications and services. By integrating with tools you already use, you can seamlessly incorporate the aa promises pdf into your existing workflows and improve overall productivity.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including SSL encryption and secure cloud storage, to protect your sensitive documents. When using the aa promises pdf feature, you can trust that your information is secure and compliant with industry standards.

-

How do I get started with airSlate SignNow for aa promises pdf?

Getting started with airSlate SignNow for your aa promises pdf is simple. Sign up for a free trial, explore the platform's features, and begin creating and signing documents that meet your requirements right away.

-

Does airSlate SignNow offer mobile access for signing aa promises pdf?

Yes, airSlate SignNow is mobile-friendly, allowing users to access and sign aa promises pdf documents on-the-go. This flexibility ensures that you never miss an opportunity to complete important agreements, regardless of where you are.

Get more for Qualified Domestic Trust

Find out other Qualified Domestic Trust

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free