Trust Benefit Child Form

What is the Trust Benefit Child

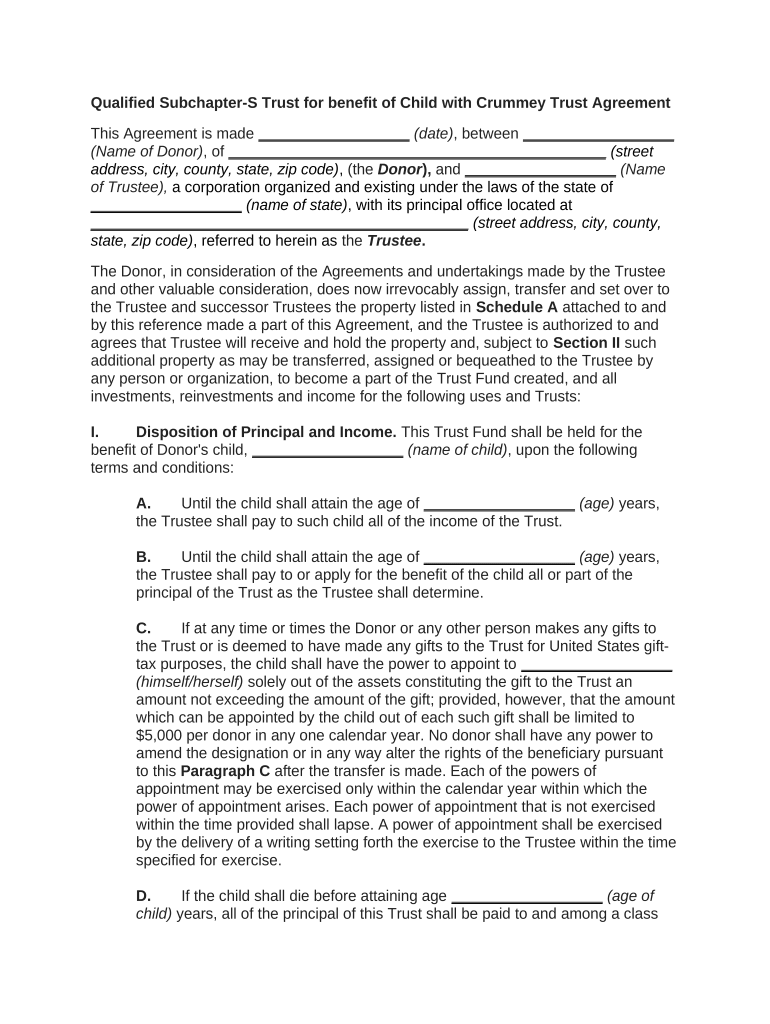

The Trust Benefit Child refers to a legal arrangement designed to manage and protect assets for the benefit of a child or minor. This type of trust is established to ensure that funds or property are allocated for the child's welfare, education, and future needs. It serves as a financial safety net, allowing the designated trustee to manage the assets until the child reaches a specified age or meets certain conditions outlined in the trust agreement.

How to use the Trust Benefit Child

Using the Trust Benefit Child involves several steps to ensure that the trust is established and managed correctly. First, a trust document must be drafted, specifying the terms of the trust, including the trustee's powers and the beneficiary's rights. Next, assets must be transferred into the trust. This can include cash, investments, or property. The trustee then manages these assets according to the trust terms, ensuring the funds are used appropriately for the child's benefit.

Steps to complete the Trust Benefit Child

Completing the Trust Benefit Child involves a series of important steps:

- Draft the trust document: Consult with a legal professional to create a document that outlines the trust's terms.

- Select a trustee: Choose a responsible individual or institution to manage the trust.

- Transfer assets: Move the designated assets into the trust's name.

- Notify beneficiaries: Inform the child or their guardians about the trust and its purpose.

- Review periodically: Regularly assess the trust to ensure it meets the child's evolving needs.

Legal use of the Trust Benefit Child

The legal use of the Trust Benefit Child is governed by state laws and regulations. It is crucial to ensure that the trust complies with relevant legal frameworks to be enforceable. This includes adhering to rules regarding the management of trust assets, the rights of beneficiaries, and the responsibilities of the trustee. Proper legal documentation and adherence to state-specific requirements are essential for the trust's validity.

Key elements of the Trust Benefit Child

Several key elements define the Trust Benefit Child, including:

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiary: The child or minor who benefits from the trust.

- Trust terms: Specific provisions outlining how and when the assets are to be used.

- Duration: The time period during which the trust will be active, often until the child reaches a certain age.

Eligibility Criteria

Eligibility for establishing a Trust Benefit Child typically requires that the beneficiary is a minor or legally defined as a child under state law. Additionally, the grantor, or person creating the trust, must have the legal capacity to manage their assets and designate a trustee. The trust must also comply with state-specific laws regarding trusts to ensure its validity and enforceability.

Quick guide on how to complete trust benefit child

Complete Trust Benefit Child effortlessly on any device

Managing documents online has gained traction among both enterprises and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the necessary forms and safely store them online. airSlate SignNow equips you with all the resources required to generate, alter, and electronically sign your documents swiftly without interruptions. Handle Trust Benefit Child on any device with airSlate SignNow Android or iOS apps and streamline your document-related processes today.

How to alter and eSign Trust Benefit Child with ease

- Find Trust Benefit Child and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes no time at all and bears the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks on any device you prefer. Edit and eSign Trust Benefit Child while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust benefit child?

A trust benefit child refers to a child who is a beneficiary of a trust, receiving financial advantages and security from it. This can provide peace of mind, knowing that their financial needs are planned for. A well-structured trust can safeguard a child's future and ensure they benefit from inheritance.

-

How can airSlate SignNow help with setting up a trust for my child?

airSlate SignNow streamlines the document signing process necessary for setting up a trust benefit child. With our user-friendly platform, you can easily draft, send, and eSign trust documents, ensuring your child's future is secured efficiently. Our service simplifies collaboration with legal advisors, making the process quicker.

-

Are there any costs associated with creating a trust benefit child using airSlate SignNow?

While airSlate SignNow offers competitive pricing, the costs associated with establishing a trust benefit child also depend on legal fees for drafting the trust. Our platform enables you to send and eSign documents at a low cost, helping you allocate more resources to the trust itself. Review our pricing plans for more details.

-

What features does airSlate SignNow offer for trust documentation?

airSlate SignNow provides features like customizable templates, bulk sending, and secure eSigning specifically designed for trust documentation. This ensures that creating a trust benefit child is straightforward and efficient. You’ll also have access to audit trails for added security and compliance.

-

Can I integrate airSlate SignNow with other tools for managing a trust benefit child?

Yes, airSlate SignNow offers seamless integrations with various tools like Google Drive, Dropbox, and CRM systems. This allows you to manage all documents related to your trust benefit child in one place. Integrating with your existing tools enhances your workflow and efficiency.

-

What security measures does airSlate SignNow implement for trust documents?

Security is a top priority at airSlate SignNow, especially when handling trust documents for a trust benefit child. We use bank-grade encryption and secure cloud storage to protect sensitive information. Plus, our compliance with legal standards ensures your documents remain confidential and safe.

-

How does using airSlate SignNow benefit my child in terms of trust management?

Using airSlate SignNow can simplify the management of trust documents, ultimately benefiting your child. By digitizing and securing these documents, you ensure timely accessibility and updates. This facilitates better financial planning for a trust benefit child, safeguarding their future.

Get more for Trust Benefit Child

- Parent waiver rps bollinger form

- 1301 w 38th street suite 601 form

- Certificate of participation application american board of form

- St luke application form

- Get the authorization to use and disclose pdffiller form

- Facility ancillary application form

- Miip treatment form pdf

- Hipaa privacy rule authorization form

Find out other Trust Benefit Child

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple