Retained Income Trust Form

What is the Retained Income Trust

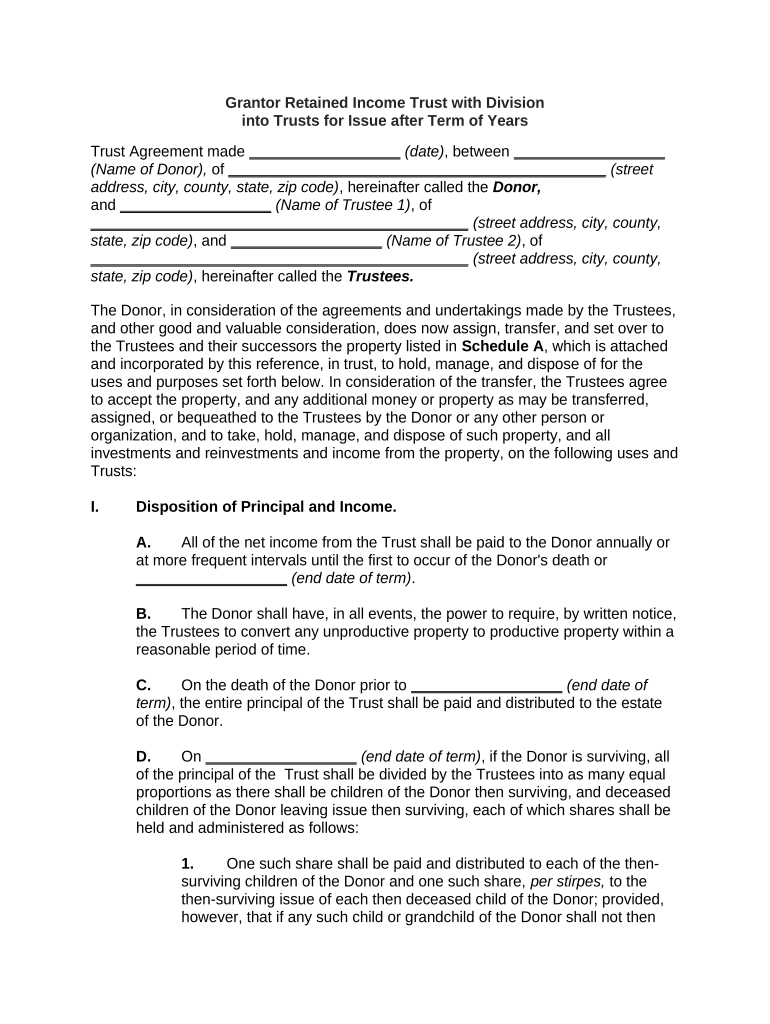

A retained income trust is a financial arrangement that allows individuals to place assets into a trust while retaining the income generated from those assets. This type of trust can be particularly beneficial for estate planning and tax management. By establishing a retained income trust, individuals can ensure that they maintain control over their income while also providing for beneficiaries in a structured manner. The trust typically specifies how income will be distributed and can include various asset types, such as real estate or investments.

How to use the Retained Income Trust

Using a retained income trust involves several steps to ensure it meets legal requirements and serves its intended purpose. First, individuals should consult with a financial advisor or attorney to understand the implications and benefits of establishing the trust. Next, the trust document must be drafted, outlining the terms, including income retention and distribution to beneficiaries. Once the trust is established, assets can be transferred into it. Regular reviews and updates may be necessary to adapt to changing financial situations or legal requirements.

Steps to complete the Retained Income Trust

Completing a retained income trust involves a series of methodical steps:

- Consult with a legal or financial professional to discuss your goals and needs.

- Draft the trust document, detailing terms, income retention, and beneficiary information.

- Transfer assets into the trust, ensuring proper documentation is maintained.

- Sign the trust document in accordance with state laws, which may require notarization.

- Review the trust periodically to ensure it continues to meet your objectives and complies with any legal changes.

Legal use of the Retained Income Trust

The legal use of a retained income trust hinges on compliance with state and federal laws. It is essential to ensure that the trust is properly established and maintained to avoid issues related to taxation or asset protection. The trust must adhere to the specific regulations governing trusts in the state where it is created. Additionally, proper documentation and record-keeping are crucial for demonstrating the trust's legitimacy and for tax purposes.

Key elements of the Retained Income Trust

Several key elements define a retained income trust:

- Income Retention: The trust allows the grantor to retain income generated from the assets placed in the trust.

- Beneficiary Designation: Clear identification of beneficiaries who will receive distributions from the trust.

- Asset Management: Guidelines for how the trust’s assets will be managed and invested.

- Distribution Terms: Specific terms outlining when and how income will be distributed to beneficiaries.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern the taxation of retained income trusts. Generally, the income generated by the trust is taxable to the grantor if they retain control over the income. It is important to report any income accurately on tax returns. Understanding these guidelines can help individuals navigate potential tax liabilities and ensure compliance with federal regulations.

Quick guide on how to complete retained income trust

Complete Retained Income Trust effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Retained Income Trust on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused task today.

The easiest way to modify and eSign Retained Income Trust without hassle

- Obtain Retained Income Trust and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Retained Income Trust and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a retained income trust?

A retained income trust is a financial arrangement that allows you to manage and preserve your income over time. It is designed to provide a steady stream of income while retaining control over the assets, making it a popular choice for individuals and businesses looking to secure their financial future.

-

How can airSlate SignNow help with retained income trust documents?

airSlate SignNow simplifies the process of sending and eSigning documents related to your retained income trust. With our easy-to-use platform, you can quickly prepare, share, and sign essential paperwork, ensuring that your trust operates smoothly and efficiently.

-

What are the benefits of using airSlate SignNow for my retained income trust?

Using airSlate SignNow for your retained income trust can streamline your document management process, saving you time and reducing errors. Our platform offers secure eSignature capabilities, ensuring that your trust documents are signed quickly and safely, giving you peace of mind.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore our features, including those related to retained income trust management. This trial enables you to evaluate our platform's efficiency without any upfront costs.

-

Can I integrate airSlate SignNow with other software for my retained income trust?

Absolutely! airSlate SignNow offers various integrations with popular business applications, allowing you to enhance your retained income trust documentation process. This ensures seamless workflows and better organization of your trust-related documents.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options specifically suited for managing retained income trust documentation. Each plan provides access to our robust features, ensuring you find a solution that fits your budget.

-

How does airSlate SignNow ensure the security of my retained income trust documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure servers to protect your retained income trust documents, ensuring that all sensitive information remains confidential and secure throughout the eSigning process.

Get more for Retained Income Trust

- Alaska form ap 311

- Pg 525 alaska court records state of alaska form

- Tf 303 alaska court records state of alaska form

- Vs 405 form

- Civ 750 stalking protective order packet alaska court records form

- Dr 415 form

- Civ 405 certificate of facts civil forms

- Adm 229 magistrate judge supplemental application 4 15 form

Find out other Retained Income Trust

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template