Download Form F 1120X Florida Department of Revenue 2013

What is the Download Form F 1120X Florida Department Of Revenue

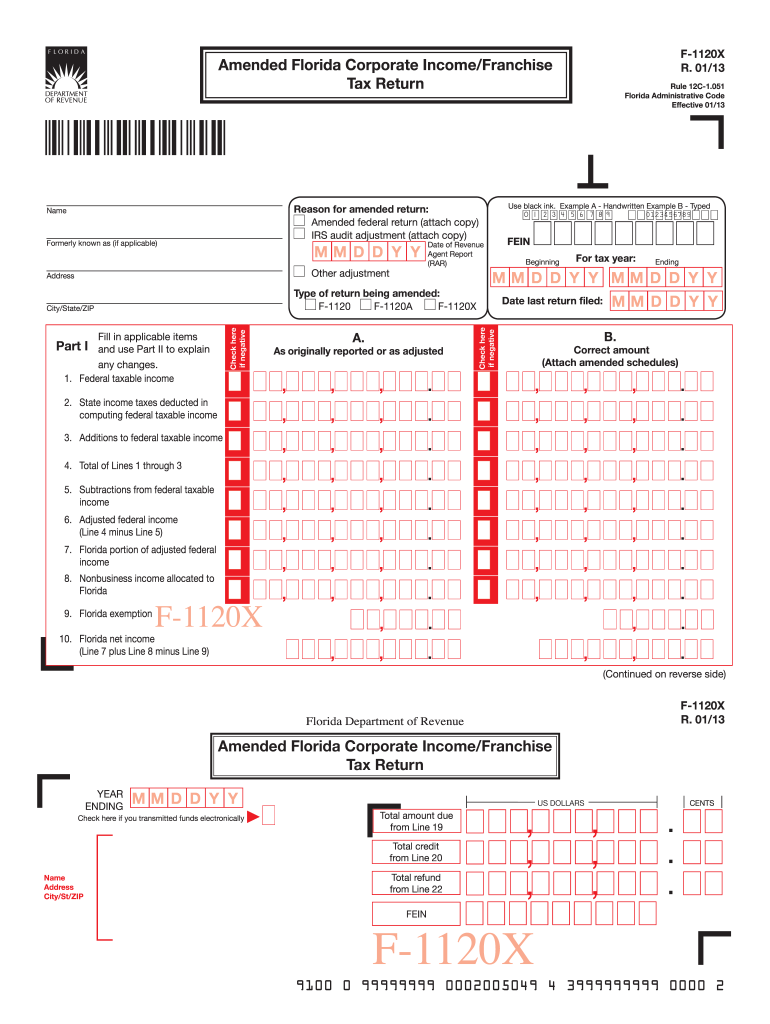

The Download Form F 1120X is a crucial document provided by the Florida Department of Revenue, specifically designed for taxpayers who need to amend their corporate income tax returns. This form allows businesses to correct errors or make changes to previously filed returns, ensuring compliance with state tax regulations. It is essential for corporations that have discovered discrepancies in their tax filings, whether due to miscalculations, overlooked deductions, or changes in tax law.

How to use the Download Form F 1120X Florida Department Of Revenue

Using the Download Form F 1120X involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the Florida Department of Revenue's official website. Next, carefully review your original tax return to identify the specific areas that require amendments. Fill out the form by providing accurate information regarding the changes you wish to make, including any adjustments to income, deductions, or credits. Once completed, the form must be signed and submitted according to the guidelines provided by the Florida Department of Revenue.

Steps to complete the Download Form F 1120X Florida Department Of Revenue

Completing the Download Form F 1120X involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Obtain the latest version of the form from the Florida Department of Revenue.

- Review your original tax return to identify the necessary corrections.

- Fill out the form, providing all required information, including the reason for the amendment.

- Double-check all entries for accuracy to avoid further issues.

- Sign the form electronically or by hand, as required.

- Submit the completed form via the preferred method indicated by the Florida Department of Revenue.

Key elements of the Download Form F 1120X Florida Department Of Revenue

The Download Form F 1120X contains several key elements that are vital for successful completion. These include:

- Taxpayer Information: This section requires the corporation's name, address, and federal employer identification number (EIN).

- Amendment Details: Clearly state the changes being made, including the specific lines on the original return that are affected.

- Signature: The form must be signed by an authorized representative of the corporation.

- Reason for Amendment: Provide a brief explanation for why the amendment is necessary.

Legal use of the Download Form F 1120X Florida Department Of Revenue

The legal use of the Download Form F 1120X is essential for maintaining compliance with state tax laws. This form is recognized by the Florida Department of Revenue as the official method for corporations to amend their tax returns. Proper use of the form helps avoid penalties and ensures that any adjustments to tax liabilities are accurately reflected in the state’s records. It is important to adhere to all instructions and guidelines provided to ensure the form's validity.

Form Submission Methods

The Download Form F 1120X can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines of the Florida Department of Revenue. Common submission methods include:

- Online Submission: Many taxpayers prefer to submit forms electronically through the Florida Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the department.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated offices.

Quick guide on how to complete download form f 1120x florida department of revenue

Your assistance manual on how to prepare your Download Form F 1120X Florida Department Of Revenue

If you’re interested in understanding how to generate and submit your Download Form F 1120X Florida Department Of Revenue, here are some brief instructions on how to simplify tax reporting.

To commence, you simply need to set up your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a very intuitive and robust document management solution that enables you to modify, draft, and finalize your income tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to update information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Download Form F 1120X Florida Department Of Revenue in minutes:

- Create your account and start working on PDFs in just a few minutes.

- Use our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Download Form F 1120X Florida Department Of Revenue in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Please be aware that filing on paper can lead to increased mistakes and delayed refunds. Be sure to check the IRS website for submission guidelines in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct download form f 1120x florida department of revenue

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

After filling out Form 6, how many days does it require to get your voter ID? Should I download it online?

I think it takes 2-3 months to verify your application and further other process then will get registered as voter in electoral roll. Then the voter Id will dispatch to you through BLO of your part of constituency.If you fill the form 6 on nvsp.in then you can check or track the status of your application.You will not supposed to get the digital copy of your voter Id online.I hope this will help you…..

Create this form in 5 minutes!

How to create an eSignature for the download form f 1120x florida department of revenue

How to create an electronic signature for your Download Form F 1120x Florida Department Of Revenue in the online mode

How to create an eSignature for your Download Form F 1120x Florida Department Of Revenue in Chrome

How to create an eSignature for putting it on the Download Form F 1120x Florida Department Of Revenue in Gmail

How to make an eSignature for the Download Form F 1120x Florida Department Of Revenue from your smart phone

How to generate an electronic signature for the Download Form F 1120x Florida Department Of Revenue on iOS devices

How to create an electronic signature for the Download Form F 1120x Florida Department Of Revenue on Android

People also ask

-

What is the process to Download Form F 1120X Florida Department Of Revenue using airSlate SignNow?

To Download Form F 1120X Florida Department Of Revenue, simply log into your airSlate SignNow account, navigate to the document section, and search for the form. Once found, you can easily download it directly to your device. Our platform streamlines this process, making it efficient and hassle-free.

-

Is there a cost associated with Downloading Form F 1120X Florida Department Of Revenue on airSlate SignNow?

AirSlate SignNow offers various pricing plans, but downloading Form F 1120X Florida Department Of Revenue can be done at no additional cost with a subscription. Each plan includes access to our document templates and forms, ensuring you can manage your filings without incurring extra fees.

-

Can I eSign the Download Form F 1120X Florida Department Of Revenue directly on airSlate SignNow?

Yes, you can eSign the Download Form F 1120X Florida Department Of Revenue directly within the airSlate SignNow platform. Our user-friendly interface allows you to add your signature quickly and securely, ensuring that your documents are legally binding and compliant.

-

What features does airSlate SignNow offer for managing forms like Download Form F 1120X Florida Department Of Revenue?

AirSlate SignNow provides a comprehensive suite of features for managing forms, including templates, eSigning, and secure storage. When you Download Form F 1120X Florida Department Of Revenue, you can customize it, share it with others for signatures, and track its status in real-time.

-

Are there integrations available for airSlate SignNow when I Download Form F 1120X Florida Department Of Revenue?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This means once you Download Form F 1120X Florida Department Of Revenue, you can easily save, share, and manage the document across your favorite platforms.

-

What are the benefits of using airSlate SignNow to Download Form F 1120X Florida Department Of Revenue?

Using airSlate SignNow to Download Form F 1120X Florida Department Of Revenue provides several benefits, including ease of use, cost-effectiveness, and enhanced security. You can streamline your document workflow, ensuring that your forms are completed accurately and submitted on time.

-

Is customer support available if I encounter issues when Downloading Form F 1120X Florida Department Of Revenue?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues or questions related to Downloading Form F 1120X Florida Department Of Revenue. Our support team is available through chat, email, or phone to ensure you have a smooth experience.

Get more for Download Form F 1120X Florida Department Of Revenue

- Assignment of lease from lessor with notice of assignment minnesota form

- Mn settlement 497312260 form

- Felony affidavit form

- Letter from landlord to tenant as notice of abandoned personal property minnesota form

- Cost child support form

- Minnesota regarding form

- Minnesota divorce 497312265 form

- Minnesota child visitation form

Find out other Download Form F 1120X Florida Department Of Revenue

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will