Form F 1120x 2016-2026

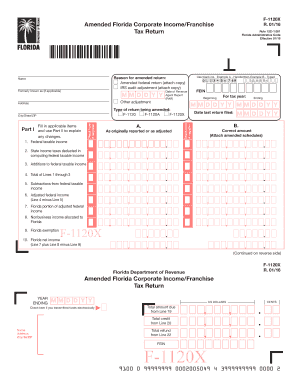

What is the Form F-1120X?

The Form F-1120X is the official document used for amending a previously filed Florida corporate income tax return. This form allows corporations to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. It is essential for businesses to accurately report their income and any adjustments to avoid penalties and ensure proper tax liability. The form is specifically designed for use by corporations that need to amend their original Form F-1120 submissions.

Steps to Complete the Form F-1120X

Completing the Form F-1120X involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including the original tax return and any supporting documents related to the changes being made. Next, fill out the form by providing the required information, such as the corporation's name, address, and tax identification number. Be sure to clearly indicate the changes being made and provide an explanation for each amendment. After completing the form, review it thoroughly for any errors before signing and dating it. Finally, submit the amended form to the Florida Department of Revenue by the specified deadline.

Legal Use of the Form F-1120X

The legal use of the Form F-1120X is governed by Florida tax laws, which stipulate that corporations must file this form to amend their tax returns within a specific timeframe. The form must be used to correct inaccuracies, such as misreported income, deductions, or credits. It is crucial for businesses to ensure that all amendments comply with state regulations to avoid legal repercussions. Additionally, the amended return must be filed in accordance with the guidelines set forth by the Florida Department of Revenue to maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form F-1120X are critical for ensuring compliance with Florida tax laws. Generally, corporations must submit the amended return within three years from the original filing date or within two years from the date the tax was paid, whichever is later. It is important to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates related to tax filings can help businesses maintain their good standing with the Florida Department of Revenue.

Form Submission Methods

The Form F-1120X can be submitted through various methods, including online, by mail, or in person. For online submissions, businesses can utilize the Florida Department of Revenue's online services, which provide a secure and efficient way to file the amended return. Alternatively, corporations may choose to print the completed form and mail it to the appropriate address provided by the Department of Revenue. In-person submissions can also be made at designated locations. Each method has its own processing times, so it is advisable to choose the one that best suits the corporation's needs.

Required Documents

When preparing to file the Form F-1120X, corporations must gather several required documents to support their amendments. These may include copies of the original tax return, any relevant schedules, and documentation that justifies the changes being made. It is also beneficial to include any correspondence received from the Florida Department of Revenue regarding the original filing. Having all necessary documents on hand will streamline the amendment process and help ensure that the submission is complete and accurate.

Quick guide on how to complete amended federal return attach copy

Your assistance manual on how to prepare your Form F 1120x

If you're wondering how to fill out and submit your Form F 1120x, here are some concise instructions on how to simplify tax processing.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, draft, and finalize your income tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures, and return to amend responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Form F 1120x in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form F 1120x in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper may lead to return errors and delays in refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct amended federal return attach copy

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How should I attach the W2 forms to the tax return? The W2 forms I received each have all four copies on a single letter page. Should I cut the respective copy out, or should I just attach the whole letter pages?

Wrong answer, guys. The IRS requires you to electronically file your tax return unless you cannot or some tax condition requires it be sent along with other documents.To the OP, How are you preparing your taxes? There are at least a dozen ways to prepare them online, some only require a smartphone. When you do that, the electronic file is sent to the IRS including your W-2 information. You don’t have to put anything in the mail except your check (if you owe).If you don’t efile, you need to complete another form 8948 explaining why you are not.

Create this form in 5 minutes!

How to create an eSignature for the amended federal return attach copy

How to make an eSignature for your Amended Federal Return Attach Copy online

How to make an eSignature for your Amended Federal Return Attach Copy in Google Chrome

How to create an electronic signature for putting it on the Amended Federal Return Attach Copy in Gmail

How to make an electronic signature for the Amended Federal Return Attach Copy from your smart phone

How to make an eSignature for the Amended Federal Return Attach Copy on iOS

How to create an eSignature for the Amended Federal Return Attach Copy on Android OS

People also ask

-

What is Form F 1120x and who needs it?

Form F 1120x is a tax form used by corporations to amend their previously filed income tax returns. Businesses that need to correct errors or make adjustments to their tax filings should use Form F 1120x to ensure compliance with the IRS regulations.

-

How can airSlate SignNow help with Form F 1120x?

airSlate SignNow streamlines the process of completing and eSigning Form F 1120x by providing a user-friendly platform for document management. With our solution, users can easily fill out the form electronically and securely send it for signatures, enhancing efficiency and accuracy.

-

Is there a cost associated with using airSlate SignNow for Form F 1120x?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, ensuring that businesses can manage their Form F 1120x and other document workflows without breaking the bank.

-

What features does airSlate SignNow offer for managing Form F 1120x?

With airSlate SignNow, users can access features like customizable document templates, advanced eSigning options, and secure cloud storage. These features facilitate the smooth handling of Form F 1120x, making it easier to amend and submit tax documents.

-

Can I integrate airSlate SignNow with other software for Form F 1120x?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM and accounting software. This integration allows users to import and export data, simplifying the preparation of Form F 1120x and enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for Form F 1120x?

Using airSlate SignNow for Form F 1120x provides numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. Our platform ensures that your tax amendments are handled securely and professionally, giving you peace of mind.

-

How secure is using airSlate SignNow for submitting Form F 1120x?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure authentication methods to protect your sensitive information, ensuring that your Form F 1120x and other documents are safe during the eSigning process.

Get more for Form F 1120x

Find out other Form F 1120x

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple