Sample Trust Deed India Form

Understanding the Sample Deed of Trust Form

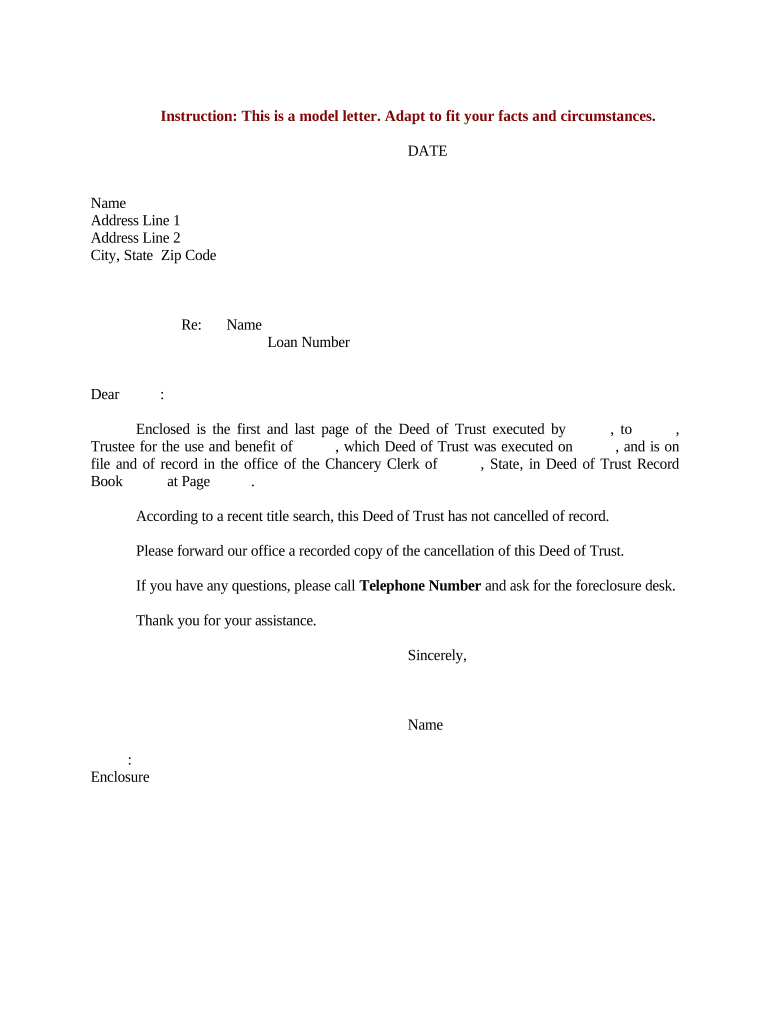

The sample deed of trust form serves as a crucial legal document in real estate transactions, particularly in the United States. It outlines the agreement between the borrower, lender, and trustee, establishing the terms under which the property secures the loan. This form is essential for protecting the interests of all parties involved, ensuring that the lender has a claim to the property if the borrower defaults on the loan. Understanding its components is vital for anyone engaging in property transactions.

Key Elements of the Sample Deed of Trust Form

Several key elements must be included in a sample deed of trust form to ensure its legality and effectiveness. These elements typically include:

- Parties Involved: The names and addresses of the borrower, lender, and trustee must be clearly stated.

- Property Description: A detailed description of the property being secured, including its legal description.

- Loan Amount: The total amount of the loan secured by the deed of trust.

- Terms of the Loan: Specifics regarding the interest rate, payment schedule, and any conditions for default.

- Signatures: The signatures of all parties involved, along with the date of signing, are necessary for validation.

Steps to Complete the Sample Deed of Trust Form

Completing a sample deed of trust form involves several important steps to ensure accuracy and compliance with legal standards:

- Gather necessary information about all parties involved.

- Provide a clear description of the property, including its legal address.

- Specify the loan amount and terms, including interest rates and payment schedules.

- Ensure all parties review the document for accuracy.

- Obtain signatures from the borrower, lender, and trustee, ensuring they are dated.

- Consider having the document notarized for added legal protection.

Legal Use of the Sample Deed of Trust Form

The legal use of a sample deed of trust form is governed by state laws and regulations. It is essential to ensure that the form complies with local legal requirements, as these can vary significantly across different jurisdictions. A properly executed deed of trust provides the lender with a secured interest in the property, allowing them to initiate foreclosure proceedings if the borrower defaults. Understanding the legal implications is crucial for all parties involved.

Digital vs. Paper Version of the Sample Deed of Trust Form

With the increasing shift towards digital documentation, the sample deed of trust form can be completed and signed electronically. Digital versions offer several advantages, including ease of access, reduced paperwork, and the ability to store documents securely. However, it is important to ensure that the digital form complies with eSignature laws, such as the ESIGN Act and UETA, to maintain its legal validity. In contrast, paper versions may still be required in certain situations, particularly where local laws mandate physical documentation.

Obtaining the Sample Deed of Trust Form

Obtaining a sample deed of trust form is relatively straightforward. These forms can often be found through legal websites, real estate agencies, or local government offices. It is advisable to use a form that is specific to your state to ensure compliance with local laws. Additionally, consulting with a legal professional can provide guidance on the appropriate use and completion of the form, ensuring that all necessary elements are included.

Quick guide on how to complete sample trust deed india

Prepare Sample Trust Deed India effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary resources to create, modify, and eSign your documents swiftly without any holdups. Manage Sample Trust Deed India on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to adjust and eSign Sample Trust Deed India with ease

- Obtain Sample Trust Deed India and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your preference. Modify and eSign Sample Trust Deed India and ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample deed of trust form?

A sample deed of trust form is a legal document that outlines the terms under which a borrower secures a loan using real property as collateral. Using a sample deed of trust form can simplify the process of preparing this important legal document. It's essential to ensure that the form is tailored to meet the specific requirements and laws of your state.

-

How can airSlate SignNow help me with a sample deed of trust form?

airSlate SignNow offers an intuitive platform to create, customize, and send a sample deed of trust form for electronic signatures. With our easy-to-use interface, you can quickly fill in necessary details and get it signed by all relevant parties. This streamlines the entire process, ensuring that your documents are handled efficiently.

-

Is there a cost associated with using a sample deed of trust form with airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow to access and manage your sample deed of trust form. We offer various subscription plans tailored to different business needs, allowing you to choose the best fit for your budget. It's a cost-effective solution compared to traditional paper-based methods.

-

What features should I look for in a sample deed of trust form?

When selecting a sample deed of trust form, look for features like customizable fields, compliance with state-specific regulations, and eSignature capabilities. These features help ensure that the form meets your needs while simplifying the signing process. airSlate SignNow provides these essential features, making it easier to manage your documents.

-

Can I integrate airSlate SignNow with other applications when using a sample deed of trust form?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when dealing with a sample deed of trust form. You can connect with CRM systems, cloud storage services, and other tools to streamline your document management. This integration capability ensures that your work is more efficient and organized.

-

What are the benefits of using a sample deed of trust form with airSlate SignNow?

Using a sample deed of trust form with airSlate SignNow provides benefits such as increased efficiency, reduced paperwork, and improved document management. You'll also enjoy the convenience of electronic signatures, which speeds up the approval process. Overall, our solution offers a modern approach to handling important legal documents.

-

How secure is my information when using a sample deed of trust form with airSlate SignNow?

airSlate SignNow prioritizes the security of your information, especially when dealing with sensitive documents like a sample deed of trust form. We employ advanced encryption methods and comply with industry standards to ensure your data remains secure. You can confidently manage your documents knowing that they are protected.

Get more for Sample Trust Deed India

- Supported employmentemployment assistance service delivery log form 4117

- Dads 2110 form

- Form 4118

- Day activity and health services dahs form 3050

- Form 1582

- Medicaid for breast and cervical cancer medicaid para el dads dads state tx form

- Form h2340

- Supervised work experience documentation form texas dshs state tx

Find out other Sample Trust Deed India

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy