Letter Collection Payment Form

What is the Letter Collection Payment

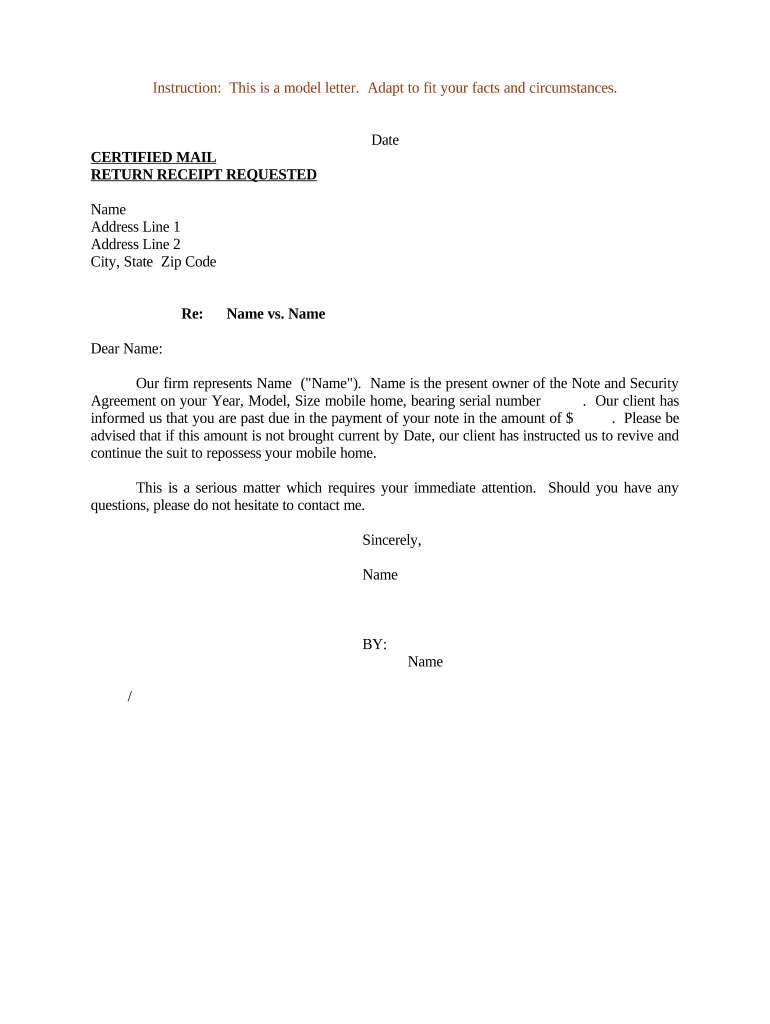

The Letter Collection Payment is a formal document used to request payment for outstanding debts or services rendered. This type of letter serves as a reminder to the recipient regarding their financial obligation. It typically includes details such as the amount owed, the due date, and any applicable late fees. By clearly outlining the terms of the debt, this letter aims to facilitate communication between the creditor and debtor, ensuring that both parties are aware of the payment expectations.

How to use the Letter Collection Payment

Using the Letter Collection Payment effectively involves several key steps. First, gather all necessary information, including the debtor's contact details and the specifics of the outstanding payment. Next, draft the letter, ensuring it is clear and professional. Include all relevant details such as the amount due, payment methods accepted, and a deadline for payment. Once the letter is complete, send it to the debtor via a reliable method, such as certified mail or email, to ensure it is received. Keeping a copy of the letter for your records is also advisable.

Key elements of the Letter Collection Payment

A well-structured Letter Collection Payment should contain specific elements to enhance its effectiveness. These include:

- Creditor Information: Name, address, and contact details of the creditor.

- Debtor Information: Name and address of the debtor.

- Payment Details: Amount owed, due date, and any applicable late fees.

- Payment Instructions: Clear guidance on how to make the payment.

- Consequences of Non-Payment: Information about potential actions if the payment is not made.

Steps to complete the Letter Collection Payment

Completing a Letter Collection Payment involves a systematic approach. Follow these steps:

- Gather all relevant information regarding the debt.

- Draft the letter, ensuring clarity and professionalism.

- Include all key elements such as creditor and debtor information.

- Specify payment methods and deadlines.

- Send the letter through a reliable delivery method.

- Retain a copy for your records.

Legal use of the Letter Collection Payment

The Letter Collection Payment must adhere to legal standards to be enforceable. It is important that the letter is clear, truthful, and not misleading. The Fair Debt Collection Practices Act (FDCPA) governs the conduct of debt collectors in the United States, ensuring that debtors are treated fairly. This means that the letter should not contain threats or coercive language. Additionally, it should provide the debtor with information about their rights, including how to dispute the debt if they believe it is incorrect.

Examples of using the Letter Collection Payment

Examples of using a Letter Collection Payment can vary based on the context. For instance, a small business may send a collection letter to a client who has not paid for services rendered. Similarly, a landlord might issue a collection letter to a tenant who has fallen behind on rent payments. In both cases, the letter serves to formally document the outstanding payment and initiate communication about resolving the issue.

Quick guide on how to complete letter collection payment

Prepare Letter Collection Payment effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly without delays. Handle Letter Collection Payment on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to edit and eSign Letter Collection Payment effortlessly

- Locate Letter Collection Payment and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Letter Collection Payment while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample mobile home?

A sample mobile home is a demonstration model used to showcase the features and options available in mobile homes. It allows prospective buyers to visualize the layout, materials, and quality of construction. Evaluating a sample mobile home can help you make informed decisions about your potential purchase.

-

What are the benefits of owning a sample mobile home?

Owning a sample mobile home offers numerous benefits, including affordability, flexibility in design, and lower maintenance costs. These homes often provide a sense of community and accessibility to amenities while allowing for customization to fit your lifestyle. A sample mobile home can serve as a great reference point for understanding these benefits.

-

How much does a sample mobile home typically cost?

The cost of a sample mobile home can vary signNowly based on size, features, and location. On average, you can expect to pay between $30,000 to $100,000 for a new mobile home. It's essential to compare prices and consult with dealers to find a sample mobile home that fits your budget.

-

What features should I look for in a sample mobile home?

When evaluating a sample mobile home, look for features like energy efficiency, quality of materials, and modern design elements. Pay attention to the layout, number of bedrooms and bathrooms, and any additional options such as outdoor space. Understanding these features can enhance your living experience in a mobile home.

-

Are sample mobile homes customizable?

Yes, sample mobile homes are often customizable to meet buyers' specific needs. Many manufacturers allow modifications in floor plans, finishes, and appliances. By considering a sample mobile home, you can explore customization options that suit your personal style and functional requirements.

-

Can I finance a sample mobile home?

Yes, financing options are available for purchasing a sample mobile home. Many lenders specialize in mobile home loans, offering various financing solutions, such as loans for new or used homes. It's advisable to shop around and compare terms to ensure you find the best financing option for your sample mobile home.

-

What are the maintenance requirements for a sample mobile home?

Maintaining a sample mobile home typically involves regular inspections, upkeep of appliances, and roof care. It's crucial to check for leaks, ensure proper insulation, and maintain plumbing systems. Understanding these maintenance requirements can help you keep your sample mobile home in excellent condition over time.

Get more for Letter Collection Payment

Find out other Letter Collection Payment

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF