Balance Sheet Deposits Form

What is the Balance Sheet Deposits

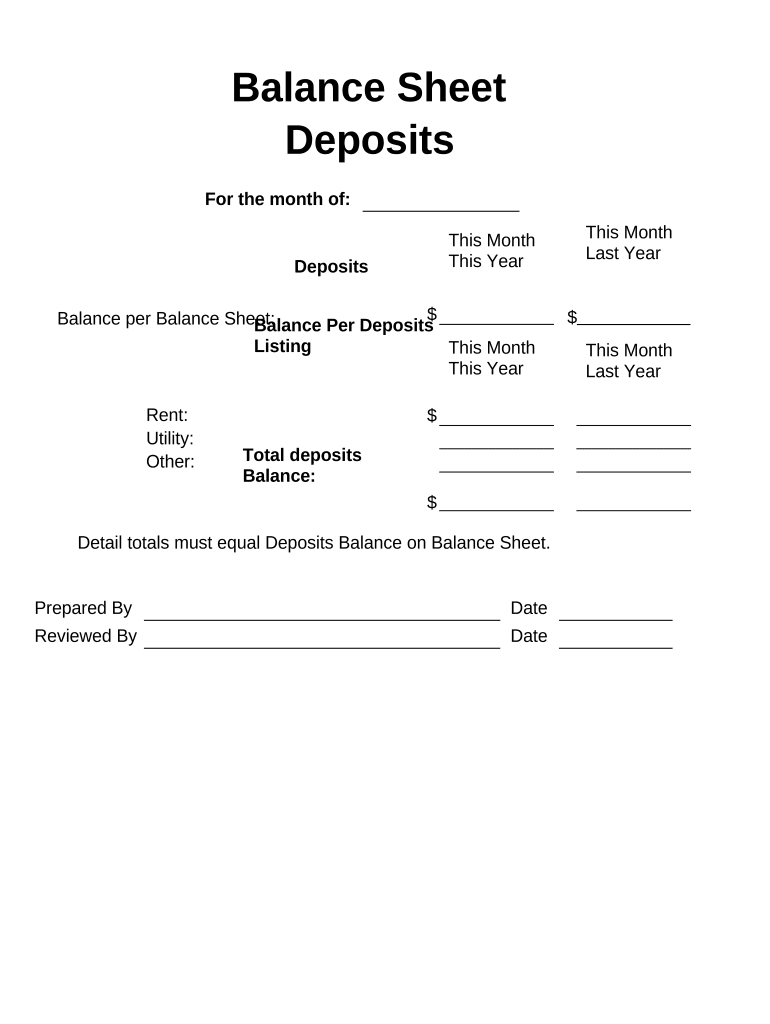

The balance sheet deposits form is a crucial financial document that provides a snapshot of a business's financial position at a specific point in time. It outlines the assets, liabilities, and equity of a company, helping stakeholders understand its financial health. This form is essential for businesses of all sizes, as it aids in financial analysis, decision-making, and compliance with regulatory requirements. Accurate completion of the balance sheet deposits form ensures that all financial data is reported correctly, reflecting the true state of the business.

How to use the Balance Sheet Deposits

Using the balance sheet deposits form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including current assets, liabilities, and equity. Next, categorize these items appropriately, ensuring that each entry aligns with accounting principles. Once the data is organized, input the information into the balance sheet deposits form. It is important to review the completed form for any discrepancies before submission. Utilizing digital tools can streamline this process, allowing for easier adjustments and secure storage of the document.

Steps to complete the Balance Sheet Deposits

Completing the balance sheet deposits form requires a systematic approach. Follow these steps for effective completion:

- Collect financial data: Gather information on all assets, liabilities, and equity.

- Classify items: Organize the data into appropriate categories, such as current and non-current assets.

- Fill out the form: Enter the categorized data into the balance sheet deposits form accurately.

- Verify accuracy: Review the completed form for any errors or omissions.

- Submit the form: Follow the appropriate submission method, whether online or by mail.

Legal use of the Balance Sheet Deposits

The legal use of the balance sheet deposits form is governed by various accounting standards and regulations. In the United States, businesses must comply with Generally Accepted Accounting Principles (GAAP) when preparing this form. This ensures that the financial information presented is reliable and comparable across different entities. Additionally, the form may be subject to audits, making it essential for businesses to maintain accurate records and adhere to legal requirements to avoid potential penalties.

Key elements of the Balance Sheet Deposits

Several key elements must be included in the balance sheet deposits form to provide a complete financial overview. These elements include:

- Assets: Resources owned by the business, such as cash, inventory, and property.

- Liabilities: Obligations or debts owed to external parties, including loans and accounts payable.

- Equity: The residual interest in the assets of the business after deducting liabilities, representing the owners' stake.

- Current and Non-Current Classifications: Distinguishing between short-term and long-term assets and liabilities.

Examples of using the Balance Sheet Deposits

Examples of using the balance sheet deposits form can vary based on the type of business and its financial activities. For instance, a small business may use the form to secure a loan by demonstrating its financial stability to lenders. Similarly, a corporation may present its balance sheet deposits during investor meetings to showcase its financial health and attract potential investors. These examples illustrate the form's importance in various business contexts, highlighting its role in financial reporting and decision-making.

Quick guide on how to complete balance sheet deposits

Complete Balance Sheet Deposits effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can effortlessly access the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without any delays. Manage Balance Sheet Deposits on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Balance Sheet Deposits without hassle

- Find Balance Sheet Deposits and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure confidential information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Balance Sheet Deposits to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Balance Sheet Deposits?

Balance Sheet Deposits represent the total funds held in bank accounts that can be easily accessed by a company. These deposits are crucial for understanding a business's liquidity and overall financial health, allowing stakeholders to make informed decisions.

-

How can airSlate SignNow help with managing Balance Sheet Deposits?

airSlate SignNow enhances the management of Balance Sheet Deposits by streamlining the documentation process. With features like eSigning and secure document sharing, businesses can effortlessly handle agreements related to deposits, ensuring that transactions are efficient and well-documented.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Each plan provides essential features for managing Balance Sheet Deposits, allowing users to choose one that aligns with their budget while providing cost-effective solutions for digital documentation.

-

What features does airSlate SignNow offer for Balance Sheet Deposits?

Among its many features, airSlate SignNow includes templates, automated workflows, and advanced tracking to help organizations manage their Balance Sheet Deposits effectively. These features enable quick document creation and easy access to transaction histories.

-

How does airSlate SignNow ensure the security of my documents related to Balance Sheet Deposits?

airSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. This ensures that all documents pertaining to Balance Sheet Deposits are securely stored and transmitted, protecting sensitive financial information.

-

Can airSlate SignNow integrate with other financial software for Balance Sheet Deposits?

Yes, airSlate SignNow easily integrates with various financial software platforms, enhancing the management of Balance Sheet Deposits. This integration allows for seamless data sharing and improved workflow efficiency, allowing users to access critical information without unnecessary delays.

-

What benefits does eSigning provide for Balance Sheet Deposits?

eSigning with airSlate SignNow streamlines the approval process for transactions related to Balance Sheet Deposits. It speeds up the time needed to finalize agreements and reduces paperwork, making it easier for businesses to keep their financial operations moving smoothly.

Get more for Balance Sheet Deposits

- Certificate of conversion form conv 1a

- 2020 business license renewal reset form city of

- Statement of citizenship alienage and immigration status california form

- Domestic partnership california form

- Abc 227 form

- California cattle brands form

- Initial application form 10 17 08

- California federal hotel tax exempt form

Find out other Balance Sheet Deposits

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter