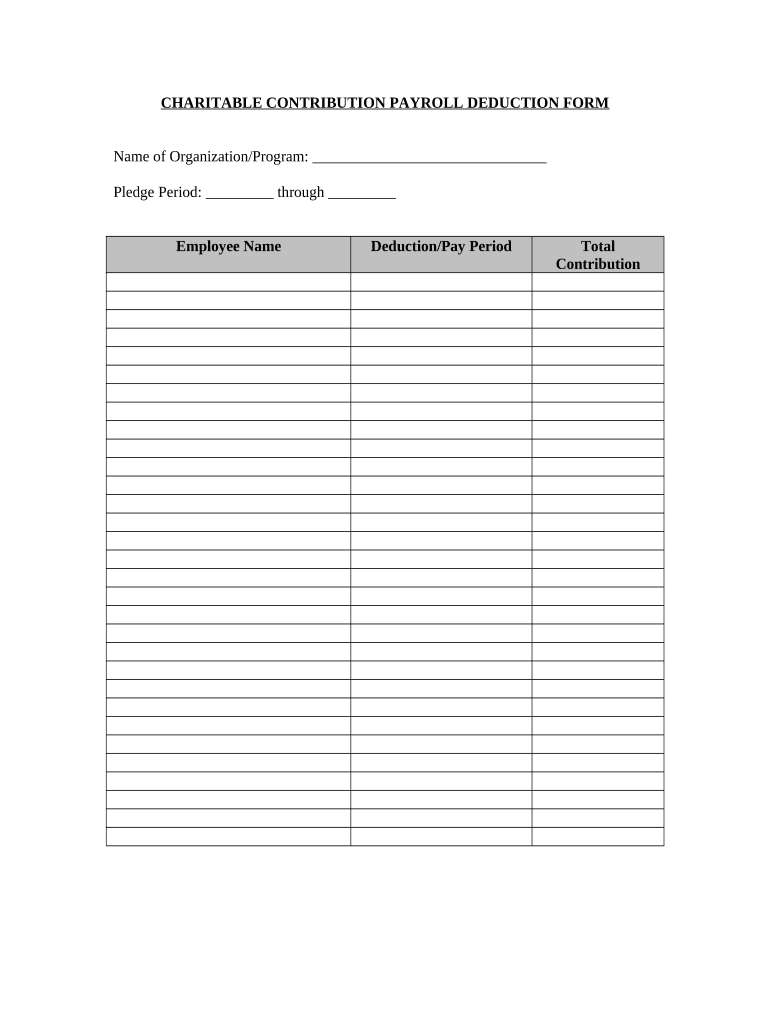

Payroll Deduction Form

What is the payroll deduction form?

The payroll deduction form is a document used by employers to authorize the deduction of specific amounts from an employee's paycheck. This form typically outlines the types of deductions, such as contributions to retirement plans, health insurance premiums, or other benefits. It serves as a formal agreement between the employee and employer regarding the deductions that will be taken from the employee's salary.

How to use the payroll deduction form

To use the payroll deduction form effectively, an employee must complete it accurately and submit it to their employer's human resources or payroll department. The form will usually require the employee's personal information, including their name, employee ID, and the specific deductions they wish to authorize. Once submitted, the employer will process the form and implement the requested deductions in the employee's payroll.

Steps to complete the payroll deduction form

Completing the payroll deduction form involves several straightforward steps:

- Obtain the payroll deduction form from your employer or download it from their website.

- Fill in your personal details, including your name, employee ID, and department.

- Specify the type of deductions you wish to authorize, such as retirement contributions or insurance premiums.

- Sign and date the form to confirm your agreement to the deductions.

- Submit the completed form to your HR or payroll department for processing.

Key elements of the payroll deduction form

Several key elements are essential to include in a payroll deduction form to ensure it is valid:

- Employee Information: Name, employee ID, and department.

- Deduction Types: Clear listing of the deductions being authorized.

- Amount or Percentage: Specific amounts or percentages to be deducted.

- Signature: Employee's signature to validate the authorization.

- Date: The date when the form is completed and signed.

Legal use of the payroll deduction form

The payroll deduction form must comply with federal and state laws to be legally binding. Employers must ensure that deductions are authorized by employees and that they adhere to regulations regarding minimum wage and maximum deduction limits. Proper documentation and record-keeping are essential to protect both the employer and employee in case of disputes.

Digital vs. paper version of the payroll deduction form

Both digital and paper versions of the payroll deduction form serve the same purpose but offer different advantages. Digital forms can be filled out and submitted online, providing convenience and faster processing. They often include features such as electronic signatures and secure submission methods. In contrast, paper forms may be preferred by those who feel more comfortable with traditional methods or lack access to digital tools. Regardless of the format, both versions must meet legal requirements to be valid.

Quick guide on how to complete payroll deduction form 497334404

Complete Payroll Deduction Form effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Handle Payroll Deduction Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Payroll Deduction Form with ease

- Retrieve Payroll Deduction Form and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal value as a conventional handwritten signature.

- Review the details and click the Done button to preserve your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Payroll Deduction Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a payroll deduction form template?

A payroll deduction form template is a standardized document that allows employees to authorize automatic deductions from their paychecks. This template helps streamline the process of managing various deductions, such as health insurance and retirement contributions, making it easier for businesses to handle payroll efficiently.

-

How can airSlate SignNow help with payroll deduction form templates?

airSlate SignNow simplifies the creation and sharing of payroll deduction form templates. With our platform, you can easily customize templates to meet your specific needs and ensure that employees can sign them electronically, saving time and reducing paperwork.

-

Is there a cost associated with using the payroll deduction form template feature?

Yes, while airSlate SignNow offers various pricing plans, the payroll deduction form template feature is included in most subscriptions. We provide cost-effective solutions that are scalable, making it a great choice for businesses of all sizes looking to manage payroll deductions efficiently.

-

What are the benefits of using a payroll deduction form template?

Using a payroll deduction form template offers several benefits, including time savings, reduced errors, and improved compliance. By standardizing the process, employers can ensure that they capture all necessary employee consents and information correctly, helping to streamline payroll operations.

-

Can I customize my payroll deduction form template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your payroll deduction form template to fit your business's specific requirements. You can add branding elements, specific fields, and modify the layout to ensure your template meets all necessary compliance standards.

-

Does airSlate SignNow integrate with existing payroll systems?

Yes, airSlate SignNow is designed to integrate seamlessly with various payroll systems and HR software. This integration allows for smooth data transfer, ensuring that your payroll deduction form template syncs with your existing payroll processes for maximum efficiency.

-

How does eSigning work for payroll deduction form templates?

With airSlate SignNow, eSigning of your payroll deduction form templates is straightforward. Employees can review and sign the forms electronically from any device, which not only speeds up the approval process but also ensures that all transactions are securely documented and easily accessible for future reference.

Get more for Payroll Deduction Form

Find out other Payroll Deduction Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation