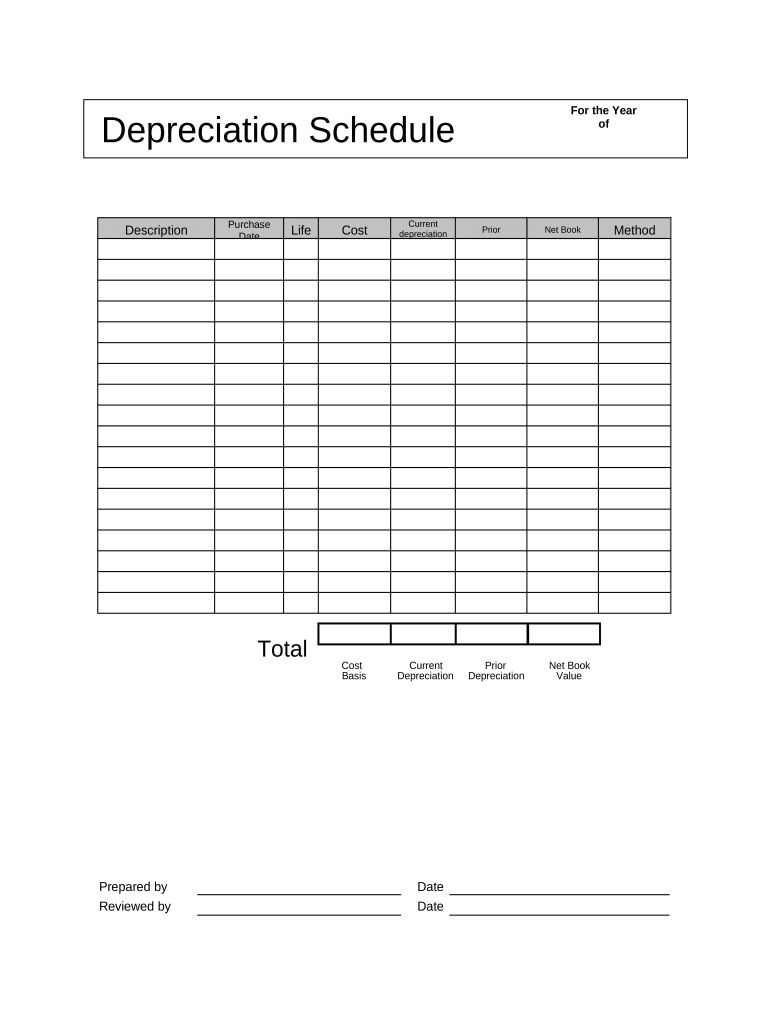

Depreciation Schedule Form

What is the Depreciation Schedule

The depreciation schedule is a crucial financial document that outlines the method and timeline for depreciating an asset's value over its useful life. This schedule is particularly important for businesses and individuals who need to report asset depreciation for tax purposes. It provides a systematic approach to accounting for the wear and tear of physical assets, ensuring that financial statements accurately reflect the value of these assets over time. By detailing the depreciation method, such as straight-line or declining balance, the schedule helps in calculating the annual depreciation expense, which can significantly impact taxable income.

How to use the Depreciation Schedule

Using a depreciation schedule involves several steps that help ensure accurate financial reporting. First, identify the assets that require depreciation. Next, determine the useful life of each asset and select an appropriate depreciation method. Once these factors are established, you can begin filling out the schedule. This includes entering the asset's purchase price, estimated salvage value, and the chosen method of depreciation. Regularly updating the schedule is essential to reflect any changes, such as asset disposals or adjustments in useful life. This practice not only aids in tax preparation but also provides valuable insights into asset management.

Steps to complete the Depreciation Schedule

Completing a depreciation schedule involves a systematic approach. Start by listing all the assets that will be depreciated. For each asset, gather the following information:

- Asset Description: Clearly name and describe the asset.

- Purchase Date: Record when the asset was acquired.

- Cost Basis: Note the total cost of the asset, including purchase price and any additional costs incurred.

- Useful Life: Estimate how long the asset will be used in business operations.

- Salvage Value: Determine the expected value of the asset at the end of its useful life.

- Depreciation Method: Choose a method such as straight-line or declining balance.

Once this information is compiled, calculate the annual depreciation expense and document it in the schedule. Regular review and adjustments will help maintain accuracy.

Legal use of the Depreciation Schedule

The legal use of a depreciation schedule is essential for compliance with tax regulations. The Internal Revenue Service (IRS) requires accurate reporting of asset depreciation to ensure that businesses do not overstate expenses or underreport income. A well-maintained depreciation schedule can serve as evidence in the event of an audit. It is important that the schedule adheres to IRS guidelines, including the appropriate methods and useful life estimates, to avoid penalties. Additionally, businesses should keep supporting documents, such as purchase invoices and maintenance records, to substantiate the information reported in the schedule.

IRS Guidelines

The IRS provides specific guidelines for the preparation and use of depreciation schedules. These guidelines detail acceptable depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS), which is commonly used for tax reporting. The IRS also specifies the useful life of various asset types, which can vary based on the category of the asset. Understanding these guidelines is crucial for ensuring compliance and optimizing tax benefits. Businesses should regularly consult IRS publications or a tax professional to stay updated on any changes that may affect their depreciation practices.

Required Documents

To effectively complete a depreciation schedule, several documents are necessary. These include:

- Purchase Invoices: Proof of acquisition costs for each asset.

- Asset Appraisals: Documentation of estimated values, if applicable.

- Maintenance Records: Information on any improvements or repairs that may affect asset value.

- Tax Returns: Previous years' returns can provide context for current depreciation practices.

Having these documents organized and accessible will facilitate accurate reporting and compliance with tax regulations.

Quick guide on how to complete depreciation schedule

Accomplish Depreciation Schedule effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal green substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and eSign your documents swiftly without delays. Handle Depreciation Schedule on any device using airSlate SignNow’s Android or iOS applications and simplify any document-centric procedure today.

How to alter and eSign Depreciation Schedule without hassle

- Find Depreciation Schedule and select Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that reason.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for the form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Depreciation Schedule and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Depreciation Schedule and why is it important for businesses?

A Depreciation Schedule is a detailed table that outlines the reduction in value of an asset over time, essential for financial reporting. It helps businesses understand asset value and tax implications, ensuring compliance with accounting standards. By managing depreciation effectively, companies can optimize financial strategies and enhance their planning.

-

How does airSlate SignNow facilitate the creation of a Depreciation Schedule?

airSlate SignNow offers features like eSigning and document management that simplify the process of creating a Depreciation Schedule. Users can easily upload financial documents, get them signed electronically, and track changes in real-time. This streamlines workflow, saving time and ensuring accuracy in asset management.

-

What features does airSlate SignNow provide that are relevant for managing a Depreciation Schedule?

With airSlate SignNow, users can access customizable templates, document versioning, and secure cloud storage, all crucial for managing a Depreciation Schedule. The platform also integrates smoothly with accounting software, enhancing the management of asset data. These features ensure that the Depreciation Schedule is always up-to-date and readily accessible.

-

Can I integrate airSlate SignNow with my existing accounting software for my Depreciation Schedule?

Yes, airSlate SignNow supports multiple integrations with popular accounting software, making it easier to manage your Depreciation Schedule. This integration allows for automated data flow, reducing manual entry errors and ensuring that your financial reports are accurate. It enhances productivity and ensures you stay compliant with financial reporting standards.

-

What pricing plans does airSlate SignNow offer for businesses needing a Depreciation Schedule?

airSlate SignNow offers competitive pricing plans tailored to various business needs. These plans provide access to essential features for developing and managing a Depreciation Schedule, ensuring cost-effectiveness. Potential customers can choose a plan that fits their budgeting and software requirements.

-

How can a Depreciation Schedule improve financial planning for a business?

A well-maintained Depreciation Schedule provides insights into asset value and helps businesses make informed decisions regarding investments and budgeting. It plays a crucial role in predicting cash flow and tax liabilities, which are essential for sustainable financial planning. Understanding depreciation allows companies to allocate resources effectively and optimize their financial strategies.

-

Is airSlate SignNow suitable for small businesses needing a Depreciation Schedule?

Absolutely! airSlate SignNow is an easy-to-use solution that caters to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it ideal for those just starting with a Depreciation Schedule. Even small businesses can benefit from professional-level document management and eSigning capabilities.

Get more for Depreciation Schedule

Find out other Depreciation Schedule

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors