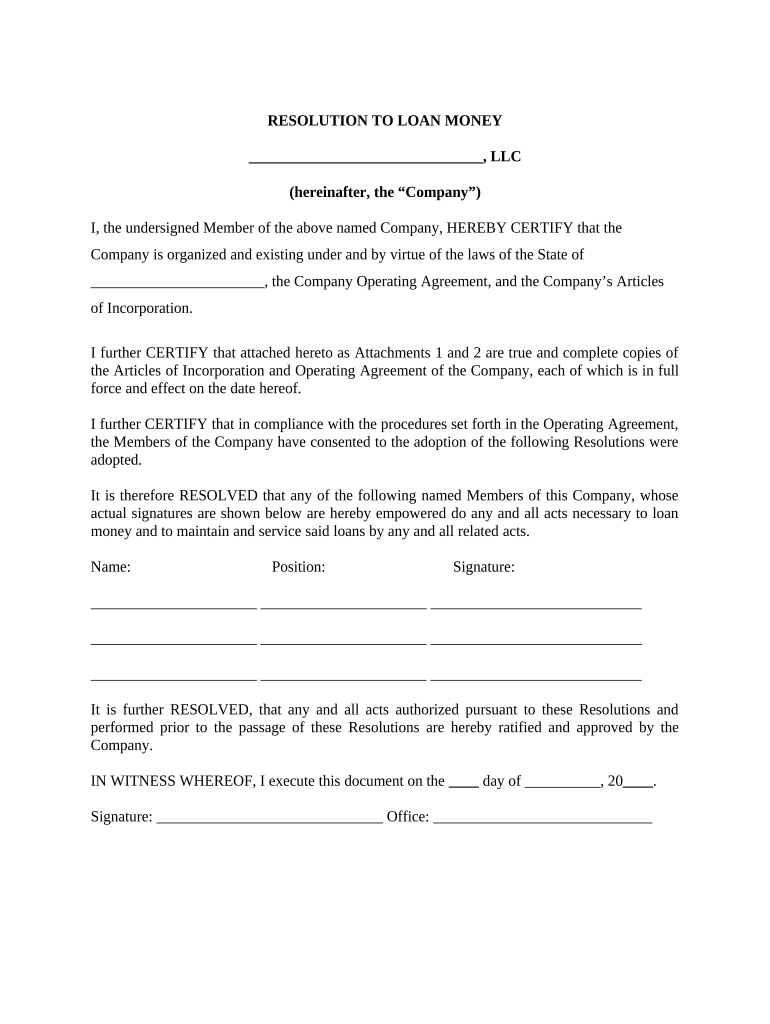

Llc Loan Money Form

What is the LLC Loan Money?

The LLC loan money refers to funds that a limited liability company (LLC) can borrow to finance its operations, expand its business, or manage cash flow. This type of loan is specifically designed for LLCs, allowing them to leverage their business structure for better financing options. Unlike personal loans, LLC loans are tied to the business entity, which can protect personal assets from business liabilities. Understanding the nature of LLC loan money is crucial for business owners looking to make informed financial decisions.

How to Obtain the LLC Loan Money

Obtaining LLC loan money involves several steps that ensure the business meets lender requirements. First, assess your business's financial health, including credit scores and existing debts. Next, gather necessary documentation, such as tax returns, financial statements, and a business plan outlining how the loan will be used. Then, research potential lenders, including banks, credit unions, and online lenders, comparing interest rates and terms. Finally, submit your application, ensuring all information is accurate and complete to increase the chances of approval.

Key Elements of the LLC Loan Money

Several key elements define the LLC loan money process. These include:

- Interest Rates: The cost of borrowing, which can vary based on the lender and the borrower's creditworthiness.

- Loan Terms: The duration for which the loan is granted, often ranging from a few months to several years.

- Collateral: Some loans may require assets to secure the loan, reducing the lender's risk.

- Repayment Schedule: The timeline and method by which the loan must be repaid, including monthly payments.

Steps to Complete the LLC Loan Money Application

Completing the LLC loan money application involves a systematic approach. Start by collecting all required documents, such as your LLC's operating agreement, financial statements, and personal identification. Next, fill out the application form accurately, providing detailed information about your business and its financial needs. After submitting the application, be prepared to answer follow-up questions from the lender and provide additional documentation if requested. Finally, review the loan agreement carefully before signing to ensure you understand all terms and conditions.

Legal Use of the LLC Loan Money

The legal use of LLC loan money is critical for compliance and financial integrity. Funds obtained through an LLC loan should be used strictly for business purposes, such as purchasing equipment, funding operational expenses, or expanding facilities. Misuse of loan funds can lead to legal issues, including potential liability for fraud. It is essential for LLC members to maintain clear records of how loan funds are utilized to ensure transparency and accountability.

Eligibility Criteria for LLC Loan Money

Eligibility criteria for obtaining LLC loan money can vary by lender but generally include the following:

- Business Structure: The applicant must be a registered LLC in good standing.

- Creditworthiness: Both the business and its owners may need to demonstrate acceptable credit scores.

- Time in Business: Many lenders prefer businesses that have been operational for at least one to two years.

- Financial Stability: Lenders will assess the business's financial history, including revenue and profit margins.

Quick guide on how to complete llc loan money

Complete Llc Loan Money seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Handle Llc Loan Money on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-driven process today.

How to modify and eSign Llc Loan Money effortlessly

- Find Llc Loan Money and then click Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your preference. Adjust and eSign Llc Loan Money and ensure effective communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an LLC loan money?

An LLC loan money refers to financing options available specifically for limited liability companies (LLCs). These loans can help businesses cover operational costs, manage cash flow, or invest in growth opportunities. Understanding how to access LLC loan money can be crucial for sustaining and expanding your business.

-

How can I apply for LLC loan money?

To apply for LLC loan money, you'll typically need to gather documents such as your business plan, financial statements, and tax returns. Many lenders offer online applications, making the process straightforward and convenient. Be prepared to provide information about your LLC and its financial health to enhance your chances of approval.

-

What are the benefits of LLC loan money?

LLC loan money can provide your business with the necessary funds to enhance operational efficiency, invest in new projects, or improve cash flow. Unlike personal loans, these funds are specifically designed for business purposes, ensuring you can manage expenditures without compromising personal finances. Accessing LLC loan money can lead to improved financial stability for your business.

-

What are common uses for LLC loan money?

Common uses for LLC loan money include purchasing inventory, covering unexpected expenses, or investing in marketing campaigns. This type of financing can also help cover operational costs during lean periods. By utilizing LLC loan money effectively, LLCs can position themselves for growth and better financial health.

-

Are there specific features to look for in LLC loans?

When searching for LLC loan money, consider features such as competitive interest rates, flexible repayment terms, and fast funding options. Additionally, look for lenders that provide personalized support and quick access to funds. These features can signNowly enhance your borrowing experience and meet your business's unique needs.

-

How does airSlate SignNow integrate with LLC loan processes?

airSlate SignNow streamlines the LLC loan process by allowing businesses to send and eSign important documents securely and efficiently. This integration reduces paperwork delays and enhances communication with lenders. By leveraging airSlate SignNow, you can expedite your LLC loan money application process, ensuring timely access to funds.

-

What is the average repayment term for LLC loan money?

The average repayment term for LLC loan money varies by lender but typically ranges from one to five years. Shorter terms may offer quicker repayment options, while longer terms can reduce monthly payments. It's essential to choose a repayment plan that aligns with your business's cash flow and financial strategy.

Get more for Llc Loan Money

- Financial planning client intake form

- Strengths and needs worksheet form

- Dhs 470 2927 fillable pdf 2010 form

- Ia dependent adult abuse form

- Iowa child support worksheet form

- Only your landlord may complete and sign this form healthandwelfare idaho

- Lara long term care state of michigan form

- Idaho vital statistics certificate request idaho vital records healthandwelfare idaho form

Find out other Llc Loan Money

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation