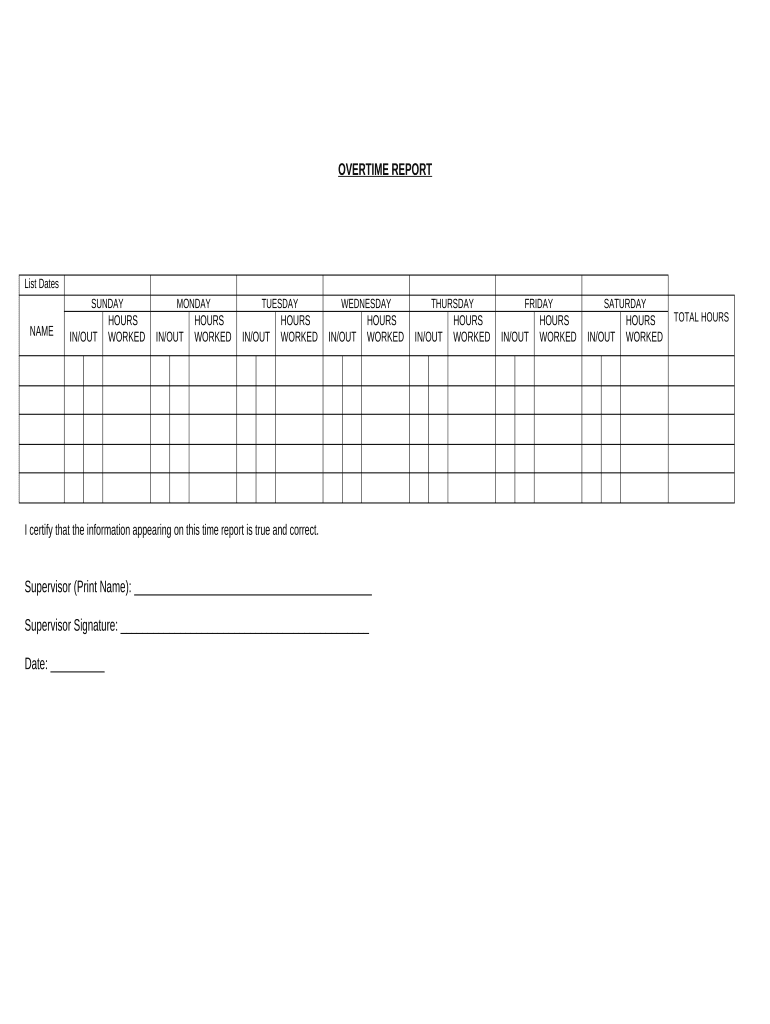

Overtime Report Form

What is the schedule of liabilities?

The schedule of liabilities is a comprehensive document that outlines a business's outstanding debts and obligations. This document is essential for financial reporting and provides a clear picture of what a company owes to creditors. It typically includes loans, accounts payable, leases, and any other financial commitments. By maintaining an accurate schedule of liabilities, businesses can effectively manage their cash flow and ensure they meet their financial obligations in a timely manner.

Key elements of the schedule of liabilities

A well-prepared schedule of liabilities includes several critical components:

- Creditor Information: Names and contact details of all creditors.

- Amount Owed: The total amount due to each creditor.

- Due Dates: Specific dates when payments are required.

- Interest Rates: Applicable interest rates for loans or credit lines.

- Payment Terms: Terms regarding how and when payments should be made.

These elements are vital for understanding the company's financial obligations and planning for future expenses.

Steps to complete the schedule of liabilities

Creating a schedule of liabilities involves several straightforward steps:

- Gather Financial Records: Collect all relevant documents, including loan agreements and invoices.

- List All Liabilities: Document each liability, including the creditor's name, amount owed, and due date.

- Organize Information: Arrange the liabilities in a clear format, categorizing them by type or due date.

- Review for Accuracy: Ensure all amounts and details are correct to avoid discrepancies.

- Update Regularly: Regularly revise the schedule to reflect any new liabilities or changes in existing ones.

Following these steps helps maintain an accurate and up-to-date schedule of liabilities.

Legal use of the schedule of liabilities

The schedule of liabilities plays a crucial role in legal and financial contexts. It is often required during audits, loan applications, and bankruptcy proceedings. Accurate documentation is essential to comply with legal standards and to provide transparency to stakeholders. Businesses must ensure that their schedule of liabilities reflects true and fair values to avoid potential legal issues.

Filing deadlines and important dates

While the schedule of liabilities itself may not have specific filing deadlines, it is important to align its preparation with relevant financial reporting periods. For businesses, this often coincides with quarterly or annual financial statements. Keeping track of these dates ensures that the schedule is ready for review during audits or financial assessments.

Examples of using the schedule of liabilities

Businesses utilize the schedule of liabilities in various scenarios:

- Financial Planning: Helps in budgeting and forecasting future cash flows.

- Loan Applications: Provides lenders with a clear view of existing obligations when applying for additional financing.

- Bankruptcy Proceedings: Essential for listing all debts and obligations to ensure fair treatment of creditors.

These examples illustrate the practical applications of the schedule of liabilities in managing a business's financial health.

Quick guide on how to complete overtime report

Complete Overtime Report effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Handle Overtime Report on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Overtime Report with ease

- Locate Overtime Report and then click Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Overtime Report and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a schedule of liabilities and how does it work?

A schedule of liabilities is a financial document that outlines an organization's debts and obligations. It helps businesses track their financial responsibilities, ensuring they stay on top of payments. airSlate SignNow simplifies the process by allowing you to eSign important documents related to your schedule of liabilities efficiently.

-

How can airSlate SignNow help manage my schedule of liabilities?

airSlate SignNow provides a user-friendly platform for sending and electronically signing documents related to your schedule of liabilities. This ensures secure and timely management of your financial obligations. By streamlining document workflows, it saves time and reduces errors, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for my schedule of liabilities?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans cater to different needs, providing a range of features for managing your schedule of liabilities without breaking the bank. You can choose a plan that best suits your organization's size and requirements.

-

What features does airSlate SignNow provide for managing a schedule of liabilities?

airSlate SignNow offers several features, including customizable templates, document tracking, and automatic reminders for due dates. These tools allow you to efficiently manage your schedule of liabilities and maintain compliance with financial obligations. Additionally, eSigning capabilities ensure that all documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other financial software?

Yes, airSlate SignNow can be integrated with various financial software tools to enhance your management of a schedule of liabilities. Numerous integrations allow for seamless data transfer and improved workflow efficiency. By connecting your existing systems, you can streamline the process and make it easier to track payments and obligations.

-

What are the benefits of using airSlate SignNow for my schedule of liabilities?

Using airSlate SignNow to manage your schedule of liabilities offers several benefits, including increased efficiency, reduced paperwork, and enhanced document security. With electronic signatures, you can expedite the signing process, allowing for faster decision-making. Additionally, the platform's accessibility ensures that you can manage your financial obligations from anywhere.

-

How does airSlate SignNow ensure the security of my schedule of liabilities?

airSlate SignNow prioritizes the security of your documents, including those related to your schedule of liabilities. Our platform employs advanced encryption and compliance with industry standards to protect sensitive information. This means you can confidently manage your financial obligations without worrying about data bsignNowes or unauthorized access.

Get more for Overtime Report

- Request for hearing denied application for counsel or waiver of fees juvenile form

- Guardian ad litem gal or attorney for a minor child amc form

- Fl 303 declaration regarding notice and service of request for temporary emergency ex parte orders judicial council forms

- Uncontested divorce forms new york state unified court

- Fillable online statement of information for a consent

- Fillable online information on appeal procedures for

- Cr 115 fill and sign printable template onlineus form

- Ch 115 request to continue court hearing temporary restraining order judicial council forms

Find out other Overtime Report

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors