Determining Self Employed Contractor Status Form

What is the Determining Self Employed Contractor Status

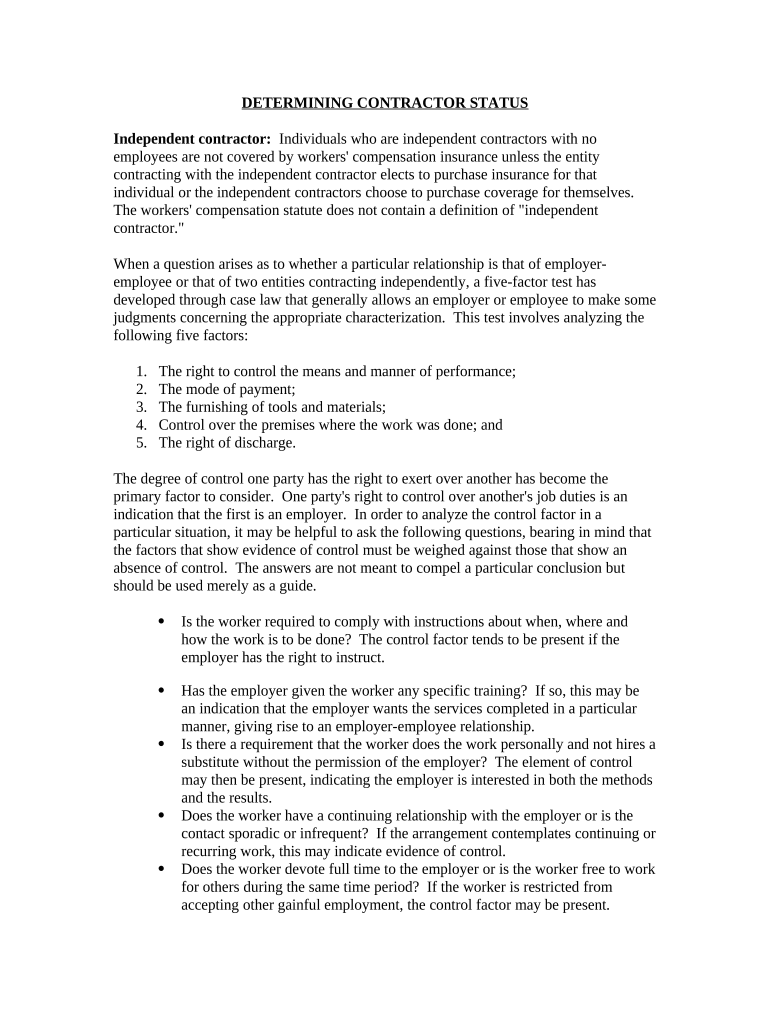

The Determining Self Employed Contractor Status form is a crucial document used to clarify whether an individual qualifies as a self-employed contractor or an employee. This classification impacts tax obligations, benefits eligibility, and legal responsibilities. Understanding this status is essential for both the contractor and the hiring entity, as it influences how income is reported to the IRS and what deductions may be available.

Steps to complete the Determining Self Employed Contractor Status

Completing the Determining Self Employed Contractor Status form involves several key steps:

- Gather necessary information, including personal identification details and business information.

- Review the criteria for self-employment versus employee status, ensuring you meet the requirements.

- Fill out the form accurately, providing all required information and ensuring clarity in your responses.

- Sign the document electronically or physically, depending on your submission method.

- Submit the completed form to the relevant authority, either online or via mail, ensuring you retain a copy for your records.

Legal use of the Determining Self Employed Contractor Status

The legal use of the Determining Self Employed Contractor Status form is essential for establishing the proper classification of workers. Misclassification can lead to significant legal and financial repercussions for both contractors and employers. It is vital to adhere to IRS guidelines and state-specific regulations when using this form to ensure compliance and protect all parties involved.

IRS Guidelines

The IRS provides specific guidelines regarding the classification of workers as independent contractors or employees. Key factors include the degree of control the employer has over the work, the financial relationship between the parties, and the nature of the work performed. Familiarizing yourself with these guidelines can help in accurately completing the Determining Self Employed Contractor Status form and avoiding potential penalties.

Required Documents

To complete the Determining Self Employed Contractor Status form, you may need to provide several supporting documents. These can include:

- Personal identification, such as a driver's license or Social Security number.

- Tax identification number, if applicable.

- Business registration documents, if you operate under a business entity.

- Financial records that demonstrate income and expenses related to your work.

Penalties for Non-Compliance

Failing to correctly classify a worker can result in significant penalties. Employers may face back taxes, fines, and legal fees if they misclassify employees as independent contractors. Additionally, contractors may miss out on benefits and protections afforded to employees. Understanding the implications of non-compliance emphasizes the importance of accurately completing the Determining Self Employed Contractor Status form.

Eligibility Criteria

Eligibility for self-employment status is determined by various criteria set forth by the IRS. Generally, these criteria assess the level of control, the nature of the work, and the financial relationship between the contractor and the employer. It is crucial to evaluate your specific situation against these criteria to determine your eligibility and ensure proper classification when completing the form.

Quick guide on how to complete determining self employed contractor status

Effortlessly Prepare Determining Self Employed Contractor Status on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Determining Self Employed Contractor Status on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-centric process today.

How to Modify and Electronically Sign Determining Self Employed Contractor Status with Ease

- Find Determining Self Employed Contractor Status and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow takes care of your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Determining Self Employed Contractor Status and ensure excellent communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Determining Self Employed Contractor Status?

Determining Self Employed Contractor Status involves assessing various criteria such as behavioral control, financial control, and the type of relationship between the worker and the business. It's important to consider how much control you have over the worker’s tasks and the financial aspects of the work done. Utilizing tools like airSlate SignNow can help streamline the documentation required for this process.

-

How can airSlate SignNow assist with Determining Self Employed Contractor Status documentation?

airSlate SignNow offers features that simplify the creation, sending, and signing of contracts and agreements necessary for Determining Self Employed Contractor Status. Our platform allows you to easily share documents and gather electronic signatures, ensuring that all agreements are legally binding and processed efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to businesses of all sizes, making it easy to choose the right option for your needs. Our solutions include essential features that support your efforts in Determining Self Employed Contractor Status while remaining cost-effective. Detailed pricing can be found on our website.

-

Does airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow integrates seamlessly with a variety of popular business tools and applications. This allows for a more streamlined workflow when Determining Self Employed Contractor Status and helps eliminate redundancies in your processes. Check our integration page for a full list of compatible applications.

-

What features does airSlate SignNow offer to enhance document management?

airSlate SignNow offers a range of powerful features, including document templates, automatic reminders, and tracking capabilities. These tools make it easier to manage and audit contracts related to Determining Self Employed Contractor Status. With our user-friendly interface, you'll save time and reduce errors in your document management.

-

What benefits can businesses expect from using airSlate SignNow?

By using airSlate SignNow, businesses can improve efficiency, reduce costs, and enhance compliance when Determining Self Employed Contractor Status. Our electronic signature solution provides a secure way to handle documents, helping organizations maintain legal validity and streamline their operations. This ultimately leads to a better experience for both the business and its contractors.

-

Is airSlate SignNow suitable for freelancers and independent contractors?

Absolutely! airSlate SignNow is designed to cater to the needs of freelancers and independent contractors as well. By providing easy-to-use tools for contract management and eSigning, it facilitates the process of Determining Self Employed Contractor Status, making it simpler for independents to manage their professional relationships.

Get more for Determining Self Employed Contractor Status

- 2021 ma dta permission to share information form

- 2020 de division of corporations fee schedule form

- 2017 ca hbex 403 form

- 2020 ca cdph 8679 form

- De authorization for release of protected health information

- 2010 ky epid 230c form

- 2019 nc topps mental health and substance use disorder child ages 6 11 initial interview form

- 2019 nc nc topps mental health and substance abuse initial interview ages 18 and up form

Find out other Determining Self Employed Contractor Status

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form