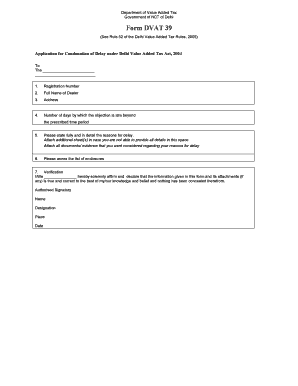

Dvat 39 Form

What is the Dvat 39

The Dvat 39 form is a crucial document used for tax purposes in the United States, particularly for businesses engaged in the sale of goods and services. This form is designed to report and remit the value-added tax (VAT) collected on sales. It serves as a declaration of the tax obligations of a business, ensuring compliance with state and federal tax regulations. Understanding the Dvat 39 is essential for businesses to maintain accurate records and fulfill their tax responsibilities.

How to use the Dvat 39

Using the Dvat 39 form involves several steps to ensure accurate reporting of VAT. First, businesses must gather all relevant sales data, including the total amount of VAT collected during the reporting period. Next, they should accurately fill out the form, detailing the sales figures and the corresponding VAT amounts. Once completed, the form must be submitted to the appropriate tax authority, either electronically or via mail, depending on state regulations. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Dvat 39

Completing the Dvat 39 form requires careful attention to detail. Here are the steps to follow:

- Gather all sales records for the reporting period.

- Calculate the total VAT collected from sales.

- Fill out the Dvat 39 form, ensuring all figures are accurate.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority by the deadline.

Legal use of the Dvat 39

The legal use of the Dvat 39 form is governed by tax laws and regulations in the United States. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Compliance with state-specific tax laws is also critical, as failure to adhere to these regulations can result in penalties. Businesses should familiarize themselves with the legal requirements surrounding the Dvat 39 to avoid any issues with tax authorities.

Required Documents

When filling out the Dvat 39 form, certain documents are necessary to support the information provided. These may include:

- Sales invoices that detail the VAT collected.

- Records of any exemptions or deductions claimed.

- Previous tax returns for reference.

Having these documents on hand will facilitate the accurate completion of the Dvat 39 and ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Timely filing of the Dvat 39 form is essential to avoid penalties. The deadlines for submission can vary by state, but generally, businesses must file the form quarterly or annually, depending on their sales volume. It is advisable to check with local tax authorities for specific deadlines to ensure compliance and avoid late fees.

Quick guide on how to complete dvat 39

Effortlessly Prepare Dvat 39 on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents promptly without delays. Control Dvat 39 on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Dvat 39 with ease

- Find Dvat 39 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow manages your document needs in just a few clicks from your desired device. Update and eSign Dvat 39 while ensuring effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dvat 39

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dvat 39 in airSlate SignNow?

dvat 39 refers to a specific feature within airSlate SignNow that streamlines the document signing process. It allows businesses to efficiently manage digital signatures while ensuring compliance with regulatory requirements. This feature is particularly beneficial for organizations that need to process high volumes of documents quickly and securely.

-

How does dvat 39 improve document handling?

With dvat 39, airSlate SignNow enhances the document handling process by automating workflows and reducing the time spent on manual signatures. This results in faster turnaround times for critical documents, leading to increased operational efficiency. The ease of use also encourages higher adoption rates among team members.

-

What are the pricing options for dvat 39 in airSlate SignNow?

airSlate SignNow offers a variety of pricing plans that include access to the dvat 39 feature, catering to businesses of all sizes. Pricing is competitive and designed to provide value for organizations looking to improve their document signing processes. Consult the airSlate SignNow website for detailed pricing tiers that include dvat 39.

-

Can dvat 39 integrate with other tools I use?

Yes, dvat 39 seamlessly integrates with various business applications and software to enhance your document workflow. Whether you use CRM systems, cloud storage services, or project management tools, airSlate SignNow can sync effortlessly. This integration capability helps in centralizing your document management processes.

-

What are the key benefits of using dvat 39?

The primary benefits of using dvat 39 include improved efficiency, time savings, and enhanced security for document transactions. By leveraging this feature, businesses can signNowly reduce the time it takes to get documents signed. Additionally, it ensures that all signatures are legally binding and securely stored.

-

Is dvat 39 suitable for small businesses?

Absolutely! dvat 39 is designed to cater to businesses of all sizes, including small businesses that require an economical and efficient document signing solution. By implementing this feature, small businesses can compete effectively by streamlining their operations and reducing costs associated with traditional document management.

-

How secure is the dvat 39 signing process?

The dvat 39 signing process in airSlate SignNow prioritizes security with top-notch encryption and compliance measures. It ensures that all documents are protected during the signing process, safeguarding sensitive information. Users can trust that their data is secure with industry-standard protections.

Get more for Dvat 39

Find out other Dvat 39

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online