Agreement Lender Form

What is the Agreement Lender

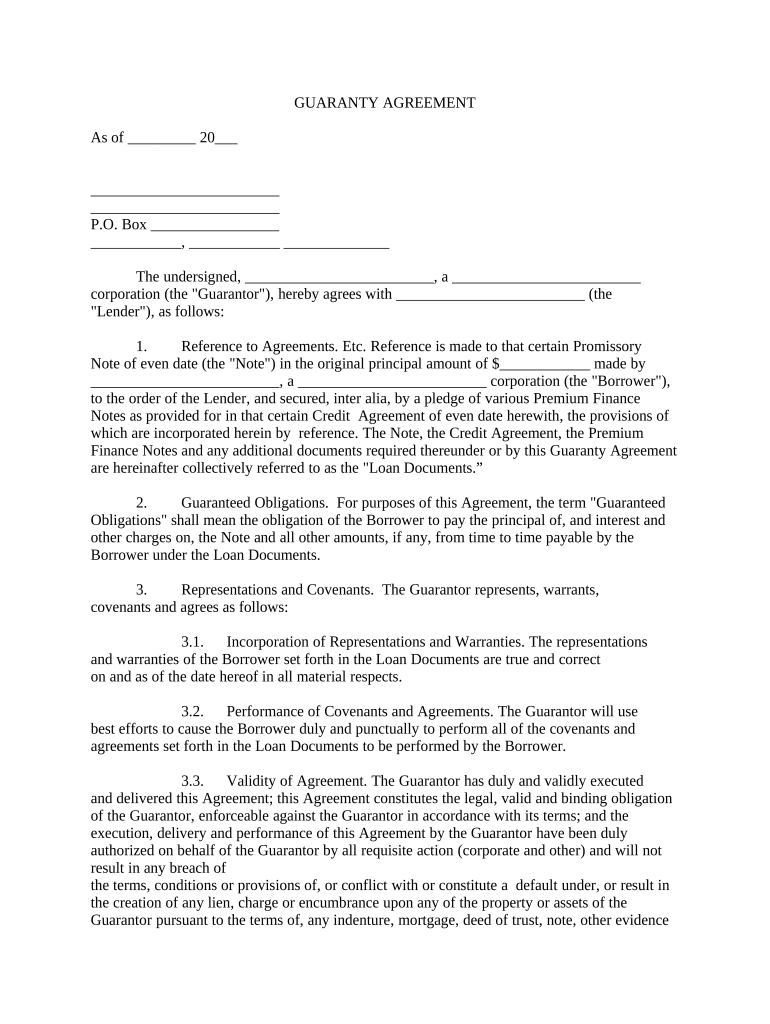

The agreement lender is a formal document that outlines the terms and conditions under which a lender provides funds to a borrower. This form is essential in establishing a clear understanding between both parties regarding the loan amount, interest rates, repayment schedules, and any collateral involved. By detailing these elements, the agreement lender serves to protect the interests of both the lender and the borrower, ensuring that all parties are aware of their obligations and rights.

How to use the Agreement Lender

Using the agreement lender involves several key steps. First, both parties should review the terms outlined in the document to ensure mutual understanding. Next, the borrower must provide necessary information, such as personal identification and financial details, which may include income and credit history. Once the form is completed, both parties should sign it, preferably using a secure electronic signature to ensure authenticity and compliance with legal standards. This process not only streamlines the lending experience but also enhances security and efficiency.

Steps to complete the Agreement Lender

Completing the agreement lender form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal and financial details.

- Fill out the form accurately, ensuring all sections are completed.

- Review the terms and conditions thoroughly with the lender.

- Sign the document using a secure electronic signature.

- Store a copy of the signed agreement for your records.

Following these steps helps ensure that the agreement is legally binding and protects both parties involved.

Legal use of the Agreement Lender

The legal use of the agreement lender is governed by various regulations, including the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures and records hold the same legal weight as their paper counterparts. To ensure compliance, it is crucial to use a reliable eSignature platform that meets these legal requirements, providing a secure and efficient way to execute the agreement lender.

Key elements of the Agreement Lender

Several key elements must be included in the agreement lender to ensure its effectiveness and legality:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Schedule: The timeline and method for repaying the loan.

- Collateral: Any assets pledged by the borrower to secure the loan.

- Default Terms: Conditions under which the lender can take action if the borrower fails to repay.

Incorporating these elements helps clarify the agreement and protect the interests of both parties.

Examples of using the Agreement Lender

The agreement lender can be utilized in various scenarios, such as:

- Personal loans between friends or family members.

- Business loans for startups or expanding companies.

- Real estate transactions where financing is required.

- Student loans for educational purposes.

Each of these examples illustrates the versatility of the agreement lender in facilitating financial transactions while ensuring clarity and legal protection.

Quick guide on how to complete agreement lender

Complete Agreement Lender effortlessly on any device

Digital document management has gained tremendous popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle Agreement Lender on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign Agreement Lender without hassle

- Obtain Agreement Lender and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your edits.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Agreement Lender and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement lender?

An agreement lender is a financial institution or individual that provides loans based on the terms outlined in a legally binding document. Understanding the role of an agreement lender is crucial for businesses looking to secure financing effectively.

-

How can airSlate SignNow help streamline agreements with lenders?

airSlate SignNow offers an efficient platform to create, send, and eSign agreements with lenders. By using our solution, you can ensure that your agreement lender documents are signed quickly and securely, reducing the time spent in negotiations.

-

What features does airSlate SignNow provide for agreement lender documents?

airSlate SignNow provides features such as template creation, automated reminders, and secure cloud storage for your agreement lender documents. These features ensure that your documents are easily accessible and well-organized, helping you manage your lending processes better.

-

Is airSlate SignNow cost-effective for managing agreement lender documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing agreement lender documents. With flexible pricing plans, businesses can choose an option that best suits their needs while benefiting from a powerful eSigning tool.

-

What are the benefits of using airSlate SignNow for agreement lender processes?

Using airSlate SignNow for agreement lender processes increases efficiency and reduces turnaround time for document signing. It enhances collaboration between parties and provides a secure platform for storing sensitive financial information.

-

Can airSlate SignNow integrate with other financial software for agreement lenders?

Yes, airSlate SignNow offers integrations with various financial software, making it easy to manage your agreement lender processes. This ensures a seamless workflow, allowing you to connect your eSigning needs with your existing financial tools.

-

How does airSlate SignNow ensure the security of agreement lender documents?

airSlate SignNow employs industry-leading security measures, including encryption and secure storage, to protect your agreement lender documents. You can confidently manage sensitive information knowing that it is safeguarded from unauthorized access.

Get more for Agreement Lender

- Transfer on death deed pdf form

- Kmtc courses and fee structure form

- Contoh format biodata pemain sepak bola

- Http bit ly form data pelamar

- Abkc registration form

- 2020 2021 nche application form

- I hereby authorize bloomfield hills schools to make deposits in the account identified below at form

- Barry county animal control shelter pre adoption form barrycounty

Find out other Agreement Lender

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF