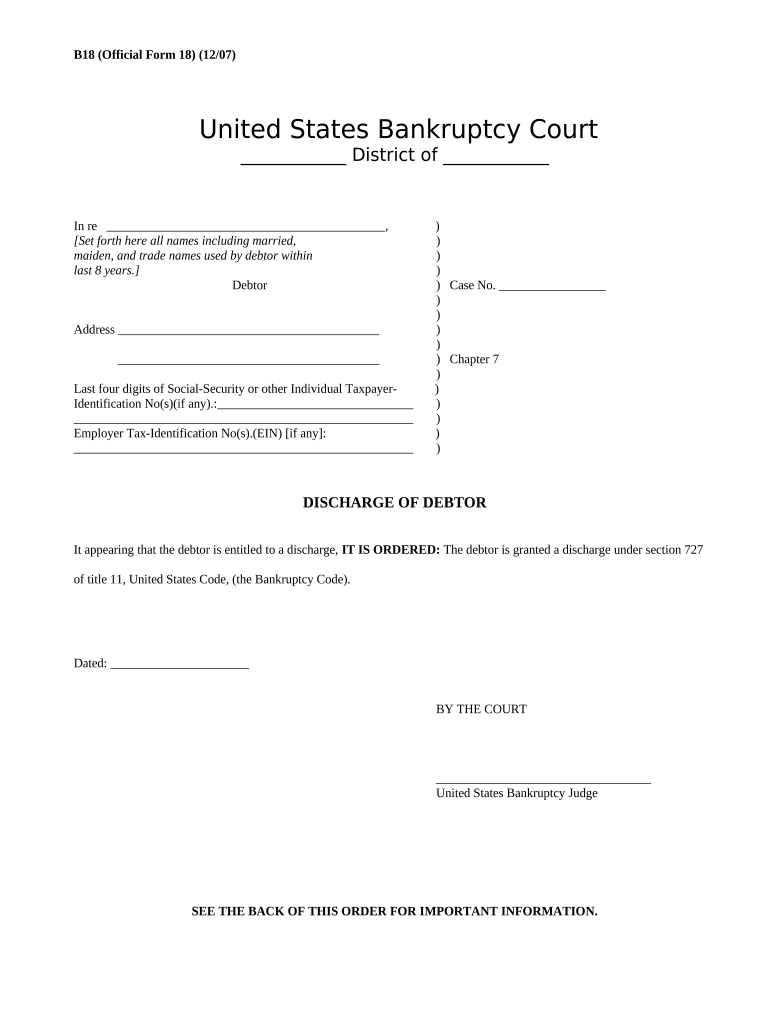

Discharge Debtor Form

What is the discharge debtor?

A discharge debtor refers to an individual or entity that has been released from the obligation to repay certain debts through a legal process. This typically occurs in bankruptcy situations, where the court grants a discharge of debts, allowing the debtor to start fresh financially. The discharge debtor is no longer liable for the debts specified in the discharge order, which can include various types of unsecured debts such as credit card balances and medical bills. Understanding the implications of being a discharge debtor is crucial for individuals seeking financial relief.

Key elements of the discharge debtor

Several key elements define a discharge debtor's status:

- Legal Order: The discharge is issued by a bankruptcy court, ensuring that it is legally binding.

- Types of Debts Discharged: Not all debts are dischargeable. Commonly discharged debts include unsecured debts, while certain obligations like student loans and child support may remain.

- Impact on Credit: While a discharge provides relief, it may negatively affect the debtor's credit score for a period.

- Duration of Discharge: The discharge remains in effect indefinitely, meaning the debtor cannot be pursued for the discharged debts.

Steps to complete the discharge debtor

Completing the process to become a discharge debtor involves several steps:

- Consultation: Meet with a bankruptcy attorney to discuss your financial situation and determine eligibility.

- Filing for Bankruptcy: Submit a bankruptcy petition to the court, including required documentation of debts and assets.

- Credit Counseling: Complete a mandatory credit counseling session before filing.

- Meeting of Creditors: Attend a meeting where creditors can question you about your financial situation.

- Receive Discharge Order: After fulfilling all requirements, the court will issue a discharge order, officially releasing you from specified debts.

Legal use of the discharge debtor

The legal use of a discharge debtor is primarily to provide relief from overwhelming financial obligations. Once the discharge is granted, it legally prohibits creditors from attempting to collect on the discharged debts. This protection is crucial for individuals looking to rebuild their financial lives without the burden of past debts. It is essential to understand that while the discharge provides significant relief, it does not erase all financial responsibilities, and certain debts may still require payment.

Eligibility criteria

To qualify as a discharge debtor, individuals must meet specific eligibility criteria, including:

- Residency: The debtor must reside in the United States or have a business presence in the country.

- Debt Limits: For Chapter 13 bankruptcy, there are limits on the amount of secured and unsecured debts.

- Previous Filings: Debtors who have received a discharge in a prior bankruptcy case may be ineligible for a new discharge for a certain period.

- Completion of Credit Counseling: Debtors must complete a credit counseling course before filing for bankruptcy.

Required documents

When filing for bankruptcy to become a discharge debtor, several documents are typically required:

- Bankruptcy Petition: The formal document that initiates the bankruptcy process.

- Schedules of Assets and Liabilities: Detailed lists of all assets, debts, income, and expenses.

- Income Documentation: Proof of income, such as pay stubs or tax returns.

- Credit Counseling Certificate: Evidence of completion of the required credit counseling session.

Quick guide on how to complete discharge debtor

Complete Discharge Debtor effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Discharge Debtor on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Discharge Debtor effortlessly

- Locate Discharge Debtor and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Mark important sections of the documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and has the same legal standing as a traditional ink signature.

- Verify the details and then click on the Done button to finalize your edits.

- Choose how you would like to submit your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Discharge Debtor to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 'back in 5 minutes sign printable'?

A 'back in 5 minutes sign printable' is a quick and easy solution for businesses and individuals who need to communicate a temporary absence. It provides a professional way to inform customers or clients that you will be back shortly, ensuring continuity of service.

-

How can I use the 'back in 5 minutes sign printable' with airSlate SignNow?

You can easily create and customize a 'back in 5 minutes sign printable' using airSlate SignNow's user-friendly interface. Simply select the document template, add your details, and send it for eSignature if needed, making it a seamless experience.

-

Are there costs associated with creating a 'back in 5 minutes sign printable'?

Using airSlate SignNow to create a 'back in 5 minutes sign printable' is cost-effective, with various pricing plans that suit different business needs. You can choose a plan that includes unlimited document creations or pay-per-use options, ensuring you get great value.

-

What are the benefits of a 'back in 5 minutes sign printable'?

The 'back in 5 minutes sign printable' provides clear communication to your clients about your availability, enhancing professionalism. It can also help maintain customer satisfaction by minimizing uncertainty during short absences.

-

Can I customize my 'back in 5 minutes sign printable'?

Absolutely! airSlate SignNow allows you to fully customize your 'back in 5 minutes sign printable' with your branding, logo, and tailored messages. This ensures that you maintain a consistent look and feel across all your communication materials.

-

Is the 'back in 5 minutes sign printable' suitable for all businesses?

Yes, the 'back in 5 minutes sign printable' is suitable for various types of businesses, including retail stores, offices, and service providers. Its flexibility makes it a universal tool for ensuring your customers know when to expect you back.

-

Can I integrate the 'back in 5 minutes sign printable' feature with other applications?

Yes, airSlate SignNow offers integration capabilities with various applications and platforms, allowing you to streamline your document management processes. This makes it easy to access your 'back in 5 minutes sign printable' from wherever you need it.

Get more for Discharge Debtor

- For wic office use only form

- Pibsbnycaddchngpibs nycgov form

- Instructions page 1 form

- Paid family leave pfl a worker funded program provides benefits to eligible workers who have a full or form

- Forms department of workforce services utahgov

- Instructions for completing the florida legislative employment application form

- Equal employment opportunity eeo request form

- Reference tca 55 17 125 form

Find out other Discharge Debtor

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract