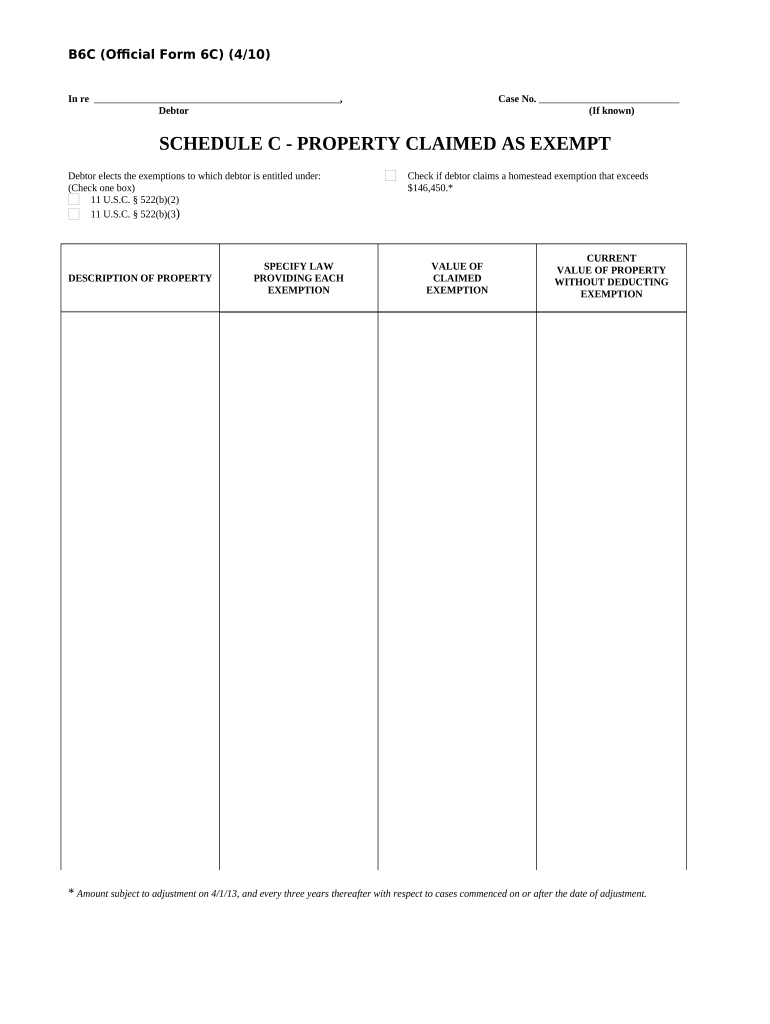

Property Claimed Exempt Form

What is the Property Claimed Exempt

The property claimed exempt form is a legal document that allows individuals or businesses to declare that certain properties are exempt from taxation. This form is particularly relevant in the context of property taxes, where specific exemptions may apply based on the nature of the property or the status of the owner. Understanding the exemptions available can help taxpayers reduce their financial liabilities, ensuring compliance with local tax laws.

How to Use the Property Claimed Exempt

Using the property claimed exempt form involves several steps to ensure accuracy and compliance. First, determine the specific exemption for which you qualify, such as homestead exemptions or exemptions for non-profit organizations. Next, gather the necessary documentation that supports your claim, which may include proof of ownership or eligibility. Finally, complete the form accurately, ensuring all required fields are filled out, and submit it to the appropriate local tax authority.

Steps to Complete the Property Claimed Exempt

Completing the property claimed exempt form requires careful attention to detail. Follow these steps:

- Review the eligibility criteria for the specific exemption you are claiming.

- Collect supporting documents, such as identification, proof of residency, or organizational status.

- Fill out the form, ensuring that all information is accurate and complete.

- Sign and date the form to validate your claim.

- Submit the form to your local tax office by the designated deadline.

Legal Use of the Property Claimed Exempt

The legal use of the property claimed exempt form is governed by state and local tax laws. It is essential to understand the specific regulations that apply to your jurisdiction, as these can vary significantly. Proper use of the form ensures that the exemptions are recognized by tax authorities, preventing potential penalties or disputes regarding tax liabilities.

Eligibility Criteria

Eligibility for claiming an exemption on the property claimed exempt form typically depends on several factors, including:

- Ownership status: You must be the legal owner of the property.

- Property type: Certain types of properties, such as residential homes or charitable organizations, may qualify for exemptions.

- Residency: Some exemptions require that the property be your primary residence.

It is important to check the specific criteria set by your state or local tax authority to ensure compliance.

Examples of Using the Property Claimed Exempt

Examples of situations where the property claimed exempt form may be utilized include:

- A homeowner applying for a homestead exemption to reduce property taxes.

- A non-profit organization claiming an exemption on property used for charitable purposes.

- A senior citizen applying for a tax exemption based on age and income criteria.

These examples illustrate the diverse applications of the form, highlighting its importance in managing tax obligations effectively.

Quick guide on how to complete property claimed exempt

Effortlessly Prepare Property Claimed Exempt on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents quickly and without delays. Manage Property Claimed Exempt on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign Property Claimed Exempt with Ease

- Retrieve Property Claimed Exempt and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Property Claimed Exempt while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'claimed exempt' mean in the context of airSlate SignNow?

In airSlate SignNow, 'claimed exempt' refers to the status an individual or entity can choose when they are not subject to certain tax withholding requirements. This feature allows users to streamline their eSigning process by easily declaring their exemption status in the documents they are signing.

-

How does airSlate SignNow handle 'claimed exempt' forms?

airSlate SignNow provides a user-friendly interface that allows signees to easily indicate if they have 'claimed exempt' status on forms. This ensures that the documents are compliant and processed correctly, reducing delays and errors in the eSignature workflow.

-

Is there a cost associated with using the 'claimed exempt' feature?

The 'claimed exempt' feature is included in the standard offerings of airSlate SignNow at no additional cost. Users can take advantage of this feature without worrying about hidden fees, making it a cost-effective option for businesses managing document signing.

-

Are there any limitations when declaring 'claimed exempt' in airSlate SignNow?

While airSlate SignNow supports the 'claimed exempt' declaration, users should ensure that they are eligible to claim this status based on current tax regulations. It's recommended to review guidelines or seek tax advice to ensure compliance when using this option.

-

Can I integrate 'claimed exempt' workflows with other software using airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various software platforms to enhance your document management processes, including those that require 'claimed exempt' declarations. This allows businesses to automate workflows and improve efficiency while maintaining compliance.

-

What are the benefits of using airSlate SignNow for 'claimed exempt' documents?

Using airSlate SignNow for 'claimed exempt' documents offers several benefits, including enhanced accuracy, faster processing times, and a more streamlined user experience. The platform ensures that all exemption claims are easily documented and appropriately managed within the signing process.

-

How secure is the information when claiming exempt through airSlate SignNow?

airSlate SignNow prioritizes security and compliance, ensuring that all information submitted, including 'claimed exempt' statuses, is encrypted and securely stored. Users can confidently sign documents knowing their sensitive information is protected against unauthorized access.

Get more for Property Claimed Exempt

- 8775330337 form

- For class of employees for whom disability benefits are not required by law form

- Request for further action by carrieremployer form rfa 2

- From wc 105a work history qualifications ampamp training disclosure form

- Form llcl 73

- Web tax user manual form

- List of all claim forms that can be submitted on the web

- Printable inventory sheet pdf form

Find out other Property Claimed Exempt

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple